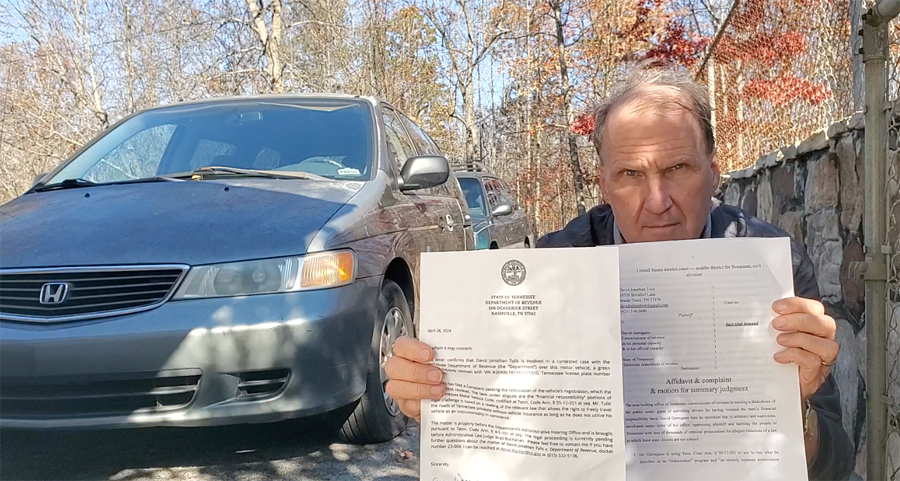

Traveling in my disputed 2000 Honda Odyssey minivan, I carry my “safety letter” issued me by revenue commissioner David Gerregano as we fight over my right to the privilege in commerce (aka, registration tag or license plate). I accuse him in three lawsuits of fraud and extortion, but he refuses to come into compliance with T.C.A. § 55-12-101 et seq, aided by state and federal judges. (Photo David Tulis)

CHATTANOOGA, Tenn., Monday, Oct. 6, 2025 — A lawsuit demands Tennessee revenue commissioner David Gerregano be ordered to decertify what a journalist pushing the case calls “The Eye of Sauron.”

The petition for preliminary injunction in Hamilton County circuit court says the department illegally runs a universal mandatory auto insurance scheme when the Tennessee financial responsibility law of 1977 doesn’t coerce anyone to buy auto insurance except the high-risk driver.

Eagle Radio Network journalist David Tulis says people under suspension by the department of safety are allowed to keep the driving privilege on condition of insurance. They buy a special policy called a “motor vehicle liability policy” certified by the insurer under notice to the department of safety.

“My motion for injunction demands decertification of the electronic insurance verification system, or the EIVS eyeball, that nails poor people who don’t comply with a policy requiring every registrant to buy auto insurance or be revoked,” Tulis says. “This program of government corruption generates up to 40,832 false criminal convictions a year for ‘no insurance,’ most all among the impoverished.”

In a nutshell ———————–

➤ Immediate relief sought in fraud program

➤ EIVS decertification, halt of 12,000 notices weekly targeted

Revenue hearing officer Brad Buchanan ruled Feb. 14 the law intends “to bar” the poor from the roads.

The motion for temporary injunction demands EIVS eyeball be temporarily closed. The petition asks Judge J.B. Bennett for a special master to oversee the “process of repair, repentance, sorrow, turning away from evil, reformation and rebuilding.” Adding filters will let EIVS monitor whether suspended drivers are current in their SR22-certified insurance policies.

Two types of individual must show proof of financial responsibility, Tulis argues. One is a licensee in a qualifying accident, who can sign an affidavit. The other is a person whom the department of safety suspends for cause who gets to keep the privilege on condition of insurance coverage.

“I’m asking for the immediate halt of this program. It’s a picture of predatory corporate capitalism feeding off the general public and jamming poor jobless or working folk deeper into their holes. A million people in Tennessee do not have or cannot afford insurance. What is so criminal about this operation? Gerregano is an insurance CEO bagman. Cops use the club. These brigands force people to buy insurance they cannot afford to obtain policies that are legally insufficient to be proof of financial responsibility as defined in the law,” Tulis says.

The program creates 28 law abrogations and violates nine Tennessee constitutional guarantees, including the right to contract and freely use the public roads, Tulis filings say.

Tulis is suing Gerregano and safety commissioner Jeff Long for fraud in a second case in the Tennessee court of appeals. He is suing Gerregano personally in U.S. district court in Nashville for $7 million in aggravated damages, an action stayed pending conclusion of state cases. His Christian ministry’s lawsuit to force Hamilton County traffic stops to be handled administratively in department of safety is on appeal in the federal 6th circuit.

#####