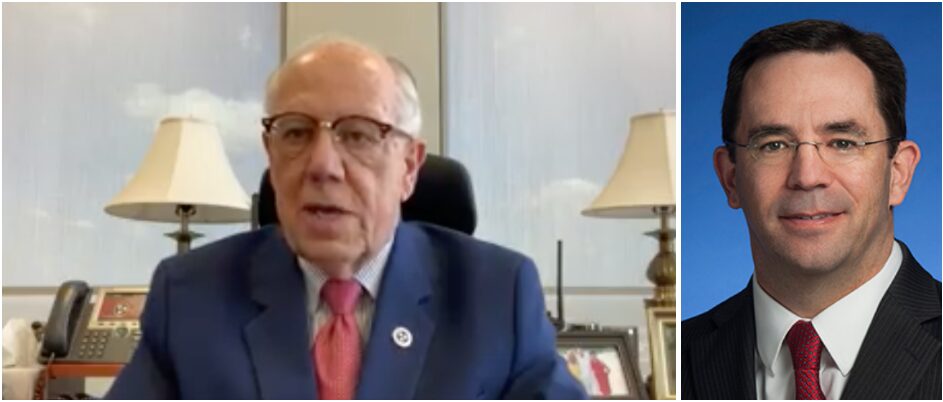

From left, Jeff Long, safety commissioner, and David Gerregano, commissioner of revenue in Tennessee. They are fighting to get a judge to drop my fraud case against them filed in the name of state. (Photos state government)

The state of Tennessee on relation has standing to sue respondent Jeff Long, commissioner of safety and principal administrator of financial responsibility in Tennessee, under its verified complaint, and to obtain dismissal of his motion to dismiss, as follows.

[This filing is my answer to commissioner Jeff Long of department of safety, a flopping fish I am hoping to not let escape Friday in a chancery court hearing making oral arguments on several motions aggressively prosecuting my Christian ministry in state and federal courts.]

Relator has standing to sue Cmsr. Long because the complaint is sufficient in factual allegations to notify him of what defense to make. “Under Tennessee Rule of Civil Procedure 8, Tennessee follows a liberal notice pleading standard, see Leach, 124 S.W.3d at 92–93, which recognizes that the primary purpose of pleadings is to provide notice of the issues presented to the opposing party and court.” Webb v. Nashville Area Habitat for Human., Inc., 346 S.W.3d 422, 426 (Tenn. 2011).

Facts and law citations in amended complaint show respondent Long’s acts are directly traceable to relator’s harms, that court rulings will satisfy the requirements of equity relief and public servant duty.

Short take —————————-

➤ Gerregano revokes people, but Long is in charge of TFRL

➤ Safety has fraudulently ‘interpreted’ sect. 139 since 2002

➤ Both commissioner liable for fraud, extortion under color of financial responsibility program

Respondent Long claims sovereign immunity and that relator allegedly failed to exhaust administrative remedies among grounds for motion to dismiss. These and other claims relator addresses in a separate response to parties’ motions to dismiss. This response defends the sufficiency of the amended complaint and relator’s standing to sue.

Relator, representing the state and her 7 million suffering citizens, attacks an arson caused by two firebrands who must be ordered to extinguish the blaze, not just each “his part.”

Sufficiency of pleadings

Respondent Long pleads “lack of authority over [electronic insurance verification system]” and “lack of redressable injury” as his defense from suit, p. 13. He is tasked with “enforcing some portions” of TFRL, p. 2.

He falsely states, motion p. 5, that relator’s “only” claim is Mr. Long’s “employing troopers” to arrest anyone in a vehicle with a suspended tag. Amended complaint offers much, much more, however.

Relator’s pleadings are sufficient under Tenn. R. Civ. P. 8 if given just liberal construction that state on relation is due as regards all the inferences that can be reasonably drawn from the pleaded facts. Amended complaint fully apprises Cmsr. Long of the relator’s grievance and his duty under Tennessee financial responsibility law of 1977 (“TFRL”).

Respondent Long has a continuing duty to “maintain” the EIVS program. “The department of safety shall cooperate with the department of revenue in developing, implementing, and maintaining the program.” § 55-12-209(b) (emphasis added). See complaint ¶¶ 30-32. He fails to do so.

Amended complaint paragraph 46 refers to T.C.A. § 55-12-204 and T.C.A. § 55-12-209 and quotes the DOSHS website stating safety “is tasked with administering the Financial Responsibility Law, which involves suspending/revoking/cancelling and restoring driving privileges while maintaining all driver records.” Amended complaint gives the website link.

Amended complaint paragraph 46 states:

The law requires DOR to search DOSHS financial responsibility division databases of SR-22 insureds. The division, says safety on its website, “is tasked with administering the Financial Responsibility Law, which involves suspending/revoking/cancelling and restoring driving privileges while maintaining all driver records.” That is why revenue “shall” consult with safety “to determine the details and deadlines related to the program,” § 55-12-204, and why “safety shall cooperate with the department of revenue in developing, implementing, and maintaining the program” § 55-12-209. Revenue did not, and does not consult with safety as required. (Lanfair deposition p. 29) EXHIBIT No. 3 Lanfair deposition transcript

Reference to § 55-12-209 also appears in paragraph 181.

Up front, amended complaint gives facts sufficient to put Mr. Long on notice and allege his role in fraud and corporate capture against the government. Among other parts of the filing.

- Paragraph 2. “[Complaint] includes department of safety Cmsr. Jeff Long *** because safety administers the Tennessee financial responsibility act of 1977 (“TFRL”) in like manner under claim of authority of T.CA. § 55-12-139.”

- Paragraph 5 alleges Mr. Long is in charge of Part 1 of the law and that Gerregano runs Part 2 of the law under Atwood “for a probationary purpose subject to safety Cmsr. Long and to Part 1 of the law,” and that DOR runs EIVS with “no-filter use *** parallel to and concurrent with TFRL, and independent from the base statute” (italics original), suggesting arbitrary and capricious program.

- Paragraph 8 says Mr. Long does “extort relator” into buying insurance insufficient legally to be evidence of proof of financial responsibility (“POFR”).

- Paragraph 61 tells how hearings under TFRL are heard in safety under T.C.A. 55-12-103. If Mr. Long were not guilty and sharing in dishonor in the fraud, he would have approached Mr. Gerregano and told him to comply with the law, using perhaps this one law to show Mr. Gerregano’s use of EIVS is apart from law.

- Long yields authority to usurping Gerregano in accepting cash payments or bonds, paragraph 66,

- Mr. Long is informed as to the moral structure of TFRL and his role in it, ¶¶ 70 and 71

Tennessee’s original 1948 financial responsibility law is paternalistic, but its moral framework is redemptive, restorative. Privilege is a means of control, and is turned into a paddle on the troublemaker. The general public is not required to “provide proof of financial responsibility prospectively,” as sect. 114(d)(1) puts it, because its members are presumed innocent, presumed by law to have rights to travel, unfettered right of ingress and egress, and are not in their use of motor vehicle in commerce under the probationary rule of suspension.

They are not red flagged in the records of safety’s financial responsibility division, keeper of the records.

- Paragraph 92 tells Mr. Long he is violating the law by enforcing T.C.A. 55-12-139 by abrogating the statute recognizing cessation of a person’s obligation to show POFR.

Sects. 102, 114, 116, 126 refer to the commissioner of safety’s authority to “release the requirement of that proof” of financial responsibility sect. 126(d). Such references are made nugatory by revenue’s policy requiring, at all times, “proof of financial responsibility” apart from any accident for which parties must accept responsibility. Release dates in Part 1 mean that people are free to use the roads without insurance generally. Participants in a qualifying accident also have power to release. “The submission to the commissioner of notarized releases executed by all parties” frees either party from any duty. Sect. 105(b)(4).

- Amended complaint ¶¶ 49 and 50 quote DOSHS discussion of the SR-22 certificate that is the primary focus of the law and this lawsuit – that being the type of insurance EIVS is charged with monitoring under T.C.A. §§ 55-12-202 and -204. This DOSHS verbiage indicates Mr. Long knows the motor vehicle liability policy is TFRL’s main “ankle monitor,” if you will, for parties with suspended licenses, the unique policy defined at T.C.A. § 55-12-102(7), endorsed and verified by the SR-22 certificate, affirming relator’s thesis and giving the court jurisdiction.

Respondent Long has a duty to be a consultant to respondent Gerregano in the “[administration]” of EIVS.

(a) The commissioner of revenue shall develop, implement, and administer an insurance verification program to electronically verify whether the financial responsibility requirements of this chapter have been met with a motor vehicle liability insurance policy; provided, the commissioner may contract with a designated agent to develop, implement, and administer the program.

(b) Prior to issuance of a request for proposal for the services of a designated agent or prior to developing and implementing the program, the department of revenue or, if applicable, its designated agent shall consult with the following entities to determine the details and deadlines related to the program:

***

(3) The department of safety; ***

T.C.A. § 55-12-204

If revenue did indeed consult with safety in creating the program, Long is negligent in his duty to tell revenue the requirements for revocation. Relator does not meet either of two requirements for suspension (qualifying accident, or a conviction or court order). If revenue did not consult with Mr. Long in creating and running EIVS, as required by T.C.A. § 55-12-204, EIVS is run illegally without lawful data search parameters.

EIVS is “to electronically verify whether the financial responsibility requirements of this chapter have been met with a motor vehicle liability insurance policy” T.C.A. § 55-12-2024 (emphasis added).

Fact witness Lanfair indicates DOR does not consult with Mr. Long’s list of SR-22 certificate holders subject to EIVS monitoring. EXHIBIT No. 3, Lanfair transcript p. 29, line 15ff.

The complaint verifies respondent Gerregano didn’t consult with Mr. Long in creation of EIVS. EXHIBIT No. 3, Lanfair transcript p. 29, lines 23-25. DOR does not consult its own self in a revocation, trusting contractor i3 Vertical to handle an “automated process.” Lanfair transcript p. 14 lines 6-18. DOR did not consult with safety in relator’s revocation. Lanfair transcript p. 13, 14, lines 13ff.

The complaint sufficiently establishes relator has standing to sue respondent Long for personal injury suffered as Mr. Long controls revocation of driver licenses and, by command to co-respondent, revocation of tags. In acts of official misconduct, respondent Long dissembles and facilitates misuse of EIVS by neglecting to give DOSHS resources to aid his fellow commissioner operate EIVS pursuant to law.

Role in misuse of driver data

He says p. 12 relator “cites no compelling authority or evidence” that Mr. Long can “intervene or reverse DOR’s revocation” of relator’s tag. He says relator’s citations to Mr. Long authority under sects. 102, 114, 116 and 126, in which Mr. Long revokes tags by order given to Cmsr. Gerregano, are “misguided.” He says “[b]ecause there are no allegations of a collision here,” TFRL provisions cited by relator regarding Mr. Long are “inapplicable” p. 13.

Respondent Long says he is not subject to suit because conditions precedent to his authority to revoke tags by “request” to revenue (§ 55-12-104). No qualifying accident, hence no order to revenue to suspend relator’s tag.

Respondent Long has half the story right. In two reference on p. 5 to “ignored *** court judgment,” he highlights the contested area of EIVS management. That is the monitoring of the adjudicated financially irresponsible person subject to TFRL and liable to have SR-22 insurance as condition of maintaining the privilege “for the length of the license’s revocation or suspension” T.C.A. § 55-12-114.

Whether qualifying accident or adjudication, neither commissioner can act against a driver license or a tag.

The records possessed by respondent Long show relator is an excellent driver, with no duty to have an SR-22 motor vehicle liability policy, or anything else as condition for exercising the privilege. Without protest or correction, respondent Long lets Mr. Gerregano ignore a state record pertaining to relator and run an illegal rogue program under color of EIVS.

Relator avers this neglect of his good driving record constitutes a “slander, defamation, slur, calumny, disparagement and maligning of his person *** broadcast statewide to law enforcement agencies.” EXHIBIT No. 29, relator affidavit “as to harms caused by slander, suspension of motor vehicle tag”

Cmsr. Long controls DOR all driver data, all driver records, all financial responsibility records, all SR-22 certificate records, according to the amended complaint. He is supposed to be an open book for EIVS to read from.

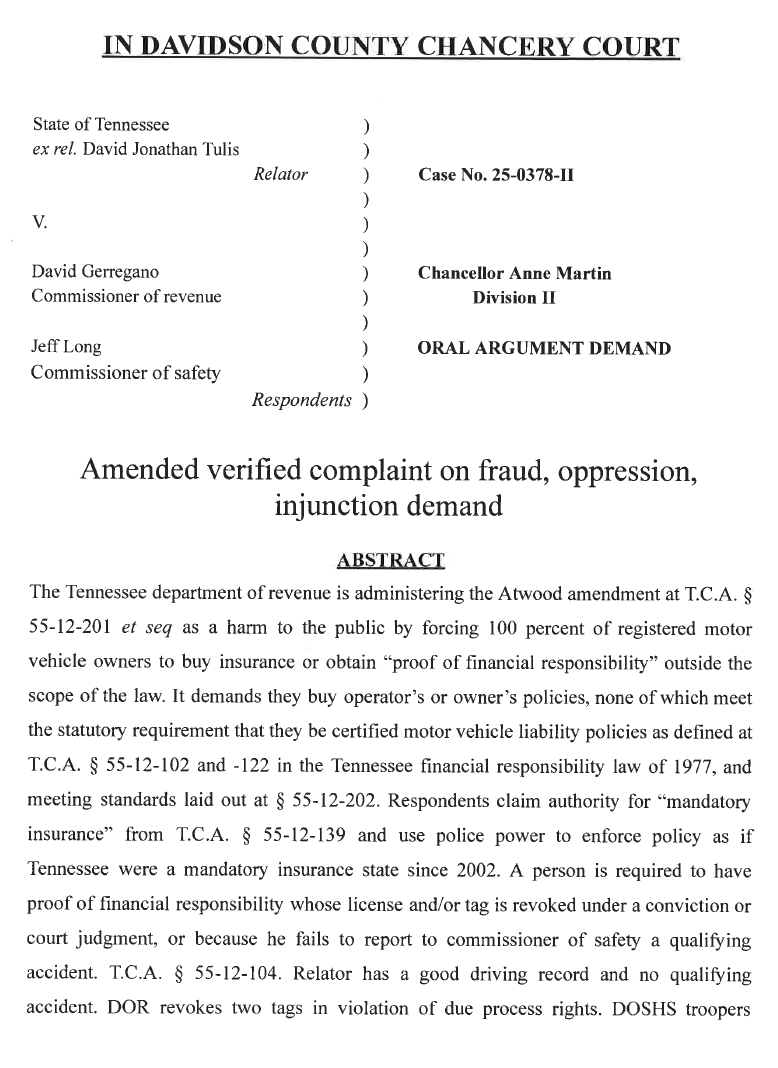

Page 1 of the amended complaint vs. Long and Gerregano.

Respondent Long consents to DOR misuse of relator driving record, specifically by its being ignored.

Amended complaint sufficiently alleges respondent Long gives substantial assistance in relator’s illegal suspension. In administering title 55, chapter 12, respondent Long leads and respondent Gerregano follows, ¶¶ 29, 30 say. “DOR receives notice from department of safety to revoke or suspend registrations of people who have been involved in a qualifying accident at § 55-12-104 and -105 and yet who fail to prove financial responsibility. Safety’s financial responsibility division receives all orders from court clerks. Safety pulls the trigger. Cmsr. Gerregano has a responsive and step-and-fetch-it secondary role. ‘[I]mmediately upon request by the commissioner of safety, the commissioner of revenue shall issue a notice of suspension of the registration of the motor vehicle’ of one who fails to make good after a finding of irresponsibility by safety or a court judgment. § 55-12-104.”

Amended complaint paragraph 127 states, “Respondent Long has 100 percent of authority under TFRL to command tag revocation. He is respondent in this suit because he fails to protect relator from misuse of the law by respondent Gerregano. Either safety ordered revocation of his vehicles, or safety’s Cmsr. Long is failing to use its records in the Financial Responsibility Division and to defend its prerogatives as an executive branch department under law to protect relator from clearly illegal activity.”

Complaint ¶¶ 129 and 130 state,

People who are target of EIVS legal surveillance and subject to tag revocation under TFRL are in the database run by DOSHS’ financial responsibility division. That agency controls the operation of TFRL. DOSHS controls EIVS, with authority for performance given to revenue throughout the two parts. As indicated below from DOSHS website, the department’s financial responsibility division administers the TFRL, which involves suspending, revoking, canceling and restoring driving privileges while maintaining all driver records. (emphasis in original)

The complaint provides website screengrabs about DOSHS’ financial responsibility and records divisions. The complaint shows Long holding with open hands the data needed to run EIVS, with Gerregano refusing to take it in revoking relator.

Amended complaint State ex rel Tulis

Paragraph 152 quotes T.C.A. § 55-12-103, the provision requiring all hearings to be held in safety. This law gives Mr. Long notice that he is 100 percent in charge of administering TFRL.

“Except as otherwise specifically provided, the commissioner [of safety] shall administer and enforce this chapter, may make rules and regulations necessary for its administration, and shall provide for hearings upon request of persons aggrieved by orders or acts of the commissioner under this chapter.” Tenn. Code Ann. § 55-12-103 (emphasis added). DOR suggests its initiatory revocation authority under Atwood necessarily dissolves safety’s control of “this chapter.”

“Revenue commissioner misreads the law to go around and behind the clear declarations of the general assembly,” amended complaint paragraph 208 says. “In a qualifying accident, the financial responsibility authority upon a registrant is triggered. The finger pulling the trigger for a registration revocation is respondent Long.”

Authority in TFRL to revoke a tag rests with Mr. Long, whose orders control Cmsr. Gerregano and revenue. Cmsr. Long consents to Gerregano’s using Long’s finger to pull the trigger against relator, causing personal and public injury.

Respondent Long admits the material fact of lack of qualifying accident or court judgment, one Long describes as ignored, p. 5.

Under law, in each instance, Mr. Long is in charge of revocation. Long gives notice to Gerregano, Gerregano suspends registration. But respondent Long cooperates with respondent Gerregano in oppression and fraud.

Like a referee on a track, respondent Long holds the starter pistol to initiate action. His pulling the trigger puts Mr. Gerregano into motion. “[I]mmediately upon request by the commissioner of safety, the commissioner of revenue shall issue a notice of suspension of the registration of the motor vehicle” T.C.A. §55-12-104. “Whenever the commissioner [of safety] suspends or revokes the license of a person by reason of a conviction, the commissioner shall request that the commissioner of revenue suspend or revoke all registrations in the person’s name, and the commissioner of revenue shall suspend or revoke those registrations immediately; provided, that the registrations in the person’s name must not be suspended or revoked, unless otherwise required by law, if the person provides and maintains proof of financial responsibility for the length of the license’s revocation or suspension.” T.C.A. § 55-12-114 (emphasis added)

Respondent Gerregano acts against relator without notice from Mr. Long, which wrong implicates Mr. Long, co-respondent.

Misuse of T.C.A. § 55-12-139

Mr. Long takes credit for 40,832 average criminal convictions of Tennesseans in the annual report made to the general assembly, with Mr. Gerregano also inking his name to the letter. EXHIBIT No. 30.

The letter is admission connecting illegal policy with mass harm of malicious and illegal prosecution of parties not subject.

Respondent Long is sued because he agrees with Mr. Gerregano that § 55-12-139(a) creates the universal mandate for auto insurance. Mr. Long acts accordingly in use of police power the amended complaint shows is unwarranted and without authority.

Respondents are linked inseparably under enforcement authority each commissioner claims under sect. 139. False claims about 55-12-139 unite respondents in a co-operative program, even a conspiracy, to violate constitutional rights.

Official oppression is a felony under T.C.A. § 39-16-403. Respondent Long’s cooperation with respondent Gerregano in misuse of EIVS is facilitation of a felony, T.C.A. § 39-11-403.

Mr. Long’s motion intends to prevent the court from seeing connection, affinity, amity or joint purpose each commissioner is required to have as regards the other.

Mr. Long, “qualified as a disciplinarian and experienced in matters pertaining to safety,” T.C.A. 4-3-2002, is forbidden to use police power criminally or oppressively.

Respondent Long’s misuse of police power under color of sect. 139 creates a direct threat to relator’s use of his 2000 Honda Odyssey minivan.

standing orders to state troopers to arrest any user of any automobile (1) with a revoked tag, and (2) charge any man or woman behind the steering wheel without insurance in criminal prosecution under sect. 139.

Relator asks the court to take judicial notice that city police and sheriff’s deputies prosecute men and women on the road pursuant to respondent Long’s arbitrary and capricious policy.

Mr. Long’s role in the program violates the division of powers. The general assembly, in passing the initial financial responsibility law in 1947, drew a line on how far it wanted to legislate public safety. The Long/Gerregano op says, “that line is not good enough. We need more safety than what’s in the law.” Their program under color of sect. 139 constitutes legislation that rejects the balance test TFRL draws between protected liberty and state regulation upon the motoring public to secure against driver irresponsibility.

This rejection of law in favor of insurance companies provides a captive customer base for profit, to the misery and suffering of the poor, and the oppression of all others who are bullied into being insurance industry customers.

Conclusion

In light of the foregoing, state of Tennessee asks the court to accept the sufficiency of the amended complaint as to facts connecting respondent Long to the harm in which the primary actor is respondent Gerregano.

He asks the court to accept the sufficiency of the facts and law in the amended complaint. It avers Mr. Long neglects his duty to maintain and oversee the entire chapter, meaning EIVS; that he fails to supply accurate information to revenue for operation of EIVS in defiance of his duty, T.C.A. 55-12-202 and 204; that he fraudulently “interprets” T.C.A 55-12-139 as creating a mandatory insurance requirement on the entire public when he knows, as an attorney and officer of the court, that EIVS applies just upon SR-22 certified policy holders of motor vehicle liability policies, and not on other people such as relator.