Given the central bank and government parasites draining off wealth, it is a staggering tribute to the American economy’s accumulated wealth and the American people’s unflagging hard work that the American economy has survived this long.

By Franklin Sanders

Despite the Fed siphoning off, destroying, and misdirecting capital and creating booms and busts that drain middle class wealth into the one percent’s hands, and in the teeth of a taxation system that cripples family wealth accumulation, punishes success and production and regulates ruthlessly to smother competition, we still have two nickels to rub together.

Just imagine what America would be without the Federal Reserve and the deficit-spending, regulation-drunk, science-hating yankee government, but with genuine economic freedom.

Still, the inevitable, if not always punctual, is always certain. Although inertia has carried the fascist Fed/government partnership this far, the inevitable approacheth.

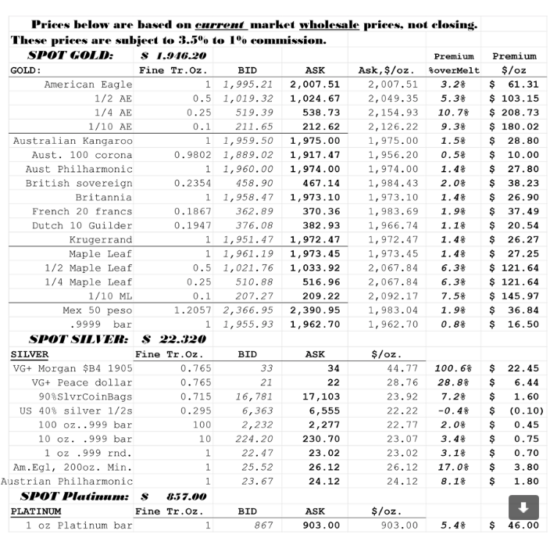

[Subscribe today to the free Moneychanger metals market update, including a wholesale price chart that lets you evaluate your trading out of paper and into lawful money. I get Franklin Sanders’ newsletter free daily. Subscribe free at this link at the Moneychanger newsletter. Volunteer Precious Metals in Lawrence County, Tenn., is my recommended provider. — DJT]

When I think of this system, a picture from those timeless Roadrunner and Coyote cartoons comes to mind, you know when the Coyote chases the Roadrunner off a cliff and runs several yards into thin air before he realizes what he’s done and pops out from behind his back a sign on a stick that reads, “Whoops,” right before he plunges half a mile to the cactus-strewn canyon floor.

I fear one day daily soon the Fed coyotes and the yankee government coyotes will find themselves flailing their legs in mid-air.

Having hacked that bone up out of my throat, let us turn to happier things, like silver and gold and the slowly dying US dollar.

The details

Today the US dollar index fell 23 basis points to 105.631. The dollar will remain in this downtrend until it hits 104 or 104.50, which will help metals. Stocks were confused today, most indices falling slightly, although the Dow Industrials managed to rise 54.77 (0.16%) to 34,337.87. Not so the S&P500 which fell 3.69 (0.08%) to 4,411.56 and wilted like lettuce in hot bacon grease when it struck the downtrend line. This rally is yet another scam to fleece the unwary hopeful.

Y’all now turn your attention to gold and silver, which for 5,300 years or till memory runneth not the contrary have been desired by human beings of all tribes, tongues and nations and still are. They remain the only financial assets which are not simultaneously someone else’s liability and so have no counterparty risk, rendering them unique assets in this world of investment dominoes.

On Comex today spot gold jumped up $12.90 (0.67%) to close at $1,945.50. Lazy, sleepy silver scrabbled up one 8.4¢ (0.38%) to 2229.9¢. Still frustrating us, the gold/silver ratio today rose 0.29% to 87.246 ounces of silver to buy one ounce of gold. But wait! Note the stubby purple arrows pointing to the double top where twice the ratio hit an intraday high at 88.22. Y’all study the RSI above and the MACD and Rate of Change below. Do you see how, for all the ups and downs of silver since October began, all these indicators have basically ground sideways? That ain’t a-gonna last. The ratio will break one way or ‘tother,, and it shouldn’t be up, bearing in mind that double top.

Y’all recall that I mentioned gold’s 200 day moving average floated at about the same level as a 38.2% correction, and a 50% correction would take it to $1921 or so? And I also wrote the gold would likely peek under the 200 DMA and scare the bejabbers out of us all? Well, Friday it closed under the 200 DMA and today climbed back above it. This is splendid — it dipped down into the 50 DMA below and bounced clean back above the 200. This doesn’t signal the correction’s end, but it does take us to a more bearable stage while gold works sideways building a base for its recovery rally.

Why, O why, would silver not follow gold up, indeed pass gold? Y’all recall those hedge fund hedges I mentioned where they buy gold and sell silver rather than simply buying gold to hedge war risk? That same tactic would explain silver’s laziness today, although I can’t prove that. It doesn’t matter, silver hit its long-term uptrend line, fell through, then scrambled right back above it. Good work, silver.

I talked to someone else today who has been bitten by the silver bug and he ticked off for me several reasons silver is the world’s most undervalued investment: supply shortage, falling new mine supply, irreplaceable industrial use, and less ready-to-come-to-market aboveground supply than gold, among others. I was glad to hear his enthusiasm, but boy! talk about teaching your grandma to suck eggs. I’ve been eating, living, and creating silver for over 40 years. That’s why I keep urging y’all to buy it while it still stands below $50 an ounce.

Do I need to say that again?

Argentum et aurum comparanda sunt.

Silver and gold must be bought.

While there is much truth written about the fraud of the US monetary system, the idea seems still to endorse making money by the manipulation or investment of money as a good thing.

The Matthew 25 parable is worth examining. Many English translations have “traded” in verse 16 or even “invested” or “trafficked”. It gives the impression that you can invest money in something to see its value grow for a return on your investment.

The reality is that the word “ergazomai” is to “to work, labor, or do work”, not invest. The idea of “trade” is more the idea of buying at wholesale and selling at retail. You are doing labor for return, not providing money for another to gain part of their gain.

Verse 25 has the one who buried the resources he was provided and did not make it work. I suggest this is closer to what the investor does.