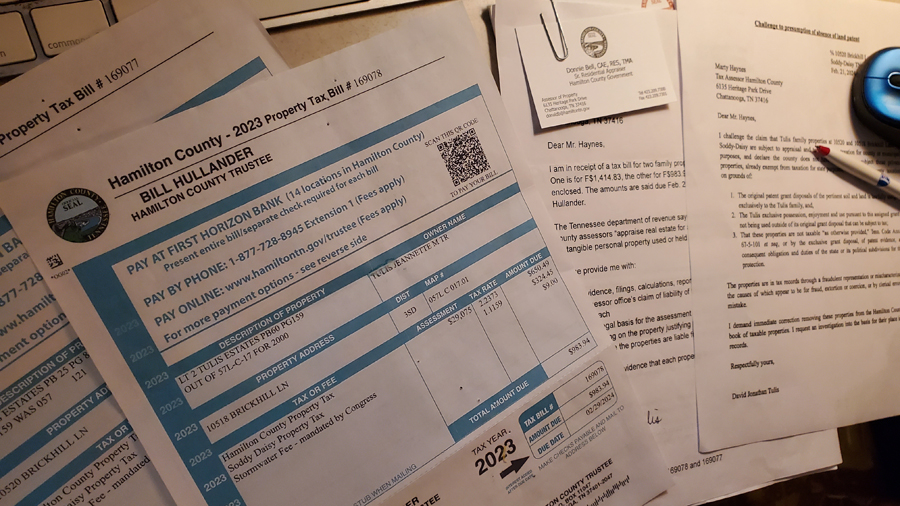

Left are tax notices and at right are two letters to property appraiser Marty Haynes of Hamilton County, Tenn. (Photo David Tulis)

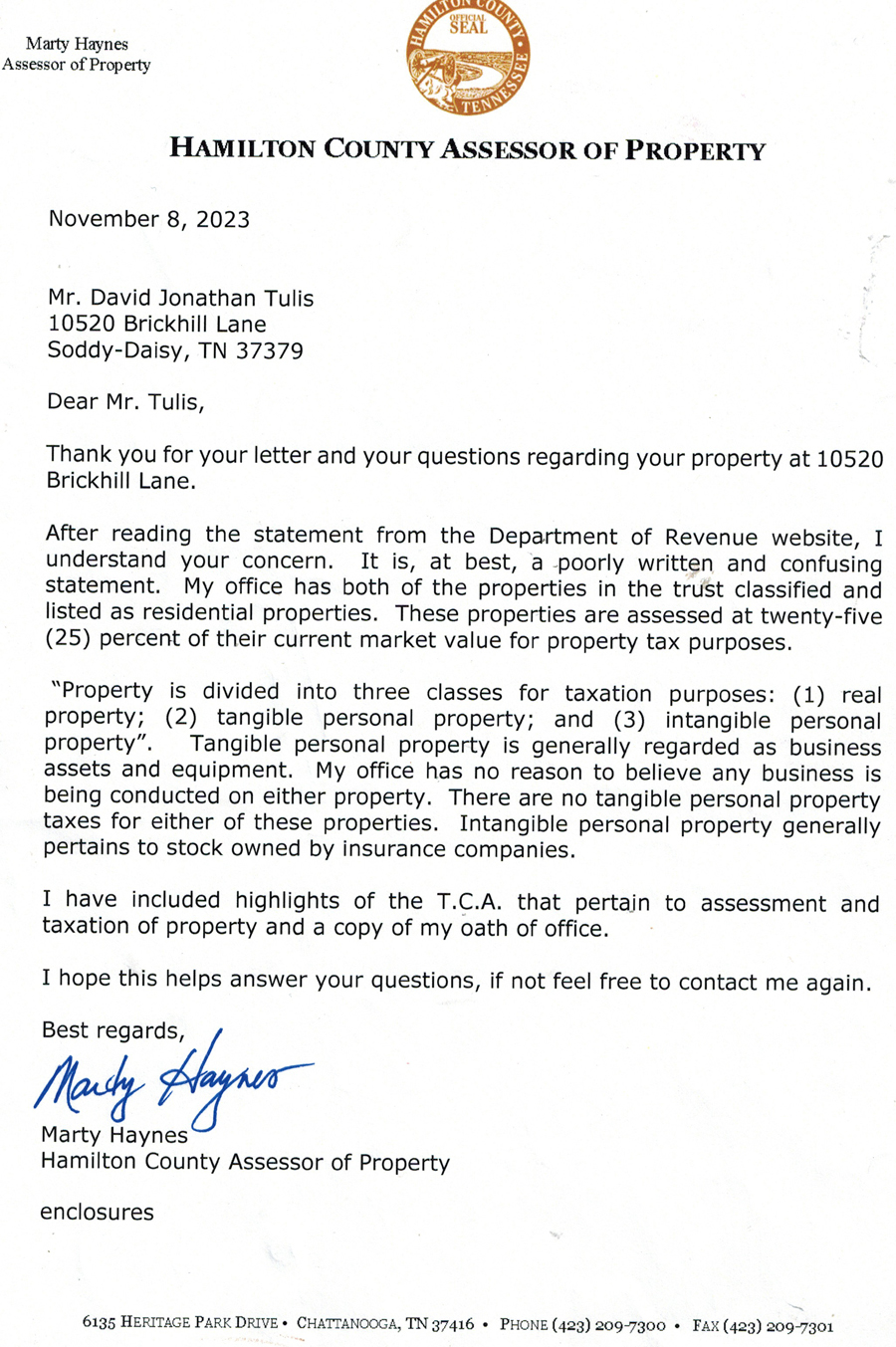

This is Marty Haynes’ answer to my first inquiry that comes attached with excerpts from Title 67, Tennessee’s tax code.

Challenge to presumption of absence of land patent

CHATTANOOGA, Tenn., Friday Feb. 23, 2024 — *** I challenge the claim that Tulis family properties at 10520 and 10518 Brickhill Lane in Soddy-Daisy are subject to appraisal and to ad valorem taxation for county or municipal purposes, and declare the county does not have jurisdiction to subject these private properties, already exempt from taxation for state purposes, to this form of county taxation on grounds of:

- The original patent grant disposals of the pertinent soil and land is lawfully assigned exclusively to the Tulis family, and,

- The Tulis exclusive possession, enjoyment and use pursuant to this assigned grant is not being used outside of its original grant disposal that can be subject to tax;

- That these properties are not taxable “as otherwise provided,” Tenn. Code Ann. § 67-5-101 et seq, or by the exclusive grant disposal, of patent evidence, and consequent obligation and duties of the state or its political subdivisions for their protection.

The properties are in tax records through a fraudulent representation or mischaracterization the causes of which appear to be for fraud, extortion or coercion, or by clerical error and mistake.

I demand immediate correction removing these properties from the Hamilton County roll book of taxable properties. I request an investigation into the basis for their place in these records.

First inquiry on how land becomes subject to tax

A Nov. 2 letter to Mr. Haynes asked the following:

I am in receipt of a tax bill for two family properties in trust of my wife, Jeannette. One is for F$1,414.83, the other for F$983.94. Copies of the property tax bills are enclosed. The amounts are said due Feb. 29, 2024, payable to county trustee Bill Hullander.

The Tennessee department of revenue says on its “property tax” webpage that county assessors “appraise real estate for assessment purposes and assess tax on tangible personal property used or held for use in business.”

Please provide me with:

- Evidence, filings, calculations, reports or any documentation justifying the assessor office’s claim of liability of these two pieces of land with houses on each

- The legal basis for the assessment on the taxable activity or business occurring on the property justifying the dollar amount said to be due in tax.

- Evidence the properties are liable for an assessment for tax purposes

In other words, evidence that each property is used in business, or is held for use in business.