A prison inmate makes a registration tag. (Photo department of correction)

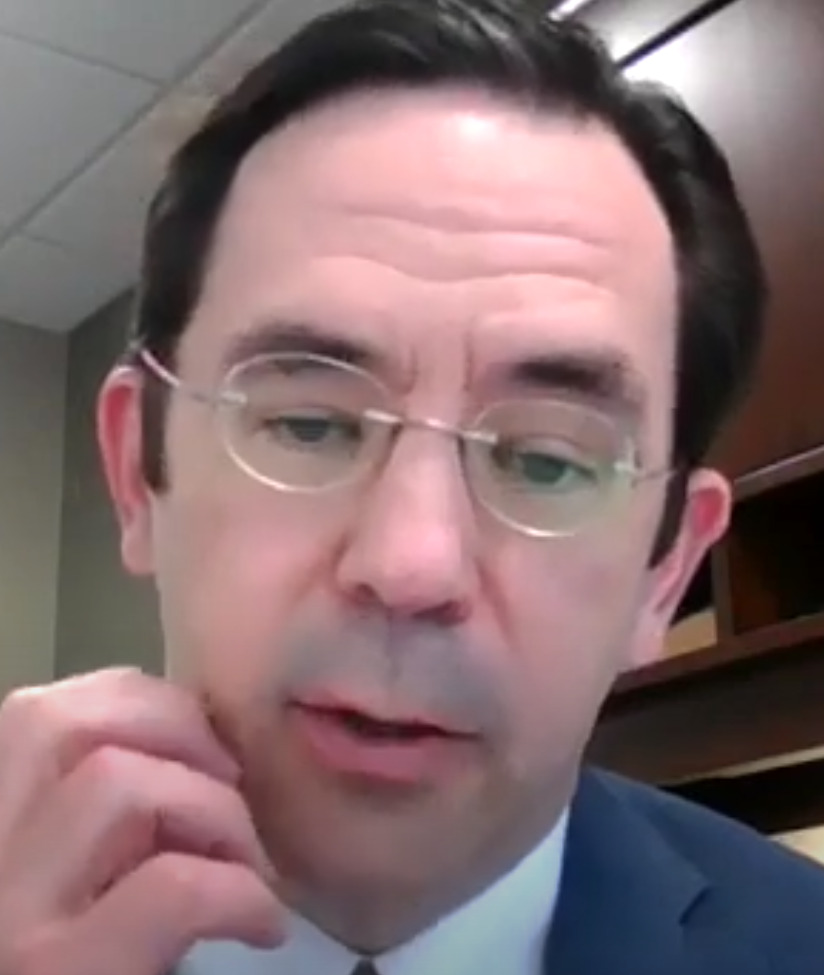

David Gerregano, center, meeting with staff, is head of the Tennessee department of revenue, an attorney who knows the law and knows he is violaating the financial responsibility law of 1977 in a mass fraud of which I am accusing him in two courts and in administrative proceedings. (Photo DOR)

CHATTANOOGA, Tenn., Friday, Nov. 1, 2024 — A quick read of my newest prosecution of the wicked starts on p. 1 of my 93pp complaint before the Tennessee three-judge panel, filed today in Hamilton County chancery court.

Legally, the crucial point is that only certified motor vehicle liability insurance policies can be required, and only people under suspension can get a certified policy.

Regular policies (owner’s, operator’s) don’t qualify as proof of financial responsibility. Yet people are forced to buy them, a gift to the insurance cartel. Up to F$2 billion in free premiums a year.

My suit, I believe puts criminal operators in high office under pressure because they are so far astray from what T.C.A. 55-12-101 and 201 et seq say. Rogue program, Mass harm for 22 years, under Democrat and GOP administrations, and no one is seeing it until today.

I include safety commissioner Jeff as a respondent, since he has been administering T.C.A. § 55-12-139 since 2002 as if all motorists are obligated to carry proof of financial responsibility.

David Gerregano, commissioner of revenue

Abstract of State ex rel. Tulis filing toay

It demands they buy operator’s or owner’s policies, none of which meet the statutory requirement that they be certified motor vehicle liability policies as defined at T.C.A. § 55-12-102 and -122 in the Tennessee financial responsibility law of 1977, and meeting standards laid out at § 55-12-202. Respondents claim authority for “mandatory insurance” from T.C.A. § 55-12-139 and have made Tennessee a mandatory insurance state since 2002 without authority.

The only persons required to have proof of financial responsibility are those whose licenses and/or tags are revoked under a conviction or court judgment, or because they fail to report to commissioner of safety a qualifying accident. T.C.A. § 55-12-104. Relator has a good driving record and no qualifying accident. DOR revokes his tag illegally, in violation of due process rights.

In short: Respondents threaten members of the public into buying insurance they cannot afford to obtain policies that no one can certify as legal proof of financial responsibility.