From left, Jeff Long, commissioner of safety; David Tulis of Eagle Radio Network; and David Gerregano, commissioner of revenue. (Photos state government)

This signature is on a document being sent today to the attorney general ofTennessee, telling him to defend the fraud under TFRL. (Photo David Tulis)

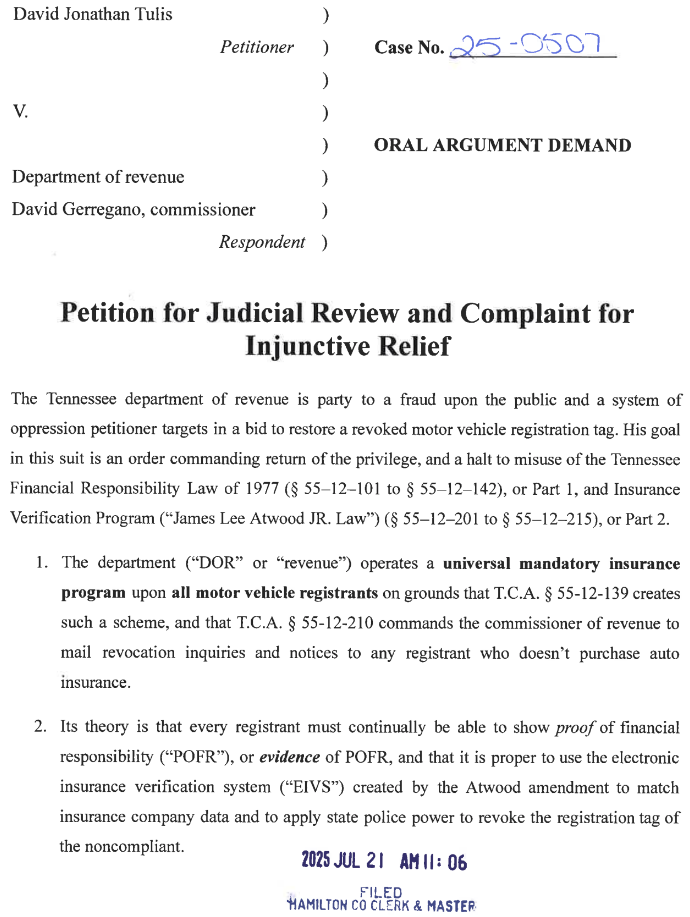

This is a copy of p. 1 of my complaint for judicial review against “Eye of Sauron.”

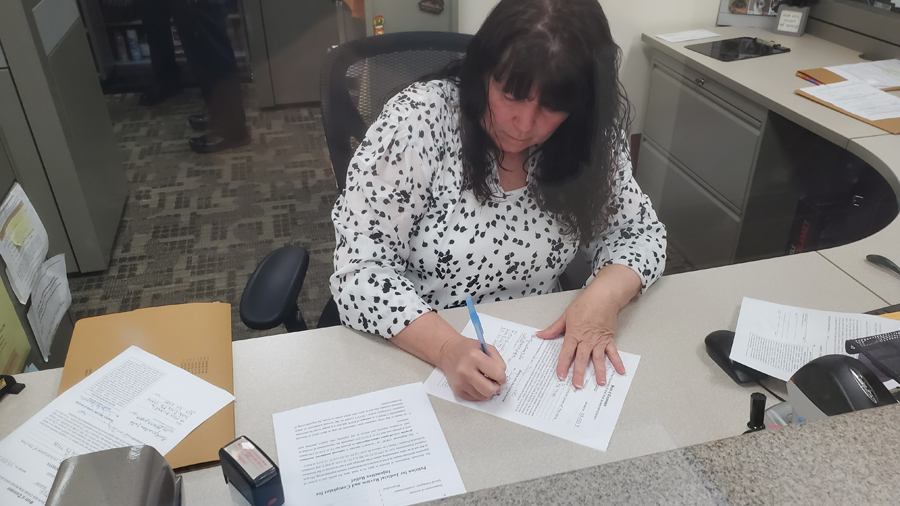

Angie Newman is the clerk who accepts my filing against “The Guano,” or commissioner of revenue David Gerregano. (Photo David Tulis)

I am waiting for service at the clerk and master’s office in Hamilton County, Tenn., in the old courthouse in Chattanooga. (Photo David Tulis)

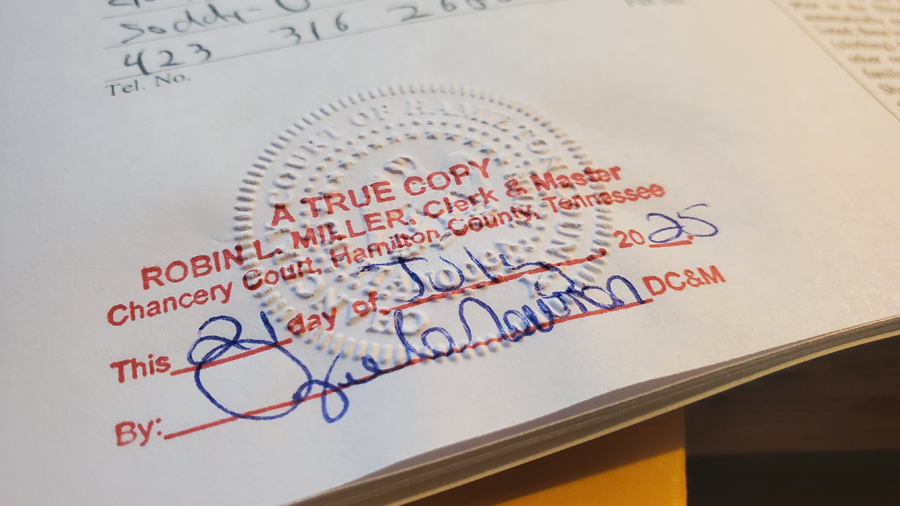

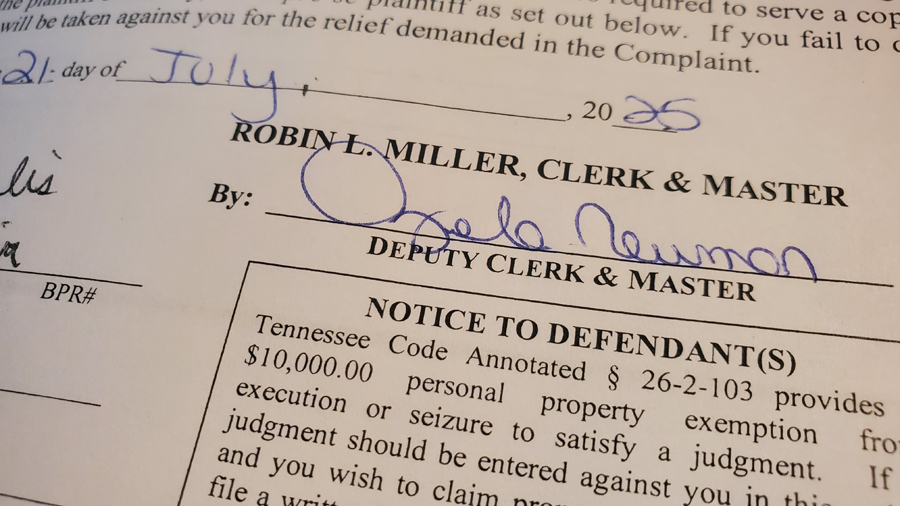

A summons signed by the clerk and master Robin Miller, through clerk Angela Newman, commands a party or his attorney to defend claims made in court. (Photo David Tulis)

CHATTANOOGA, Tenn., Monday, July 21, 2025 — A radio reporter is suing the state revenue commissioner in Hamilton County chancery court alleging that his auto insurance monitoring system is “a degenerate, landscape-burning ‘Eye of Sauron.’”

Eagle Radio reporter David Tulis has been in litigation with commissioner David Gerregano 706 days in administrative hearings. He demands the Gov. Bill Lee appointee decertify the electronic insurance verification system, or EIVS, that Tulis in court filings likens to the blistering eyeball atop a tower from the Lord of the Rings literary and Hollywood franchise.

Armor-piercing petition targets Eye of Suaron – filed copy

This action is the third by Tulis to be working its way through the courts. Tulis is suing Gerregano and safety commissioner Jeff Long in action recently moved to the Tennessee court of appeals. In federal court he is suing Gerregano personally for injunction and $7 million in punitive damages. The chancery case is based on the record in two years of proceedings over the Gerregno-revoked 2000 Honda Odyssey minivan tag.

The petition argues the Tennessee financial responsibility law of 1977 in no way obligates members of the general public to have auto insurance. A former 24-year copy editor at the Chattanooga Times Free Press, Tulis says the law applies to two categories of people.

“The first is those involved in a qualifying accident with $1,500 or more in damage,” Tulis says.

“The second group are people with suspended licenses who have been adjudicated to be high risk or financially irresponsible. These folks get the privilege restored on condition of buying a unique insurance product called a ‘motor vehicle liability policy.’ This policy is certified according to state law. That legal certificate is the well-known SR-22.”

Without authority of law, his litigation contends, the two departments have created a universal mandatory insurance operation enriching insurance companies. He says that the electronic insurance verification system — or EIVS — illegally trawls insurance company data for the noncustomer. “The eye is supposed to squint only — to monitor people with suspended licenses who missed a payment.”

“This extortion op is approved by Gov. Lee. It afflicts the entire public in Tennessee with compulsory insurance contracts under duress. The program stripmines the poor who cannot afford insurance. They have every right to be on the road. In punishment because they can’t pay, they are forced to become customers and clients of the court system as criminal defendants. That’s 40,800 good souls every year. I am outraged. Aren’t you?”

Put a belt of tracers for David to fire via GiveSendGo

David runs a personal nonprofit fighting and mercy ministry. He thanks you for checks sent directly to c/o 10520 Brickhill Lane, Soddy-Daisy, TN 37379. Also at GiveSendGo.