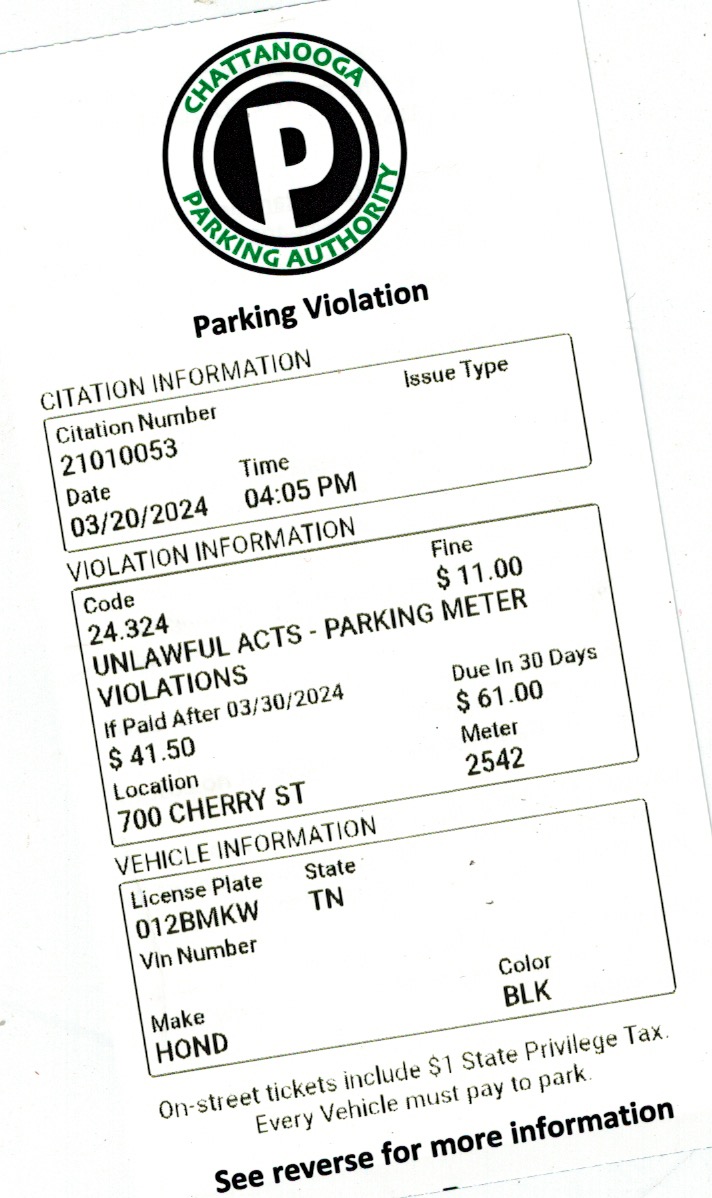

Parking ticket collection programs by city municipal corporations skirt state law and fail in good sense, as in my case in Chattanooga, Here is the meter my green RAV4, left, offended March 20, 2024. (Photo Chattanooga parking authority)

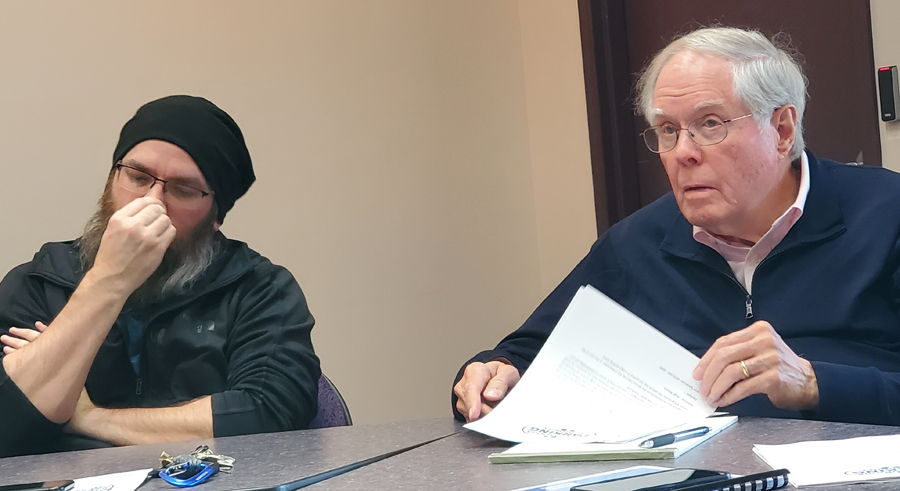

Jon Bell, left, is general manager of Chattanooga parking authority. Right, hearing officer Hugh Moore. (Photo David Tulis)

Do the four corners of this lawsuit contain legal material sufficient to bring the city government relief? No, not if the wrong provision is cited on the face of the document, and not if this tax mechanism is put upon people exercising a statewide privilege who do not live in the limits of the city corporation.

CHATTANOOGA, Tenn., Monday, May 6, 2024 — It’s good to fight small battles so that one is fit for bigger ones.

I had a hearing in front of the Chattanooga parking authority and tore into its legal infrastructure like a twister wrecking a Midwestern farmtown shopping mall, arguing law — and not facts, excuses or circumstance.

Parking tickets are lawsuits. The paperwork is the miniature form on water-resistant paper and served via wiper blade placement. In Chattanooga the claim is for F$11 if not paid within 10 days (see mine, nearby).

I was one of three people making appeal April 24 in a downtown office near where city buses roll into a garage under a parking deck. At the table were tradesmen Aaron Spearman and David Spears. They’d been making deliveries, with defenses in the realm of circumstances. The judge was Hugh Moore, a patrician retired lawyer. General manager Johnathan Bell sat in on proceedings without taking on the role of movant or prosecutor, which certainly was his right to do.

We sat in a grayish conference room across the way from Chattanooga Choo-Choo, a world-famous landmark.

My opening statement is that as a press member I am grateful that CPA always gives media vehicles a pass. In thanks, I say, I make a defense that will allow CPA to fortify its legal position in future cases. Collections against scofflaw parking “customers” and violators of other parts of the city code is way behind in Chattanooga.

One alleged debtor owes F$24,129, mostly for uncut grass among rental houses, says Chattanooga city court clerk Anthony Byrd. He says he is taking action against people such as David Eason, Clabon E. Fairbanks, Tatina Dyskina and Thomas Tripp. The smallest “debt” among these parties is F$11,589. Among these purported debtors are parking “violators.”

My arguments to defeat claim

Grounds for defying claims of infraction as a matter of law:

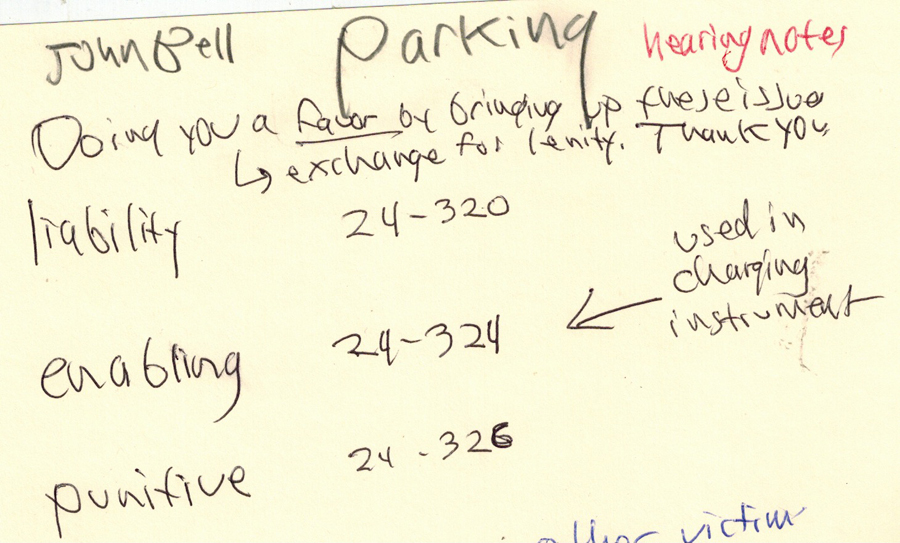

➤ The charging instrument is defective because it cites 320 in this Chattanooga city ordinance when it should be 324. Citing to wrong part of the ordinance is fatal to the claim.

➤ The parking authority violates state law pretending authority to tax a statewide privilege of people who do not reside in the city (they don’t reside within the corporation).

Your starting point is any defect within the charging instrument, the four corners of which must be sufficient. The basis of the authority must be on the ticket itself. See if the ticket refers to the city code or ordinance. Look up your city and probably you’ll end up at Municode.com. print out the entire parking code, probably about four pages.

The liability ordinance creates the duty. Find that one. If the ticket cites any other provision, the parking lawsuit is a misfire. The ticket fails to notify you of the nature of the claim. If the ticket does not cite the liability (duty) provision, it does not identify the basis of the accusation for which relief may be granted. It falls short of its duty to provide defendant that against which he must defend.

The Chattanooga parking authority, an agent of the city, suffers from more than a defective charging instrument.

It breaches limits in state law.

In your state’s code, go to the volume dealing with counties, cities or municipalities. It may contain a limitation on a city’s taxing power.

In Tennessee, the limits include a ban on taxing the statewide privilege of motor vehicle registration. Cities and counties cannot interfere with the exercise of driving and operating a motor vehicle statewide by a state licensee.

You defeat the parking ticket if you are a nonresident of the city that is making the civil accusation via the ticket charging instrument. That’s how it works in Tennessee.

Tennessee protections

All parking ticket “suits” use the registration plate that shows the automobile is more than that. It’s a motor vehicle.

The licensing as a privilege of the driving of any motor driven vehicle upon the roads, streets or other highways of the state is declared an exclusive state privilege and no tax for such privilege under any guise or shape shall hereafter be assessed, levied or collected by any municipality of the state.

T.C.A. § 6-55-501 (emphasis added)

Tag No. 639BKTV, borne by my 313,000-mile RAV 4 is under an “exclusive state privilege” and “no tax for such privilege” shall be imposed by “any municipality of the state.”

Any rule in conflict with the above law at 501 is “declared inoperative and of no effect.”

(a) All ordinances, rules or regulations heretofore passed, enacted or promulgated by any incorporated municipality of the state in conflict with § 6-55-501 are declared inoperative and of no effect.

***

(c) No municipality shall require any person who does not reside within the municipality’s corporate boundaries to purchase a city automobile tag, or pay any license fee, regulatory fee, inspection fee, safety inspection fee, or any citation or fine for noncompliance with any regulatory, license, or inspection requirement, or tax of whatever nature for the privilege of driving a motor vehicle on the roads, streets or highways of such municipality.

Tenn. Code Ann. § 6-55-502 (emphasis added)

City of Chattanooga and its parking authority division are imposing a tax under guise of parking violation fine and a $1 “privilege tax” upon accused in his use of the public street within the corporate city limit.

The parking authority has power to “control all parking meters in the city *** “[s]ubject to all applicable state laws and regulations.” Sec. 24-312(e)(5)

Parking Authority v. Tulis — motion for summary judgment

City ordinance recognizes this possibility. It has a savings clause that recognizes powers greater than the limited municipal authority exercised by CPA.

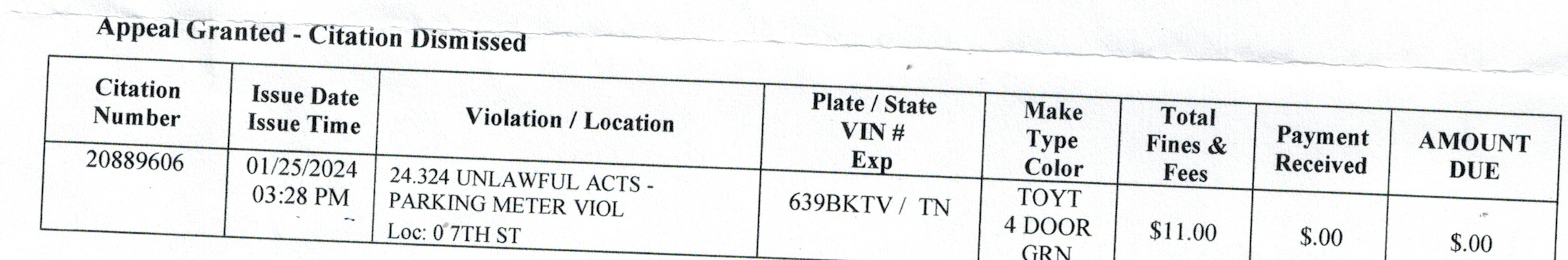

The Chattanooga parking authority fails to state a claim for which relief may be granted. It cites as authority for its prosecution a provision in the city code, sec. 24-324, one that does not create any duty or liability upon accused because it is an enabling or procedural provision. The liability law imposing duty on a member of the public is sec. 24-320. CPA, thusly, cites a provision that does not empower its claims as against me and other users of city streets.

CPA seeks to impose a privilege tax and a duty upon a party exercising a state-protected privilege under T.C.A.§ 6-55-501, ignoring the limit in control of all parking meters in the city that is ““[s]ubject to all applicable state laws and regulations.” Sec. 24-312(e)(5).

The case makes a claim upon a person not subject to city of Chattanooga ordinances, a nonresident who lives in Soddy-Daisy under protection of a protectible interest in a statewide privilege.

I use cardstock in all legal proceedings, for easy handling and durability. Notice the arrow points to the provision cited in the ticket — the ENABLING provision of the law (324). Oooops. I argue the charge must be based on the liability provision (sect. 320). The liability provision is the part that imposes on you a “known legal duty” to perform some act of obedience or compliance.