Today is the 51st anniversary of Nixon closing the gold window in 1981, that is, he suspended convertibility of the US dollar into gold for foreign central banks.

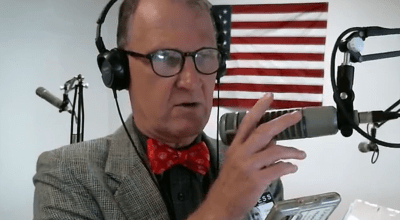

By Franklin Sanders / The Moneychanger newsletter

At that time, the Yankee government would only convert dollars to gold for central banks, not individuals. US dollar inflation had caused a run on the dollar — foreign central banks and investors saw the handwriting on the wall and knew the US would be forced to devalue the dollar against gold.

(From Tennessee’s most important newsletter, The Moneychanger)

Watch this two-minute video clip of Nixon’s speech to the nation on 15 August 1971. I remember because I saw it at the time. He opens with a lie, he continues with lies, and he ends with a lie. He opens with “We must protect the position of the American dollar as a pillar of monetary stability around the world.” Wrong, it was the very instability of the dollar that was forcing his hand, thanks to US deficit spending and the Federal Reserve monetizing the dollar.

Fifty-one years later it takes $1,781.40 to buy an ounce of gold, making the US dollar worth 0.00056 ounce (0.174 gram) of gold. The dollar has lost 97.5% of its value against gold

He said he would “suspend temporarily” gold convertibility, but 51 years later the suspension is still “temporary.” He blames the favorite whipping boy of inflationary tyrants, those dirty “speculators,” but it wasn’t speculators inflating the dollar. Finally, he says Americans shouldn’t fear the ‘bugaboo of devaluation” because, shucks, unless you are planning a trip abroad or buying imported wine or cars, it won’t affect you. Lies, lies, all lies.

How did the end of dollar gold convertibility affect the world? It put the whole globe on a fiat monetary standard for the first time in history and set off an unending tidal wave of inflation and economic and monetary turmoil. Did it stabilize the dollar? You tell me. On 15 August 1971 an ounce of gold cost $43.40, that is, the dollar was equal to 0.023 oz of gold (0.715 grams). Fifty-one years later it takes $1,781.40 to buy an ounce of gold, making the US dollar worth 0.00056 ounce (0.174 gram) of gold. The dollar has lost 97.5% of its value against gold.

Why can’t we imagine that? For gold to lose 97.5% of today’s value it would have to rise to $71,256.00 an ounce. As I said, unimaginable, but it happened then. Why not now?

Commentary from Mr. Sanders’ free email update service — tops for daily analysis of the metals markets. Franklin Sanders’ incomparable newsletter, published monthly except September. Markets, investments, interviews, alternative health, and much more, all written to help Christians prosper with their principles intact in an age of monetary and moral chaos. F$149/year. https://the-moneychanger.com/