Kayla Clark holds Elsie Elizabeth Rose Clanton, whose dad, right, Jason Kyle Clanton, holds the child in a more recent photo. (Photos Kayla Clark)

March 4, 2025 — Our work is paying off in a case involving a woman, Kayla Clark, described as homeless in a police charging instrument alleging a crime for not having auto insurance in the use of her white 2000 Honda Odyssey minivan in January in Lawrence County, Tenn.

She intends to use our “if-it-were-me-this-is-what-I’d-file” analysis in a pre-plea remedy and avoidance in general sessions court in Lawrenceburg on Thursday. She is using our well-developed standard analysis of the fraud we are fighting. If the people of Tennessee can’t beat fraud in high court, we can perhaps whip it in the lower venues.

Of course I don’t give anyone legal advice, don’t run a law business, do not practice law, and leave it to the discretion of intelligent Tennesseans to assemble together under Tenn. const. art. 1, our bill of rights, to make remonstrance or address, and to petition for redress of grievances from commercial government and insurance- and bank-owned general assembly members. If you want legal advice, I suggest you find a lawyer downtown or maybe on another planet, where the law truly matters.

IN THE GENERAL SESSIONS COURT OF

[fill in blank] COUNTY

STATE OF TENNESSEE

V.

_____[ YOUR NAME HERE ]______________

Accused rebuts the state’s presumption that she is subject to Tennessee financial responsibility law of 1977 (“TFRL”) or that under an inapplicable law she has failed to provide evidence of financial responsibility. She (1) challenges the court’s subject matter jurisdiction, (2) requests the court to take mandatory judicial notice of the following points of fact and law in support of said rebuttal and jurisdictional challenge and (3) demands the case be dismissed ministerially as a matter of law.

INTRODUCTION

The charge under the Tennessee financial responsibility law of 1977 at T.C.A. § 55-12-101 et seq, known as Part 1, and 201 et seq, known as Part 2, stems from the allegation that the person so charged is a party (1) involved in a qualifying accident who must show financial responsibility for role in damages, or (2) a person liable to maintain evidence or proof of financial responsibility (“POFR”) on account of a criminal conviction in a motor vehicle-related ruling by a court or the department of safety.

The law identifies parties subject to the requirement of maintaining such evidence or proof, namely those exercising the driving and operating privilege under condition precedent of having obtained a motor vehicle liability policy as defined in T.C.A. § 55-12-102.

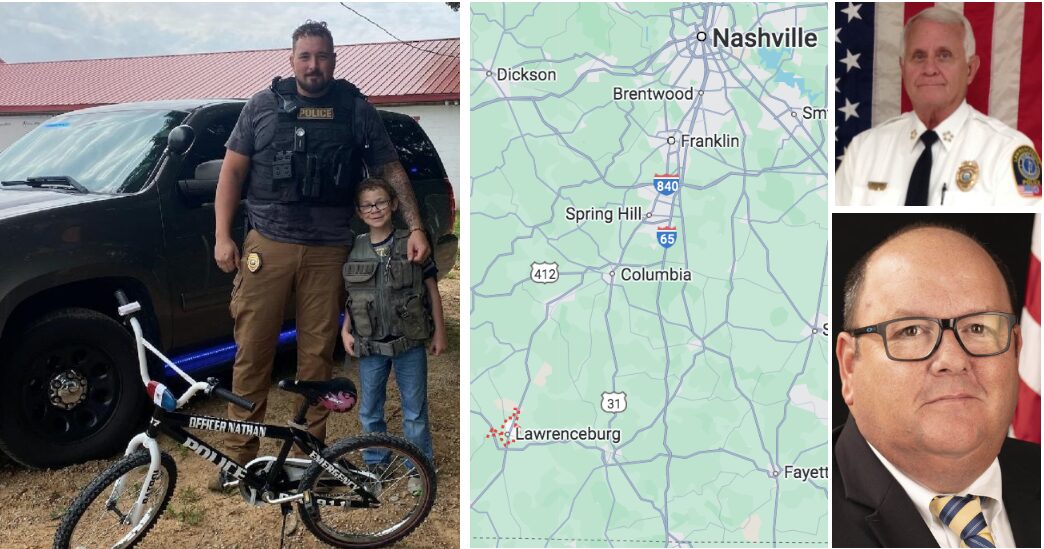

Lawrenceburg, Tenn., cop Nathan Wright with ride-along boy in service of city chief of police Terry Beecham, top right, with district 22 prosecutor Brent Cooper, bottom right, prosecuting Kayla Clark for “driving without insurance” under a shakedown run by department of revenue. (Photos Lawrenceburg police department, DA’s office)

FACTS OF THE CASE

The court is asked to take judicial notice of the following adjudicative facts.

FACT 1. Accused, who is lives in [ ENTER YOUR FACTS HERE ].

FACT 2. NO evidence of record exists that accused was involved in a qualifying accident, T.C.A. § 55-12-104, that being one involving death, physical injury or more than $1,500 in damages.

FACT 3. Accused alleges no evidence of record exists that accused is subject in this matter to the financial responsibility law on grounds of the driving privilege being suspended by a court or by department of safety.

FACT 4. A rebuttable presumption controls the allegations made, that being that accused is a person subject to a duty to show financial responsibility, either for a qualifying accident or under a settlement with department of safety or a court to obtain a motor vehicle liability policy, also known as SR-22 certificated insurance.

EXCEPTIONS A DEFENSE IN TFRL ALLEGATIONS

A person becomes subject to the requirement to show financial responsibility after a qualifying accident,“(2) The owner or operator of any vehicle where there is no physical contact with another vehicle or object or person.” T.C.A. § 55-12-104.

A list of 14 exceptions to any duty to show financial responsibility is at T.C.A. § 55-12-106 that states a no-contact accident qualifies as an exception.

“The requirements of security and revocation contained in this part shall not apply to: *** (5) Any operator or owner of a motor vehicle involved in an accident wherein no injury or damage was caused to the person or property of anyone other than the operator or owner[.]” T.C.A. § 55-12-106.

Accused demands dismissal of the charge on grounds of her falling under the exception of “no injury or damage” caused.

TO WHOM DOES FINANCIAL RESPONSIBILITY APPLY?

Further grounds for dismissal are based upon the matter of certified motor vehicle liability policies as central to the operation of TFRL, and the lack of any possibility the accuser has grounds to claim accused is liable for such duty.

A person on making application for a driver license agrees to comply with TFRL as or when required sometime in the future. T.C.A. § 55-12-138, “I CERTIFY THAT I UNDERSTAND ABOUT TENNESSEE’S FINANCIAL RESPONSIBILITY LAW AND I AGREE TO ABIDE BY IT.”

Parties liable for performance under TFRL are those involved in qualifying accidents. Parties subject to the duty to show financial responsibility are charged under T.C.A § 55-12-139,

This provision is the basis for the purported criminal charge in instant cases.

Parties subject to prosecution under sect. 139 agree to an obligation to obtain insurance following criminal conviction for a motor vehicle-related criminal offense if they intend to restore their driving and operating privilege.

(a) Whenever the commissioner suspends or revokes the license of a person by reason of a conviction, the commissioner shall request that the commissioner of revenue suspend or revoke all registrations in the person’s name, and the commissioner of revenue shall suspend or revoke those registrations immediately; provided, that the registrations in the person’s name must not be suspended or revoked, unless otherwise required by law, if the person provides and maintains proof of financial responsibility for the length of the license’s revocation or suspension.

T.C.A. § 55-12-114 (emphasis added)

Such person is required to maintain POFR “for the length of the license’s revocation or suspension” after which he or she is free from any duty to buy the financial product as required in the law.

A suspended party buying an SR-22 policy is not forever bound to buy such special insurance. “[T]he person shall provide proof of financial responsibility prospectively for a length of time equal to the length of time for which the suspension or revocation was in effect.” T.C.A. § 55-12-114.

The financial responsibility law is the means whereby the state through its commercial licensing regime in T.C.A. § Title 65, chapter 15, carriers, and Title 55, motor and other vehicles, protects the interests of the general public by securing relief for parties injured in qualifying auto or vehicular accidents.

Court cases show Tennessee is a voluntary insurance, after-accident state where each registrant or licensee has the “first bite of the apple” after a motor vehicle accident and must show responsibility in an accident. T.C.A. § 55-12-104, -105 for taking financial responsibility.

That is done by showing he is insured with regular insurance or is self-insured. He may also give affidavit to the commissioner of safety indicating private settlement, thereby showing responsibility. He may also pay the amount of money involved in the accident to the safety commissioner as an indemnity. T.C.A. § 55-12-105.

The law does not compel or coerce any registrant or licensee to buy personal auto operator’s, owner’s or liability insurance to cover a particular vehicle.

MOTOR VEHICLE LIABILITY POLICY = POFR

The parties compelled to buy insurance as a condition precedent to maintaining the driving and operating privilege buy what the law calls the “motor vehicle liability policy,” defined in T.C.A. § 55-12-102.

Such policy insures a person in whatever auto or vehicle he or she drives.

The policy is certified.

(7) “Motor vehicle liability policy” means an “owner’s policy” or “operator’s policy” of liability insurance, certified as provided in § 55-12-120 or § 55-12-121 as proof of financial responsibility, and issued, except as otherwise provided in § 55-12-121 by an insurance carrier duly licensed or admitted to transact business in this state, to or for the benefit of the person named therein as insured

T.C.A. § 55-12-102

Certification is a guarantee that the policy exists, the licensed insurance company endorsing and confirming to state of Tennessee that it issues and secures as proof of financial responsibility the person for whom the policy is sold under the evidence of the certificate, or proof of financial responsibility.

The insurance industry calls such certificate the SR-22. It constitutes evidence or proof of financial responsibility.

Ordinary motor vehicle operator’s, owner’s or liability insurance sold by participants of the Tennessee automobile insurance plan at T.C.A. § 55-12-136 are outside the scope of TFRL.

They cannot and do not satisfy the requirements of proof of financial responsibility.

The police officer or deputy in an encounter with a member of the public, in an accident scene, uses the electronic insurance verification system (“EIVS”) to check if a driver’s certificate remains current with the departments of safety and revenue.

The department of revenue, under Part 2—Insurance Verification Program (“James Lee Atwood JR. Law”), operates this system that scans insurance companies’ full books of business that include all motor vehicle liability policies that some insureds obtain as condition for use of the privilege.

The officer is required to obtain evidence of financial responsibility “as required.”

focus on the motor vehicle liability policy is confirmed in sect. 139.

If the driver of a motor vehicle fails to show an officer evidence of financial responsibility, or provides the officer with evidence of a motor vehicle liability policy as evidence of financial responsibility, the officer shall utilize [EVIS] as defined in § 55-12-203 and may rely on the information provided by [EVIS] for the purpose of verifying evidence of liability insurance coverage.

T.C.A. § 55-12-139(b)(1)(C) (emphasis added)

RELIEF REQUESTED

THEREFORE, given that TFRL applies to parties in a qualifying accident and to parties under suspension who agree to carry insurance certified to be the motor vehicle liability policy described in T.C.A. 55-12-102, accused —

-

- Demands the court ministerially dismiss the case with prejudice as a matter of law; and

- Requests the court enter an order, in writing, stating findings of facts and conclusions of law should this demand be denied.