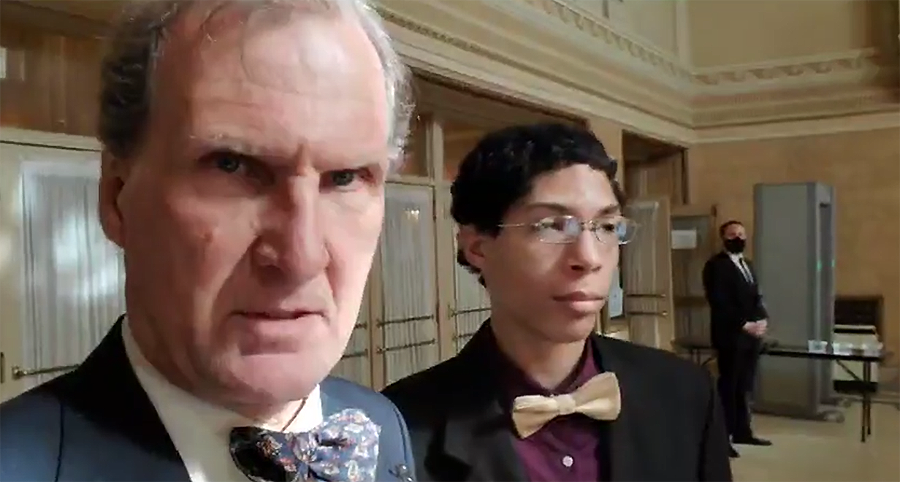

Hearings in the Flexibility v. Cupelli et al case are in this circuit court in Hamilton County, Tenn., overseen by judge Kyle Hedrick, at right. (Photo David Tulis)

Pieter Bruegel’s painting ”Land of Cockaigne” depicts a locale where wealth, food, pleasure roll off trays into our mouths, and we don’t have to work — a lala-land in which Flexibility Capital Inc. usury contracts live. If the borrower’s business stumbles — no matter. Just write Flexibility a check and pay off the balance due, and all will be good.

Pieter Bruegel’s painting ”Land of Cockaigne” depicts a locale where wealth, food, pleasure roll off trays into our mouths, and we don’t have to work — a lala-land in which Flexibility Capital Inc. usury contracts live. If the borrower’s business stumbles — no matter. Just write Flexibility a check and pay off the balance due, and all will be good.

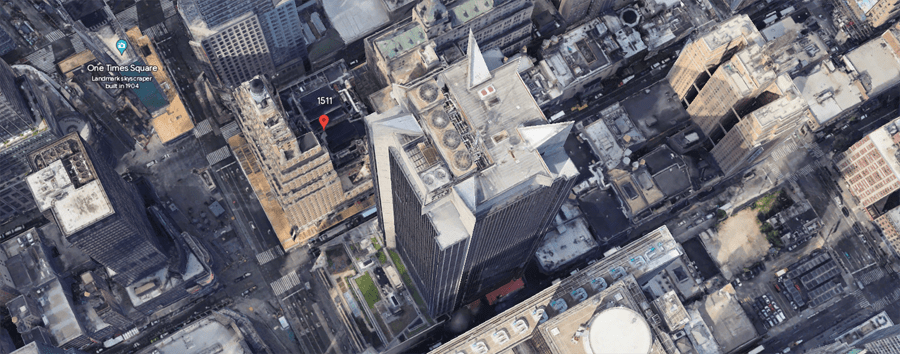

High-rolling lender Flexibility Capital has a mailing address at the red dot among the high rises of New York, working to stripmine value out of people in Tennessee and in other states. (Photo Google Earth)

The fraudulent state of emergency for CV-19 that puts these protesters in front of the Hamilton County, Tenn., courthouse in 2020 prevents my NoogaRadio 96.9 FM station from meeting its obligations, resulting in a merchant cash advance lawsuit against me demanding more than F$30,000 in debt, court costs and legal fees. (Photo David Tulis)

CHATTANOOGA, Tenn., Saturday, Oct. 7, 2023 — A loan to my investigative news radio station in Chattanooga turns out a bad investment in 2020 when an illegal state of emergency collapses the economy in Tennessee and effectively puts me out of business.

By David Tulis / NoogaRadio Network

A high interest loan — dressed as an advance purchase of future receivables or a merchant cash advance — had just hit the bank account of Hot News Talk Radio LLC (no longer in existence) when Gov. Bill Lee effectively declared martial law and imprisoned the people in their houses. Flexibility Capital sued the “personal guarantors” of their loan — my business partner and me.

David Tulis, radio reporter

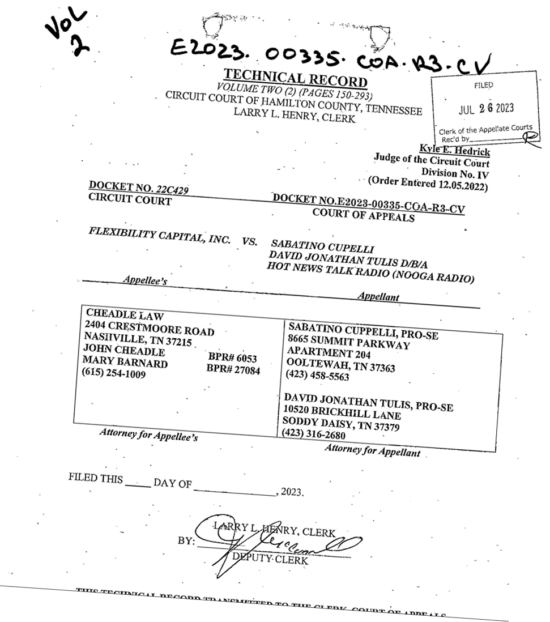

The case Flexibility Capital Inc. v. Sabatino Cupelli et al, E2023-00335-COA-R3-CV, is in the court of appeals in Knoxville. The clerk got a filing from me Friday night at 10:06.

Oral arguments are set Nov. 14, 2023, at 1:30 p.m. in the courts building in Knoxville and are set to be live on YouTube.

We discover in fighting back that the transaction is not legal in Tennessee because it violates the Tennessee usury law, and is not an authentic advance purchase of future receivables. It is a fraudulent loan because its 14-page contract absolutely requires repayment. A genuine cash advance on future receivables is a much more complex arrangement and implies lender risk. The funder becomes effectively a short-term partner, bearing risk.

Many business owners in the Chattanooga area have dealt with such funders. Their come-ons in the mail and by phone are common to everyone in business.

And the profits are high.

208.05 % rate of interest

The rate of interest is so high because the loans are guaranteed by the principles in the business personally, and not by assigning collateral such as houses, cars or property. The loans are extended, minus hefty fees, and arrangements are quickly made — in days or hours. No such case has been decided in state courts. I am demanding a ruling clarifying that business lenders in Tennessee cannot operate in Tennessee if they extend fraudulent and deceptive contracts that are unenforceable in court.

My brief in the court of appeals describes the situation in which you may find yourself. Key points about your situation:

➤ The 14-page lending agreement shows risk-sharing on the first 10 pages

➤ A personal guarantee, pp. 11-14, overwrites the prior pages

➤ The agreement is a loan, absolutely repayable and not a genuine advance purchase of your future cash flow

➤ The loan at the 200-plus percentage rate may violate your state’s lending or usury law

➤ A key case giving advice on how to discern whether you are a loan-shark victim in a fraudulent, illegal contact is the U.S. bankruptcy case involving CapCall and the Shoot the Moon restaurant chain

Introduction

Appellant challenges knowing and intentional criminal fleecing by Flexibility Capital and asks the court to rule as to the lawfulness of contracts such as that controlling in this case. Appeal is brought to prevent injury to the interests of the public and prevent prejudice to the judicial process evidenced in fraud on the court in the Hamilton County trial court. Flexibility is a predatory lender with a contract that the record shows is so self-contradictory and confusing that debt collector Cheadle Law and appellee make damning admissions against interest on the first page of the complaint (TR p. 6), proving from the start appellant’s grievances about its fraudulent nature. (1)

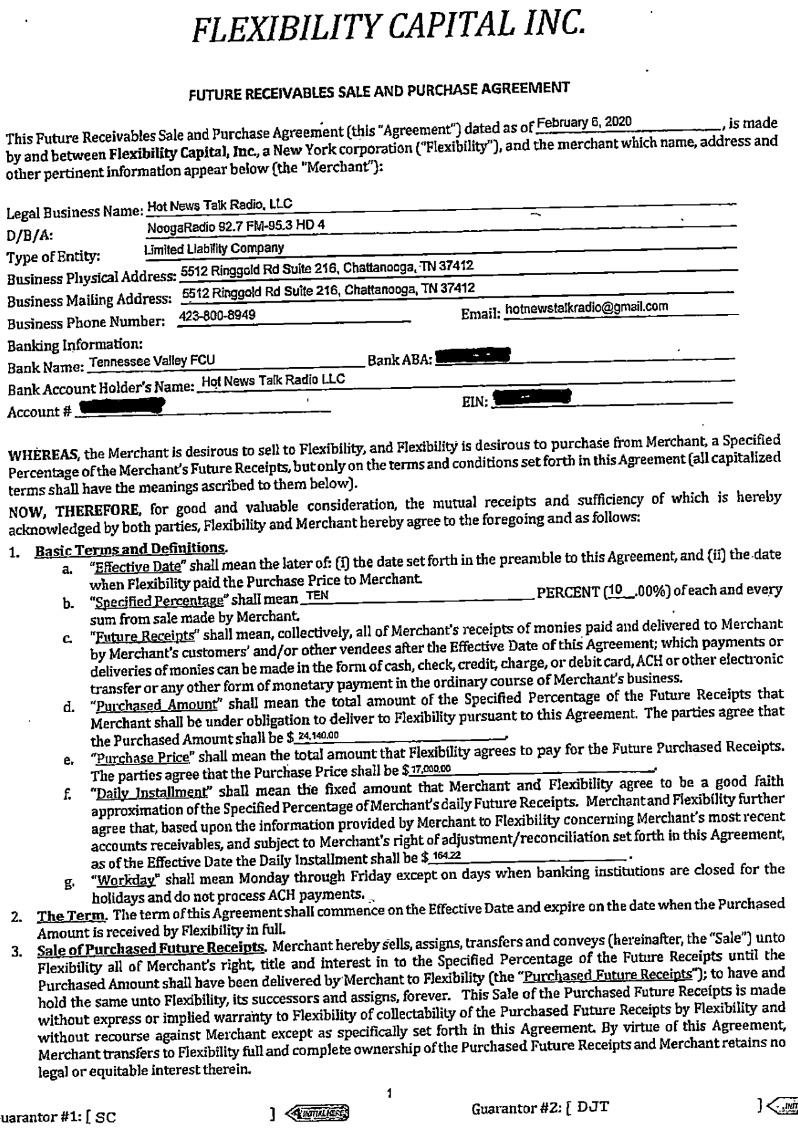

This is Page 1 of the pretended “future receivables sale and purchase agreement” that fraudulently hides an illegal usury loan constituting a misdemeanor in Tennessee and a felony in New York, approved by local judge Kyle Hedrick in Hamilton County circuit court.

Merchant cash advance funder Flexibility is an accounts receivable financier in violation of the usury laws of Tennessee (misdemeanor) and New York (felony). It extends loans wildly beyond statutory loan limits in each state. Cheadle is fellow tortfeasor stripmining small business and the working poor in Tennessee, managing an extensive book of business among Flexibility debtors (75 cases in Knox County week of Nov. 28, 2022.) (TR p. 251).

The trial court injures appellant by refusing to heed repeated objections and motions regarding subject matter jurisdiction. When the accused challenges it, all other issues are to be laid aside until plaintiff establishes that the court has authority over the subject matter. These refusals are plain error in which, to all appearances, the Hamilton County circuit court, Flexibility and Cheadle are conjoined at the hip to abuse appellant, forcing a case into appeal that is owed a dismissal with prejudice.

The basis of the subject matter jurisdiction challenge is the 14-page “future receivables sale and purchase agreement” dated Feb. 6, 2020 (TR p. 25). The contract is not signed by any man or woman at Flexibility — a sidebar problem for Flexibility. If indeed the purported agreement is for a loan absolutely required to be repaid, as the complaint insists that it is, such loan is illegal and unenforceable in any court, no matter what concessions about risk sharing appear in the contract.

The trial court holds fast to its finding that because accused do not file a statement of material facts, plaintiff wins summary judgment. The court pits procedural signposts against jurisprudential infrastructure and finds the infrastructure wanting.

Issues presented for review

This case deals with a money loan to two Tennesseans by a New York City lender and whether it is sufficiently legal and enforceable so as to give a Hamilton County trial court authority to hear the case.

- Is the Flexibility Capital Inc. contract a lawful advance purchase of future receivables contract in which the lender takes market risk, including loss of its money, or does the absolute requirement for repayment mean the contract is for a loan of money?

- Is the loan at 208.05% APR and lawsuit to enforce it an unconscionable and fraudulent violation of usury limits at T.C.A. § 47-14-103 and T.C.A. § 47-14-110?

- Is the trial court correct to ignore pleadings of no subject matter jurisdiction for plaintiff’s lack of standing as loan is unlawful, and so joining in intrinsic fraud upon the court by plaintiff?

Statement of the case

Flexibility sues appellant and business partner Sabatino Cupelli on May 12, 2022, in Hamilton County sessions court in form of a motion for summary judgment. The contract states such suit will be filed only in New York (TR p. 33, ¶ 37). Attached to the complaint is a brief, exhibits, a statement of material facts, attorneys John and Mary Cheadles’ billing statement and the contract (TR p. 25 ff). To get right of discovery, accused accept default judgment in sessions and appeal to circuit.

Significant in the case is the switch in legal positions between the parties. At first, accused insist the arrangement between Flexibility and accused, doing business as Hot News Talk Radio, is an advance purchase of future receivables, not a loan. Cheadle and Flexibility insist the case is about a loan.

Later, parties swap positions. Accused insist the contract is for a loan with an absolute requirement to repay. Flexibility seems to change sides, too. In proposed orders it strips out loan language (“plaintiff loaned defendants money” [TR p. 67]) and trial court signs drafts indicating the contract is an authentic advance purchase of future receivables (TR p. 219).

Accused file a Rule 8 motion July 14, 2022, for sanctions against the Cheadles since plaintiff’s insistence that it is a loan contradicts the first section of the “future receivables sales and purchase agreement” that accused initially believed controlled (TR p. 67). The motion is denied. The court orders “the documents underlying this lawsuit shall be referred to as the ‘future receivables sale and purchase agreement,’” as titled on the contract, Page 1 (TR p. 25).

Also on July 14, 2022, accused file a motion to compel discovery under Rule 26.02. The motion is an attempt to discover the origin of the loan funds by another party, Kapitus, to whom they made initial application, and the possibility that Flexibility has no interest in the loan and no position to enforce it. (Cheadle says accused did “agree to strike” this motion, the record shows. TR p. 71)

Mary Cheadle of Cheadle Law in Nashville pursues debtors for loan sharks such as Flexibility Capital, as here in Hamilton County circuit court. (Photo David Tulis)

On Aug. 10, 2022, accused file Motion in opposition to summary judgment motion. On Aug. 12, 2022, appellant files Affidavit and amended answer to motion for summary judgment. This affidavit defends against the lawsuit under the contract’s advance purchase of future receivables section pp. 1-10 (TR p. 94 ff). These provisions show that Flexibility is willing to accept borrower failure and nonpayment.

Gov. Bill Lee’s state of emergency March 12, 2020, collapsed the economy, to appellants’ harm, nearly forcing the radio station off the air. The affidavit and exhibits show contract interference by third parties into performance of the agreement. It argues the contract is “‘not a loan,’ and ‘the purchase price is paid to merchant in consideration for the ownership of the purchased future receipts and that payment of the purchase price by Flexibility is not intended to be, nor shall it be construed as a loan *** that requires absolute and unconditional repayment on a maturity date. To the contrary, Flexibility’s ability to receive the purchased amount *** and the date when the purchased amount is paid in full (if ever) are subject to and conditioned upon performance of merchant’s business *** [emphasis added].’” (internal citation omitted) (TR p. 99).

Gov. Bill Lee, center, visits Motlow State in October 2022. (Photo governor’s office)

On Sept. 13, 2022, accused file a motion for summary judgment on grounds that “two legal impossibilities *** inhere in the controlling contract, one an original impossibility, and one supervening.” A supporting brief is premised on appellant’s belief the contract is an authentic and lawful advance purchase of future receivables. It analyzes the guaranty provisions of the contract as “an original impossibility” with Gov. Lee’s shutdown of the business a “supervening impossibility” (see brief generally, TR p. 144 ff). The motion is ordered stricken in the dec. 5, 2022, order of summary judgment (TR p. 221)

On Nov. 1, 2022, Flexibility files a response to accuseds’ motion for summary judgment, alleging they failed to support their contentions “with any financial documentation or supporting affidavit.” The accused fail to comply with Rule 36.01 (admissions of material fact), Flexibility says, and defendants misrepresented their company’s good standing as a corporation. That the company was not at the time in good standing means that “defendants *** are personally liable” (TR p. 191).

Nov. 2, 2022, accused make a Supplemental filing with the court showing the court their interrogatories target the fraudulent nature of the contract and demanding whether Flexibility is a real party in interest.

On Nov. 7, 2022, in a motion hearing not of record, appellant seasonably calls to the attention of the trial judge the problem of subject matter jurisdiction. The court rules for plaintiff’s motion for summary judgment, reading it aloud at a hearing.

Accuseds’ oral motion to reconsider indicates they raise the subject matter jurisdiction at the hearing. On Nov. 17, 2022, accused file a motion to reconsider raising the legality of the contract for the first time (TR p. 205). A supporting brief points out that the contract makes absolute requirement for repayment, and is thus a loan contract under illegally usurious terms. Lake Hiwassee Dev. Co. v. Pioneer Bank, 535 S.W.2d 323 (Tenn. 1976) The motion says the lawsuit is a fraud on the court.

On Nov. 17, 2022, accused file a motion to reconsider and documents in their defense, including (1) an affidavit attesting to the usury defense (TR p. 208), and (2) a brief in support (TR p. 200).

This volume is the second in the court case record rising from Hamilton County, Tenn., to the court of appeals in Knoxville, demanding a ruling that “business funders” such as Flexibility Capital of New York are tortmongers and criminal actors suing unenforceable contracts in Tennessee courts.

On Dec. 5, 2022, the court enters an order of summary judgment (TR, p. 219). It says “defendants executed a future receivables sale and purchase agreement with plaintiff. Plaintiff advanced future receivables to defendants. Defendants failed to pay as promised. *** Defendants detain plaintiff’s collateral and have declined to turn over possession of collateral to plaintiff.” The court describes the relationship between lender and borrower in terms of a loan with repayment an absolute obligation. “The amount due plaintiff by defendants was $21,061.38 as of August 5, 2020” (TR p. 220).

Plaintiffs on Dec. 9, 2022, file an answer accuseds’ motion to reconsider. The motion doesn’t deny claims it is fraudulent. It doesn’t attempt to rescind or justify earlier admissions the contract is a loan of money. It denies usury as follows:

Tennessee Courts have long allowed default interest at the contractual rate of 24 percent per annum and held that such a rate is not usurious. J.& B. Investments v. Surti, 258 S.W.3d 127, 136-137 (Tenn.Ct.App. 2007). The interest provided for in the underlying agreement is not usurious.

TR p. 226

Flexibility loan shark case court record – 1

Flexibility loan shark case court record – 2

On Dec. 19, 2022, accused file “Answer to plaintiff response to motion to reconsider, challenge to subject matter jurisdiction,” highlighting the jurisprudence for subject matter jurisdiction. This document is handed to plaintiff and filed with the clerk the day of a hearing in which appellant challenges subject matter jurisdiction.

On Dec. 27, 2022, accused timely file Motion to set aside order for intrinsic fraud & demand for mandatory judicial notice, citing the illegal nature of the contract and putting the court on notice (TR p. 252). “The court rejects the duty in well established law to have its conscience shocked at fraud, deceit, usury, ill-dealings. (2) Defendants demand it take mandatory judicial notice of the law, per Tennessee evidence rule no. 202 as regards the control of state law and court rulings” (emphasis original) (TR p. 253). The filing gives further detail on intrinsic fraud.

On Jan. 18, 2023, the court signs an Order denying defendants’ motion to reconsider, saying it “will not disturb its earlier ruling” and that defendants “failed to respond to plaintiff’s specification of material acts as required by Rule 56.03 *** after being provided additional time *** to comply. *** Defendants are now attempting to belatedly assert new defenses including subject matter jurisdiction. The time has run to assert such defenses. The judgment is final” (TR p. 264).

On Feb. 6, 2023, Flexibility replies to accuseds’ Motion to set aside order, reporting the court’s agreement with its suit, says “the Court *** found that defendants assertion that the Court does not have subject matter jurisdiction has been waived as not previously asserted” (emphasis added). Accuseds’ motion to set aside constitutes “the same belated arguments” as before (TR, p. 266).

On Feb. 27, 2023, appellant attempts to set aright the judicial ship with Affidavit and objection to signing final order in which he belabors the rule in American jurisprudence that if subject matter jurisdiction is challenged, the burden falls upon the opposing party to establish it, and that Flexibility’s failure to do so under court supervision is a fraud against the two accused, and a fraud on the machinery of the court in which Hamilton County circuit court shares and espouses, despite appellant’s red warning flags at bar and in brief (TR p. 269).

On April 10, 1012, the court issues Order denying defendants’ motion to set aside order for intrinsic fraud and demand for mandatory judicial notice. “Omission of a statement of material facts is fatal to a case, generally,” accused say (TR p. 256). “It depends on the case. Defendant’s procedural goofs are unjust to flag when the case itself flutters the pennant of the Jolly Roger, deserving no berth in this port” (emphasis in original). Appellant files notice of appeal March 8, 2023 (TR p. 281).

Standard of review

Standard for review in this case is the law making investments and advance purchase of future receivables distinct from loans, whether a loan past 10 percent per year is legal under the state usury law, and whether an issuer of an illegal loan and his lawyer debt collector have standing to invoke a trial court’s subject matter jurisdiction

TENNESSEE LAW. Tennessee recognizes purchases in advance of business receivables. “‘Account purchase transaction’ means an agreement under which a commercial entity sells accounts, instruments, documents, or chattel paper to another commercial entity subject to a discount or fee, regardless of whether the commercial entity has a repurchase obligation related to the transaction” Tenn. Code Ann. § 47-14-102.

“Omission of a statement of material facts is fatal to a case, generally,” accused say (TR p. 256). “It depends on the case. Defendant’s procedural goofs are unjust to flag when the case itself flutters the pennant of the Jolly Roger, deserving no berth in this port”

— David Tulis, NoogaRadio investigative reporter

“‘Usury’ is the collection of interest in excess of the maximum amounts authorized by or pursuant to this chapter or any other statute” Tenn. Code Ann. § 47-14-102. Tennessee bans interest in many types of loans beyond 10 percent per year. § 47-14-103. Maximum rates. The law provides a defense against suit such as this one. “(a) A defendant sued for money may avoid the excess over lawful interest by pleading usury, setting forth the amount of such excess. (b) In order to sustain a defense of usury, the burden is on the party claiming usury” Tenn. Code Ann. § 47-14-110.

Willful usury is a Class A misdemeanor. T.C.A. § 47-14-112.

“To constitute usury there must be a requirement that the money loaned be repayable absolutely. If it is payable only upon some contingency, the transaction is not usurious.” Id. Lake Hiwassee at 325. Usury imports the existence of four elements: (1) A loan or forbearance, either express or implied; (2) an understanding between the parties that the principal shall be repayable absolutely; (3) the exaction of a greater profit than allowed by law; and (4) an intention to violate the law. Jenkins v. Dugger, 96 F.2d 727, 729 (6th Cir. 1938).

NEW YORK LAW. New York law prohibits usury past 25 percent per year in two laws. First-degree usury is an act by someone with a criminal record. Second degree criminal usury lacks the criminal record element, and is as follows:

A person is guilty of criminal usury in the second degree when, not being authorized or permitted by law to do so, he knowingly charges, takes or receives any money or other property as interest on the loan or forbearance of any money or other property, at a rate exceeding twenty-five per centum per annum or the equivalent rate for a longer or shorter period.

Criminal usury in the second degree is a class E felony.

N.Y. Penal Law § 190.40 (McKinney)

Crime of criminal usury in the second degree requires proof only that defendant charged or received money or other property as interest on a usurious loan. McKinney’s Penal Law § 190.40. *** Finding that defendant received interest on usurious loan as part of a scheme or business of making or collecting usurious loans was supported by evidence that he made a loan of $2,000 for which he required interest payments at the rate of $100 per week, that he later twice renegotiated the loan, requiring interest at effective annual rates of 109.2% and 145.6%, and that he directly participated in collection efforts on two of the loans.

People v. Valentzas, 70 N.Y.2d 446, 517 N.E.2d 198 (1987)

“New York’s criminal usury statute prohibits a person from knowingly charging interest on a loan at a rate exceeding 25% per annum.” *** The defense of criminal usury requires proof that “the lender (1) knowingly charged, took or received (2) annual interest exceeding 25% (3) on a loan or forbearance.” Funding Grp., Inc. v. Water Chef, Inc., 852 N.Y.S.2d 736, 740 (Sup.Ct.2008), judgment entered, (N.Y.Sup.Ct. Apr. 16, 2008). There is a strong presumption against a finding of usury under New York law, and the party seeking to assert it as a defense bears a heavy burden as to all three elements. *** Critically, in assessing a usury defense, the Court must “look to the nature of the transaction and not to the form in determining whether such transaction was usurious.”

Pro. Merch. Advance Cap., LLC v. C Care Servs., LLC, No. 13-CV-6562 RJS, 2015 WL 4392081, at *4 (S.D.N.Y. July 15, 2015) (some internal citations omitted)

Flexibility Capital is at 1501 Broadway Suite 1511, New York, N.Y. 10036

A challenge on subject matter jurisdiction is never untimely. A challenge to subject matter jurisdiction cannot be waived and may be raised at any time. Johnson v. Hopkins, 432 S.W.3d 840, 843-44 (Tenn. 2013). Church of God in Christ, Inc. v. L. M. Haley Ministries, Inc., 531 S.W.3d 146, 157 (Tenn. 2017). “Whenever subject matter jurisdiction is challenged, the burden is on the plaintiff to demonstrate that the court has jurisdiction to adjudicate the claim” Redwing v. Cath. Bishop for Diocese of Memphis, 363 S.W.3d 436, 445 (Tenn. 2012). “As orders and judgments entered by courts lacking subject matter jurisdiction are void, ‘issues regarding subject matter jurisdiction should be considered as a threshold inquiry” and “resolved at the earliest possible opportunity.'” Nandigam Neurology PLC v. Beavers, 639 S.W.3d 651, 660 (Tenn. Ct. App. 2021)

Statement of facts

The central fact of the case is the contract between Flexibility Capital and the accused. Appellant follows the order in the statement of issues to establish the facts emanating from the agreement, and after that the purely legal question of whether Flexibility has enough of the right kind of facts and law to invoke the court’s subject matter jurisdiction.

I. ILLEGAL CONTRACT

Appellant avers the contract sought to be enforced in this lawsuit is unconscionable and unenforceable on grounds it is an illegal loan at 208.05 annual percentage rate. Petitioner here reviews state law and the contract to see if they give Flexibility standing to sue and the court jurisdiction.

Petitioner includes in the subject matter jurisdiction analysis the “acceptable forum” provision of the agreement stating such suit is to be heard solely in New York.

The contract that lender Flexibility Capital puts before the public in Tennessee and appellant is, generally stated, a hybrid agreement. The loan agreement in the closing pages of the document effectively overwrites a contract for advance purchase of future receivables, an agreement of self-demolishing and incoherent nature (TR p. 25ff, generally).

Pages 1-10 of the contract are an advance purchase of future receivables of the merchant radio station, with Flexibility bearing risk. (3) Pages 11-13 are the personal guaranty in which appellant and partner Cupelli are absolutely bound to repay the total balance due, regardless of the receivables flowing into the business (TR p. 35-37). Page 14 is Appendix A, fee structure.

The two sections each require signatures, though no one at Flexibility signs either section. The pages are numbered consecutively, pp. 1 to 14, with the parts constituting a single document and agreement.

Part 1 of contract

The contract itself goes to great lengths to avoid appearances that the purchase for advance receivables is a loan at usury, as appellant insists in the lower court. The contract convinces the borrowers that the lender agrees to share in the risk of their venture.

The contract recognizes business rises and falls, and that it is possible the merchant/borrower may fail and generate fewer or even no future receipts. The contract at “Risk sharing acknowledgements and arrangements” states,

The period of time that it will take Flexibility to collect the purchased amount is not fixed, is unknown to both parties as of the effective date of this agreement and will depend on how well or not well merchant’s business will be performing following the effective date. As an extreme example, in the event merchant’s business ceases to exist after Flexibility’s purchase of the purchased future receipts for reason outside merchant’s control, Flexibility may never recover any moneys spent on such purchase. [emphasis added]

p. 3, ¶ 14(a)(ii), TR p. 27

Flexibility assumes risk involved with accuseds’ federally licensed radio station.

[O]r if the full purchased amount is not remitted because the merchant’s business went bankrupt or otherwise ceased operations in the ordinary course of business (but not due to Merchant’s wilful or negligent mishandling of its business), and merchant shall not have breached this agreement, merchant would not owe anything to Flexibility and would not be in breach of or in default under this agreement.

p. 4, ¶ 14(a)(v), TR p. 28

Flexibility agrees to purchase the purchased future receipts knowing the risk that merchant’s business may slow down or fail, and Flexibility assumes these risks based exclusively upon the information provided to it by merchant ***.

****

Furthermore, Flexibility hereby acknowledges and agrees that merchant shall be excused from performing its obligations under this agreement in the event merchant’s business ceases its operations exclusively due to the following reasons (collectively, the “valid excuses”). (i) [A]dverse business conditions that occurred for reasons outside merchant’s control and not due to merchant’s willful or negligent mishandling of its business. *** [N]atural disasters or similar occurrences beyond merchant’s control.

p. 4, ¶ 14(b), TR p. 28

The agreement is “not a loan,” and “the purchase price is paid to merchant in consideration for the ownership of the purchased future receipts and that payment of the purchase price by Flexibility is not intended to be, or shall it be construed as a loan *** that requires absolute and unconditional repayment on a maturity date.”

To the contrary, Flexibility’s ability to receive the purchased amount *** and the date when the purchased amount is paid in full (if ever) are subject to and conditioned upon performance of merchant’s business *** [emphasis added]

p. 4, ¶ 14(c), (TR p. 28)

Under these terms, Flexibility Capital extends credit to operators of Hot News Talk Radio LLC knowing that it risks not getting paid. It takes that risk; too, the borrower takes the risk of the obligation to pay via future receivables, intending to fulfill the terms, its owners and managers operating in good faith with the radio and news business their calling, vocation and livelihood, and none other encompassed in the agreement.

Part 2 of contract (converting legal advance purchase of future receivables into usury loan)

The contract disputed in this case admits itself into the world of loans for money by having a personal guaranty, pp. 11-13, that makes the funds repayable absolutely.

c. Buyer is not willing to enter into the Agreement unless Guarantor irrevocably, absolutely and unconditionally guarantees prompt and complete performance to Buyer of all the obligations of Merchant under the Agreement (collectively, “the Obligations”).

p. 11, TR p. 35

As an inducement to take risk, Flexibility requires the borrowers to make absolute guarantee of repayment of the full amount to Flexibility.

Guaranty of Obligations. Guarantor hereby irrevocably, absolutely and unconditionally guarantees to Buyer prompt, full, faithful and complete performance and observance of all Merchant’s Obligations; and Guarantor unconditionally covenants to Buyer that if default or breach shall at any time be made by Merchant in the Obligations, Guarantor shall well and truly pay or perform (or cause to be paid or performed) the Obligations and pay all damages and other amounts stipulated in the Agreement with respect to the nonperformance of the Obligations, or any of them. [italics added]

p. 11, TR p. 35

The exchange for the purchased amount (of receivables) is

payment for an adequate consideration and is not intended to be treated as a loan or financial accommodation from Buyer to Merchant.

p. 12 ¶ 5, TR p. 30

To cover its actions, plaintiff wins defendants’ “[acknowledgment]” that Flexibility is “not a lender, bank or credit card processor, and that Buyer has not offered any loans to Merchant, and Guarantor waives any claims or defenses of usury in any action arising out of this Guaranty” (TR p. 36 ¶ 5).

The “personal guaranty of performance” is part of the contract, not a separate agreement. It constitutes pp. 11-14 of the 14-page document, the guaranty’s page numbers included on front-facing pages. The guarantee on the face of the contract — and not apart from it — makes the money referred to the “future receivables sale and purchase agreement,” starting on Page 1, absolutely repayable.

No man or woman at Flexibility signed the contract on Page 10. Lines for a signature, printed name and title are empty. No man or woman from Flexibility signs the erstwhile personal guaranty, either. The Appendix, Page 14, also contains no signature of man or woman at Flexibility (TR p. 38).

This lack of a party signature is not dispositive of any claim appellant might make indicating a failure to have a meeting of the minds among the parties. (4) It suggests a desire on the part of Flexibility staff to avoid personal responsibility for violating New York’s usury ban. The only Flexibility personnel appear in the case arrive after filing suit. Gina Monteforte, purported president of Flexibility Capital, appears by affidavit (TR p. 43). The trial court at the first hearing overrules defendants’ objections about lack of signature.

Facts of the case

Appellant and his business partner Cupelli applied for an advance purchase of future receivables from Flexibility or Kapitus, a cooperating business lender. The record indicates the disputed loan is the second loan obtained to benefit Hot News Talk Radio. A first loan, in October 2019, was for $18,905. (5) Flexibility does not ask the identity of any customer or receivable.

In this case, accused receive $16,320 by direct deposit. The agreement requires Hot News Talk Radio to pay $164.22 every weekday. The total balance due is $24,140, or $7,820 more than the loan amount received. It was to take 147 weekdays to pay off the loan, or 29.4 weeks, slightly more than half a year (TR p. 39).

Appellant initially tells the trial court the rate of interest is 47.916 percent for the 29-week period, or nearly 100 percent per annum. The correct rate is 208.05% APR. (TR p. 229), a figure not denied by Flexibility.

In business, receivables vary widely day to day. The contract says the payments are an advance purchase of future receivables. But Flexibility’s payment schedule is the same number of dollars every weekday. There is no connection between receivables and repayment. Repayment is fixed daily upon a loan of money, as noted in the complaint.

Hot News Talk began having trouble paying March 5, 2020, with a $35 fee imposed for insufficient funds. Automatic payments failed March 9, 11, 12 and 13 (TR p. 39).

Gross receipts had dried up under the state of emergency declared by Gov. Bill Lee on March 12, 2020. The economy, thanks to a scorched-earth state policy of mass house arrest, was in collapse. The record shows appellant’s harm under the state of emergency and the breach against appellant that caused him to sue to bring Gov. Lee under compliance with the state health law at T.C.A. § 68-5-104, and thereby halt the economic meltdown that wrecked his business and his personal estate. He obtained no relief pursuing relief 878 days in or in front of state and federal courts.

David Tulis and apprentice Hayden Couvillon of NoogaRadio Network are cast into outer darkness at Tivoli Theater in Chattanooga by the Tim Kelly city mayor administration, which refuses them access to witness his swearing in because they insist on not wearing CV-19 chin diapers. (Photo David Tulis)

Flexibility was unwilling to be flexible in letting the radio merchant delay payments until it could generate receivables, and sues this case.

In circuit the parties switch arguments midstream, with appellant insisting the contract is a loan because it is absolutely repayable under usurious terms, and Flexibility ending (with trial court aid) by holding forth that the contract is not absolutely enforceable as a loan because it is a lawful “future receivables sales and purchase agreement,” as described finally by the court.

Investigative journalist’s 13 questions to win in discovery (holder in due course, original agreement, proof of value given, etc.)

The suit begins with claims by Flexibility that the transaction is a loan. Flexibility and Cheadle Law firm confess the transaction is a loan with an absolute duty for repayment in an attempt to exact usurious interest. Plaintiff admissions are as follows:

“6. On February 6, 2020, Sabatino Cupelli and David Jonathan Tulis, d/b/a Hot News Talk Radio, executed a future receivables sale and purchase agreement with Flexibility Capital. 7. Flexibility Capital loaned Sabatino Cupelli and David Jonathan Tulis, d/b/a Hot News Talk Radio, money.”

Affidavit of Gina Monteforte, president of Flexibility Capital (emphasis added)

“Defendants borrowed money from plaintiff and failed to pay as promised. This is a straight-forward collection case to recover the balance due on a loan.”

Plaintiff’s motion for summary judgment (emphasis added)

“Plaintiff loaned defendants money. Defendants failed to pay the money back.

Plaintiff’s motion for summary judgment (emphasis added)

“Plaintiff loaned defendants money.”

Plaintiff’s brief in support of summary judgment (emphasis added)

“Defendants executed the agreement. Plaintiff loaned defendants money.”

Plaintiff’s brief in support of summary judgment (emphasis added)

“Plaintiff loan[s] defendants money. Defendants failed to pay as promised. A balance remains due. There remains no genuine issue as to any material fact, and plaintiff is entitled to a judgment as a matter of 1aw.”

Plaintiff’s brief in support of summary judgment (emphasis added)

The president of Flexibility, Mrs. Monteforte, and company debt collectors Mary Cheadle and John Cheadle of Nashville describe the transaction in terms of lending money. In their affidavit in support of suit, the Cheadles twice refer to “loan documents” (TR p. 49). In insisting they are lawyers candid with the court under accused’s Rule 8 motion, they aver:

Defendants assert that the statement that “Plaintiff loaned defendants money” in plaintiff’s statement of facts in supporting of its motion for summary judgment is “misleading”. This is not true.

The facts are that defendants applied for commercial funding. Defendants executed a future receivables sale and purchase agreement with plaintiff. Plaintiff loaned defendants money that was to be paid back from defendant’s future receivables.

TR p. 77 (emphasis added)

Are lawyer statements insisting that “plaintiff loaned defendants money” signs of carelessness or incompetence? Appellant proposes they are repeated admissions as to how Flexibility views its business. These usages are not harmless error or lawyerly canoodling not affecting Flexibility’s claims.

These statements of material fact contradict the face of the contract and its terms pp. 1 to 10. They are in the record unamended, uncorrected as an admission of the true nature of the contract, statements against interest, ones sure to be trustworthy, credible and material as they tend to injure the claims of the plaintiff in face of law in two states forbidding usury.

Misled into thinking the contract is an advance purchase of future receivables, accused file a motion to sanction Mary Cheadle for lack of candor to the court in referring to “loan” and “loan for money.” The court denies the motion, accepting her description of the loan deal as truthful.

II. SUBJECT MATTER JURISDICTION

This case is about a New York lender seeking to enforce a loan contract that is illegal in New York and in Tennessee, the victims being two Tennessee citizens running a radio station and network. Shall a plaintiff enforcing a 208.05 percent interest loan win a summary judgment and the court’s execution of judgment on an accused – with seizure of two credit union accounts belonging to appellant and other assets threatened – with no subject matter jurisdiction?

The trial court’s treatment of appellant shocks the conscience.

Flexibility violates state criminal law to peddle such loans, and John and Mary Cheadle are in breach of the code of professional responsibility to aid and abet them, following appellant notice to the attorneys under Rule 8. Not only is the loan agreement illegal. It’s dishonest and deceptive. When appellant and his business partner realize they are fraud victims, they give notice Nov. 17, 2022, to the trial court.

It has taken this long for accused to realize they are victims of fraud of which this prosecution is a part. By this motion they take action forthwith and do not sit on their rights by remaining silent and not demanding relief. They declaim against fraud and by notice of this motion attempt to remove themselves from its taint and spare the court from being smeared in it.

Motion to reconsider, p. 7 (TR p. 215)

It is no defense for Flexibility or for the lower court to say that the issue of subject matter jurisdiction is “untimely.”

Judgments or orders entered by courts without subject matter jurisdiction are void, see Brown v. Brown, 198 Tenn. at 610, 281 S.W.2d at 497; Riden v. Snider, 832 S.W.2d 341, 343 (Tenn.Ct.App.1991); Scales v. Winston, 760 S.W.2d 952, 953 (Tenn.Ct.App.1988). The lack of subject matter jurisdiction is so fundamental that it requires dismissal whenever it is raised and demonstrated. See Tenn.R.Civ.P. 12.08. Thus, when an appellate court determines that a trial court lacked subject matter jurisdiction, it must vacate the judgment and dismiss the case without reaching the merits of the appeal. See J.W. Kelly & Co. v. Conner, 122 Tenn. 339, 397, 123 S.W. 622, 637 (1909).

Dishmon v. Shelby State Cmty. Coll., 15 S.W.3d 477, 480 (Tenn. Ct. App. 1999)

Appellant asks the court to review a second defect in Flexibility’s standing, which defect is incorporated into appellant’s challenge of subject matter jurisdiction. The agreement requires the lawsuit to be filed in New York.

37. Governing Law, Venue and Jurisdiction. This Agreement shall be governed by and construed exclusively in accordance with the laws of the State of New York, without regards to any applicable principles of conflicts of law. Any lawsuit, action or proceeding arising out of or in connection with this Agreement shall be instituted exclusively in any court sitting in New York State, (the “Acceptable Forums”). The parties agree that the Acceptable Forums are convenient, and submit to the jurisdiction of the Acceptable Forums and waive any and all objections to inconvenience of the jurisdiction or venue. Should a proceeding be initiated in any other forum, the parties waive any right to oppose any motion or application made by either party to transfer such proceeding to an Acceptable Forum. [emphasis in original]

Contract, ¶ 37, TR p. 33

Insofar as the forum being a Hamilton County circuit court vs. a New York court is a subject matter jurisdiction issue, appellant raises the matter today in support of his analysis of no subject matter jurisdiction.

Analysis

Flexibility escapes banking regulation by being part of the nonbank shadow financial economy, one much freer to extend cash advances to businesses in true sales of future receivables, and at return levels more lucrative than traditional lending. The sector’s high rates of interest account for the fact that borrowers don’t have to sign over assets, but promise to pay under threat of lawsuit under personal guaranty provisions. Stressed business operators and Flexibility quickly settle on cash advance terms suitable for short-term economic or project emergencies.

To land work, a contractor may need to buy supplies or instantly double or triple his payroll. He obtains a cash advance and commences a project, confident he can stay afloat until payments start coming as stages of work are completed. The cash advance industry serves the American free enterprise system, counting on the promises of capitalism, opportunity and profit. Business counterparties rise or fall together, each party putting its best assets forward.

Tulis Report airs every morning at 7 a.m. in Chattanooga, on Facebook at TNtrafficticket and on Rumble.com at Noogaradionetwork. Tulis sued Gov. Bill Lee in 2020 in an 878-day case for fraud in the Covid emergency, and is suing supreme court justice Roger Page for false imprisonment and false arrest in covering the secretive Tennessee judicial conference in Nashville in November 2021. (Photo David Tulis)

Courts look beyond the form of a transaction to its substance. The general rule on the nature of a loan is in 45 Am.Jur.2d Interest and Usury 146 at 122, as cited in id. Lake Hiwassee Dev. Co.:

‘It is a general rule that the sale or purchase of negotiable or assignable commercial paper or other chose in action or evidence of indebtedness transferable in trade and business transactions, for a valuable or legal consideration after its first negotiation, is not usurious although the price or other consideration determined upon is less than the nominal or face value of the instrument purchased. The courts, however, always look beyond the form of the transaction and to its substance, when it is challenged as usurious, and even though it is in the form of a sale at a discount or a sale in the nature thereof of commercial paper or other choses in action, if it is in substance and purpose a loan in excess of the legal rate of interest it will be condemned as usurious.’

Id. Lake Hiwassee at 325

“To constitute usury there must be a requirement that the money loaned be repayable absolutely. If it is payable only upon some contingency, the transaction is not usurious.1 The basic definition of ‘loan’ is an advance of money with an absolute promise to repay. *** It is well established that the courts of this State will disregard the form of the transaction and look to the substance of the dealings between the parties. In determining whether or not a given transaction is usurious, court will disregard form and look to substance.” Mallory v. Columbia Mortg. & Tr. Co., 150 Tenn. 219, 263 S.W. 68 (1924), overruled on other grounds by Dole v. Wade, 510 S.W.2d 909 (Tenn. 1974).

“Interest is compensation for the use of money which may be demanded by the lender from the borrower, and usury is interest in excess of the lawful rate. *** A loan involving compensation for the use of money must be found to exist as a prerequisite to a finding of usury.” Id. Lake Hiwassee at 327

Accused present to the trial court a copy of an unpublished federal bankruptcy case involving Shoot the Moon LLC, a restaurant business, and CapCall LLC, an ostensible advanced buyer of future receivables, outlining the distinction between true advanced sales of future receivables and loans (TR p. 235)). The contract evaluation by that court may assist the court in hearing this case. (6)

The court must look at the substance of the transaction between the parties and identifying its essential character. A transaction is judged by its real character, rather than by the form and color which the parties have seen fit to give it.

The Flexibility complaint, as noted above on Page 15, conceives of the contract in debtor-borrower terms. The contract has loan-like features giving Flexibility recourse against property other than receivables.

- Flexibility claims collateral interest in “all accounts, including without limitation, all deposit accounts accounts-receivable, and other receivables, chattel paper, documents, equipment, general intangibles, instruments, and inventory *** now or hereafter owned or acquired by merchant” (contract p. 6 ¶ 16, TR p. 30).

- In the power of attorney section of the contract, p. 8 ¶ 26 , Flexibility can “obtain and adjust insurance,” “collect monies due or to become due under or in respect of any of the Collateral,” “collect any checks, notes, drafts, instruments” and “sign Merchant’s name on any invoice, bill of lading or assignment directing customers or account debtors to make payment directly to Flexibility” (TR p. 32). Such scheme appears to let Flexibility take over the radio station in pursuing interest beyond receipts from ad sales.

- Flexibility’s U.C.C. financing statement with the secretary of state of Tennessee gives Flexibility “a first priority lien on all of Seller’s tangible assets and intangible assets”). Flexibility’s security interests in the exchange are significantly broader than one expects from a sale of future receivables (TR p. 41).

Appellant filed with the court, on Dec. 19, 2022, a Shoot the Moon “memorandum disposition resolving competing motions for partial summary judgment,” In re Shoot The Moon, LLC, 635 B.R. 797 (Bankr. D. Mont. 2021) (TR p. 235ff)

Observes the Shoot the Moon court,

These provisions all reflect an allocation of risk whereby CapCall is protected by significantly more than just the value of the receivables it purportedly bought while the Shoot the Moon entity remains exposed. Such an overall arrangement is consistent with a debtor-creditor relationship, not a seller-buyer relationship.

Memorandum opinion p. 11 (TR p. 245)

When the counterparty has a legal right to be paid in full by the business, the existence of that legal right would be indicative of a debtor-creditor relationship even if practical realization of that legal right is “contingent on a merchant’s success” and hence not assured. [emphasis in original]

Id. In re Shoot The Moon at 820

Instant case in which plaintiff seeks enforcement of a contract is like that in Shoot the Moon, with expansive lender security interests beyond those of a purchase of future receivables.

The Flexibility agreement, as noted above, gives the impression of an advance purchase of future receivables by describing “[excusable]” events requiring the lender to accept no, or late, payments. These events on one extreme are bankruptcy, “adverse business conditions” and natural disasters “or similar occurrences beyond Merchant’s control,” down to, on the other extreme, payments less than the “specified percentage” (10 percent) “of each and every sum from sale made by Merchant” (contract p.1, TR p. 25).

The contract’s “merchant’s right for reconciliation” provisions at ¶10 run more than a full page. If the merchant experiences “sporadic increase or decrease in its daily receipts” (contract ¶ 10, TR pp. 26, 27), it can petition to change payments higher or lower. Reducing the amount on a slow day or for a bad week must be in writing. The merchant can “request retroactive reconciliation of the Merchants actual daily receipts for one full calendar month.” While the contract states on ¶ 1(b) the lender takes 10 percent “of each and every sum from sale made by Merchant,” the operation of the loan in this case brooks no variation in the fixed $164.22 deduction each weekday siphoned to Flexibility.

The economic collapse caused by Gov. Bill Lee’s 2020 state of emergency is detailed as a third-party interference at TR pp. 95-97. TR pp. 102-137 include executive orders, and appellant’s affidavit of injuries and harms caused by that third party against the agreement.

The record says nothing about emails and phone calls between the parties before the economic shutdown killed all radio station cash flow starting March 2, 2020, the date of first “failed” attempt by Flexibility to collect its $164.22 due. The payment record shows payments consistently failing starting March 11, 2020 (TR p. 39). The payments “fail” because the merchant account contains dollar amounts less than $164.22, meaning Flexibility wants more than 100 percent of that day’s receipts.

The lack of variation in payments suggests the contract’s “advance purchase of future receivables” and its reconciliation rules are a sham. The withdrawal drumbeat show the relationship between the parties is debtor-lender, not merchant-buyer of varying receipts.

It benefits plaintiff that its contract has provisions showing grace upon the merchant. The top New York court in K9 Bytes, Inc. v. Arch Cap. Funding, LLC, 56 Misc. 3d 807, 818, 57 N.Y.S.3d 625, 633 (N.Y. Sup. Ct. 2017) says right for reconciliation provisions indicate agreements such as Flexibility’s are a receivables purchase.

The reconciliation provisions allow the merchant to seek an adjustment of the amounts being taken out of its account based on its cash flow (or lack thereof). If a merchant is doing poorly, the merchant will pay less, and will receive a refund of **633 anything taken by the company exceeding the specified percentage (which often can also be adjusted downward). If the merchant is doing well, it will pay more than the daily amount to reach the specified percentage. See, e.g., Retail Capital, LLC v. Spice Intentions Inc., 2017 WL 123374 at *2 (Sup.Ct. Queens Co. Jan. 3, 2017) (not a loan when “The agreement provided a reconciliation on demand provision whereby the parties [were each] permitted to demand the monthly reconciliation of funds from the other to ensure that neither entity collected more or less of the sales proceeds than they were contractually entitled to collect from the designated bank account.”).

If there is no reconciliation provision, the agreement may be considered a loan.

Id. K9 Bytes at 632, 633

The court gives credence to the contract provisions for reconciliation. “Having weighed all of the factors, the Court finds that the Arch agreements are sufficiently risky such that they cannot be considered loans, as a matter of law. Under no circumstances could Arch be assured of repayment, because its agreements are contingent on a merchant’s success, and the term is indefinite. Accordingly, the Court dismisses the usury claims against Arch in their entirety” id. K9 Bytes at 633, 634.

However, in instant case, the personal guaranty obliterates Flexibility’s risk exposure as expressed in its reconciliation provision. The personal guaranty overwrites the advance purchase of future receivables section of the contract with its risk-sharing provisions, and makes the agreement one for a loan absolutely repayable on demand. The guaranty makes the first 10 pages of the agreement legal pretense and balderdash. Payment is absolute, not contingent.

Argument

A foreign loan corporation with a state-based debt collector law firm is suing to assert a lender’s rights to payment under a prima facie illegal contract. The lower court rejects its plain duty to dismiss the case with prejudice on subject matter jurisdiction grounds — and joins in on the hornswoggling of two Tennessee citizens accused. “If the court doesn’t have subject matter jurisdiction, the court of appeals will let it know lickety-split,” the judge tells appellant.

The illegal loan evidences no meeting of the minds as no person from Flexibility signs it. (oral objection overruled). Its rapacious rate of interest violates the usury ban in Tennessee (and in New York) and cannot be collected on. The contract is fraudulent civilly. It pretends to be one thing (purchase of assets), but is really another (loan). The record shows the defendants become aware of the fraud in the course of proceedings, and give notice (TR p. 215).

Flexibility extends a loan absolutely repayable, meeting the requirement for the arrangement as illicit usury. The personal guaranty section of the contract make clear that contract language about Flexibility’s taking a risk with the radio station and liable to not get paid at all from receipts is mere jibber-jabber. Flexibility extends a loan, one denounced by affidavit (TR p. 208) as usurious. The only statement Flexibility makes that the loan is not usury is an unsupported statement: “The interest provided for in the underlying agreement is not usurious” (TR p. 226).

Flexibility’s defense is riddled either with incompetence or rejection of the candor rule to the court. Plaintiff’s response to defendants’ motion to reconsider. Flexibility states,

12. The agreement provides for interest at the rate of 10 percent. Defendants defaulted in their payments. Pursuant to the terms of the agreement, upon default, the entire sum will be due at the rate of 12 percent per annum.

TR p. 225

Flexibility indicates the agreement is for a loan at 10 percent APR. But such admission is Flexibility’s shooting itself in the foot. The contract at ¶ 1(b) at TR p. 25 indicates the 10 percent refers to “Specified purchase price shall mean TEN PERCENT *** of each and every sum from sale made by Merchant.” This figure is in the “advance purchase of future receivables” section of the loan agreement, and suggests the Flexibility daily take varies daily according to cash flow into accuseds’ account. Flexibility and Cheadle allege the 10 percent of daily receipts is the same as a 10 percent rate of interest on a loan, a ludicrous assertion without foundation.

This case is about a 208.05 percent APR loan disguised as advanced purchase of future receivables in violation of T.C.A. § 47-14-103, maximum rates, with Cheadle Law ignoring its Rule 8 obligation to not assist in criminal activity and to be candid with the trial court.

Contract provisions are clear. The parties’ relationship is of lender and debtor. Repayment amount by the radio station is the same daily, no matter the ups and downs of business, like a loan payment schedule. The personal guaranty puts the borrowers personally on the hook for the whole amount at first signs of economic stress, meaning the amount is absolutely repayable and due, as if somehow the radio station operators have cash money in their back pockets with which to pay, as if indeed a loan were clamoring for its absolute right of repayment.

This building houses the debt collecting law business of John Cheadle, top photo, and his wife, Mary, in Nashville. (Photo Cheadle law firm)

The contract part 1 implies Flexibility is a risk-taking investor, willing to wait through dry times, as it is buying receivables as they come in. Its expansive verbiage making this point is fraudulent and misleading, as appellant made clear in circuit.

Federal judge Whitman Holt notes in Shoot the Moon, the review of such relationship is intensely fact based. The court looks at the parties’ intentions. The business funder’s contract in instant case implies the arrangement is not authentic as a sale, but is a loan. Appellant’s affidavit regarding usury in Flexibility Capital loan (TR p. 208) is unrebutted by any legal substance or fact by Flexibility.

Appellant in the alternative asks the court to consider an issue raised below, that of original and supervening impossibility, either or both exonerating appellant from payment. Appellant, trying to avoid running long, incorporates this analysis below by referring to TR p. 144ff. With a valid excuse of an intervening impossibility — the state of emergency lockdown March 2020 — appellant is not in breach of contract.

Flexibility “may declare merchant in default *** by sending a default notice,” but it can also determine a breach without notice simply by virtue of not getting a payment (TR p. 31, ¶ 22). Contract ¶ 23, suggesting the parties to the contract live in Shlaraffenland or “the land of cockaigne,” (7) declares the following:

Upon receipt of such default notice, merchant shall immediately pay Flexibility the unpaid portion of the purchased amount. [emphasis added]

TR p. 31

These terms are an original impossibility. The accused are in business to make a living selling radio ads. The living has been destroyed by unforeseeable government action. Stipulations such that borrowers “shall immediately pay the unpaid portion of the purchased amount” in ad revenues are an impossibility built originally into the contract, unperformable by merchant and unperformable by guarantors personally as ad revenue flow is halted.

Fraud on the court

Appellant is the victim of trial court prejudice and malice. His Affidavit and objection to signing final order cites 12 cases as to the necessity of a court to have subject matter jurisdiction before it can hear the first word of a controversy. The court, and the plaintiff and its lawyers are imposing a fraud on the circuit court of Hamilton County, and failing in the court’s duty to uphold public confidence in the judicial department of state government.

The case is a fraud on the trial court. That appellant’s demands for dismissal for a void case are ignored gives opportunity for Tennessee’s judicial system to come into disrepute, to appear degraded, corrupted, a closed union shop biased against the citizenry and men and women in Tennessee generally. The trial court cannot be used to prosecute illegal business dealings, which nature denudes the court of subject matter jurisdiction.

Fraud on the court is a grievous matter involving attorneys and judges. The standard is set forth as follows:

[T]he elements of fraud upon the court *** consisting of conduct:

- On the part of an officer of the court;

- That is directed to the “judicial machinery” itself;

- That is intentionally false, wilfully blind to the truth, or is in reckless disregard for the truth;

- That is a positive averment or is concealment when one is under a duty to disclose;

- That deceives the court.

Demjanjuk v. Petrovsky, 10 F.3d 338, 348 (6th Cir. 1993)

“‘Fraud on the court’ other than fraud as to jurisdiction, is fraud which is directed to judicial machinery itself and is not fraud between parties or fraudulent documents, false statements or perjury; it is thus fraud where court or member is corrupted or influenced or influence is attempted or where judge has not performed his judicial function so that impartial functions of court have been directly corrupted” Bulloch v. United States, 763 F.2d 1115 (10th Cir. 1985).

Fraud by definition: “It is something said, done, or omitted by a person with the design of perpetrating what he knows to be a cheat or deception.” Black’s Law Dictionary, 6th Ed., p. 661.

Actual fraud is an intentional and knowing misrepresentation of the truth or intentional and knowing concealment of a known fact (committed with actual knowledge) that constitutes common law fraud.

Flexibility and attorneys John and Mary Cheadle are suing to enforce a contract they call a loan for money that puts the entire action under the shadow of Tennessee’s usury ban. They have acted deceitfully and fraudulently upon the accused. They act deceitfully and dishonestly upon the court, knowingly and intentionally, as officers of the court, and induce the court to perform injustice against defendants, in violation of state law and Rule 8.

Kyle Hedrick is circuit court judge in Hamilton County, Tenn. He refuses to heed challenge to the court’s subject matter jurisdiction, forcing Flexibility v. Cupelli into the court of appeal in defiance of his duty to handle the case and dismiss the complaint, based on criminal conduct, ministerially. (Photo Kyle Hedrick)

The trial court is in like breach. It violates the state’s code of judicial conduct Rule 10 promulgated in the interest of justice. The trial court:

- ➤ Refuses to rule on the matter of subject matter jurisdiction, which issue can be raised at any time and which authority must be established by the moving party in the suit;

- ➤ Illicitly denies proper, timely motion on subject matter jurisdiction, saying appellate judges will decide the issue (Rule 2.7);

- ➤ Allows prosecution of an illegal, criminal contract, despite oral and written notice of its criminal nature (Rule 1.1);

- ➤ Accepts fraud on defendants by plaintiff, and fraud on the court soaked into the venue by Judge Hedrick’s breaches of law, despite notice (Rule 1.1);

- ➤ Allows attorney Cheadle to violate state law in assisting an illegal out-of-state enterprise to persist in its case, despite notice (Rule 2.15);

- ➤ Refuses to comply with the Tennessee usury law, timely and correctly presented in defense (Rule 1.1);

- ➤ Refuses to act in a way to promote confidence in the judiciary (Rule 1.2);

- ➤ Appears to act partially (Rule 2.2) and with prejudice and bias (Rule 2.3).

Relief requested

Appellant demands the following:

- A finding of law and fact that the Flexibility Capital contract is void, unenforceable and against law and public policy in Tennessee.

- A finding that contracts of this nature are deceptive, having exhaustive treatment of the purchase of ebbing and flowing receivables, but also having as part of the contract an absolute duty to repay, showing that the “advance purchase of future receivables” part of the agreement is fraudulent, intended to deceive..

- That the case be remanded to the trial court for dismissal with prejudice on the grounds of lack of subject matter jurisdiction, including a finding that Flexibility has forever waived right to sue in New York by suing in Tennessee, in violation of its contract.

- A command to Flexibility to restore the funds seized from appellant’s two Tennessee Valley Federal Credit Union accounts, with interest, and cease attempts to seize a Honda Odyssey minivan registered in appellant’s name.

- A reprimand or appropriate sanction of attorneys John and Mary Cheadle for violating the candor requirement of officers of the court, and for participating in a fraud on the court.

- A declaration that attorneys in Tennessee cannot involve themselves in criminal, fraudulent activity, such as that brought against appellant by John and Mary Cheadle, state licensed officers of the court bound by Rule 8 in the code of professional responsibility and warned by appellant about fraud on the court cited in Demjanjuk, explaining fraud on the court so that it might be avoided as a harm to the public interest.

- A determination that the plain error of the trial court is a breach of the rules of judicial conduct at Rule 10.

FOOTNOTES

- “This is a straight-forward collection case to recover the balance due on a loan,” Flexibility says on Page 1 of its complaint (TR p. 6).

- “‘Fraud vitiates and avoids all human transactions, from the solemn judgment of a court to a private contract. It is as odious and as fatal in a court of law as in a court of equity. It is a thing indefinable by any fixed and arbitrary definition. In its multiform phases and subtle shapes, it baffles definition. It is said, indeed, that it is part of the equity doctrine of fraud not to define it, lest the craft of men should find ways of committing fraud which might evade such a definition. In its most general sense, it embraces all ‘acts, omissions, or concealments which involve a breach of legal and equitable duty, trust or confidence justly reposed, and are injurious to another, or by which an undue and unconscientious advantage is taken of another.’ 1 Bouv.L.D., page 613.”

New York Life Ins. Co. v. Nashville Tr. Co., 200 Tenn. 513, 523, 292 S.W.2d 749, 754 (1956) (emphasis added) - “[O]r if the full Purchased Amount is not remitted because Merchant’s business went bankrupt or otherwise ceased operations in the ordinary course of business *** and Merchant shall have not breached this Agreement, Merchant would not owe anything to Flexibility and would not be in breach of or in default under this Agreement.” ¶ 14(a)(v) (TR p. 28)

- “One function of the signature is to show the signor’s intent to be bound by the terms stated, but other manifestations of assent can serve the same purpose in the absence of signature. **** The parties’ actions or inactions, as well as spoken words, can establish mutual assent. **** “[T]he existence of a contract, the meeting of the minds, the intention to assume an obligation, and the understanding are to be determined … not alone from the words used, but also the situation, acts, and the conduct of the parties, and the attendant circumstances.” Moody Realty Co. v. Huestis, 237 S.W.3d 666, 674–75 (Tenn. Ct. App. 2007) (internal citations omitted)

- The record indicates appellant confusion between the two loans it obtained from plaintiff. Accuseds’ Affidavit and amended answer to motion for summary judgment, p. 1, does not give reliable details. But they are corrected above. (TR p. 94)

- A footnote in Shoot The Moon cites the following as authority on the distinction between loan vs. sale of future receivables: See Robert D. Aicher & William J. Fellerhoff, Characterization of a Transfer of Receivables as a Sale or a Secured Loan Upon Bankruptcy of the Transferor, 65 AM. BANKR. L.J. 181, 186-94 (1991). The Aicher and Fellerhoff article cites and collects various cases to support its inventory of the relevant factors. Other courts have since relied on this articulation of the relevant legal principles. See, e.g., Dryden Advisory Grp., LLC v. Beneficial Mut. Sav. Bank (In re Dryden Advisory Grp., LLC), 534 B.R. 612, 620 (Bankr. M.D. Pa. 2015); In re R&J Pizza Corp., 2014 Bankr. LEXIS 5461, at *7-8 (Bankr. E.D.N.Y. Oct. 14, 2014); Sterling Vision, Inc. v. Sterling Optical Corp. (In re Sterling Optical Corp.), 371 B.R. 680, 686-87 (Bankr. S.D.N.Y. 2007). In re Shoot The Moon, LLC, 635 B.R. 797, 814 (Bankr. D. Mont. 2021) (TR p. 240)

- As in Pieter Breughel’s “The Land of Cockaigne,” 1567, a land of plenty in medieval myth where the lazy lie under a tilted table as wine and grub fall into their awaiting mouths, where the pig is equipped with a knife to slice it, where the duck lays its neck across a platter, and where pies slide off the the knight’s roof into his gaping mouth — where the real world retreats before magic, free money and endless bounty.

Mr. Tulis, Left a message at Post & Email on Saturday, November 4, 2023 at 2:09 AM, not sure if you get messages there. I’ve been following your case with interest and wish you well. You mentioned your hearing would be 10/31. I looked on TN Court of Appeals’ YouTube at https://www.youtube.com/@TNCourts/streams but didn’t see any YouTube stream.

Looked at the court docket with the case number you posted at https://pch.tncourts.gov/CaseDetails.aspx?id=86494&Number=True but the last entry is 10/11/2023 Docket Activity-Docketed (Oral Argument)

Did you win on 10/11? It says Oral Argument so hoping for an update. I’ve read all your posts and the big PDF files, it’s a really interesting case about the huge interest rate. Please let us know where to find the livestream, maybe I looked in the wrong place. Checked your substack but didn’t see anything else about the 10/31 hearing there either.

We’ve been thinking of you, please let us know the update,

Godspeed.