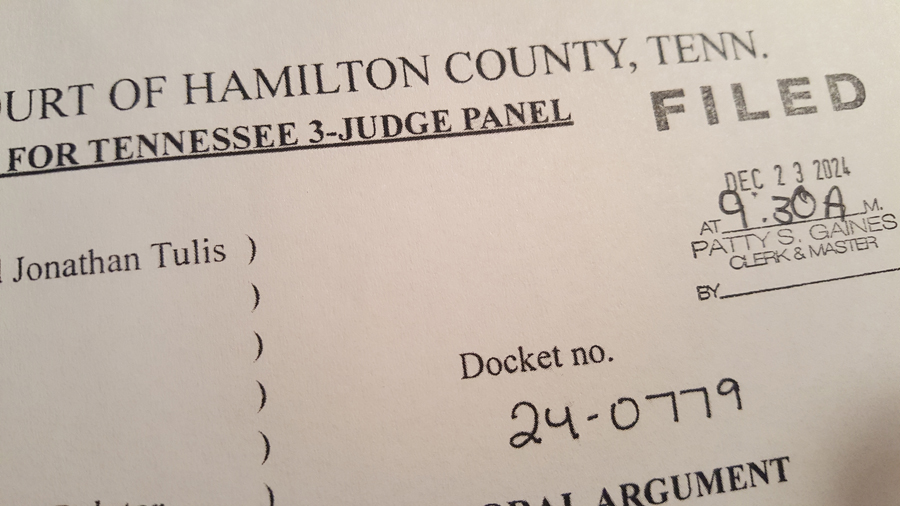

This shows the date that my 93-page complaint is filed in McMinn County chancery court. The case was filed Nov. 1, 2024, and served on the respondents Nov. 4. They have not answered after more than 50 days. The rules give them 30. (Photo David Tulis)

Our draft order submitted for the court’s consideration

ORDER FOR PRELIMINARY INJUNCTION

This case concerns the duty and lawful authority of the respondents to accurately administer the Electronic Insurance Verification System (“EIVS”) over those affected parties made “subject to” the state’s financial responsibility provisions for the stipulated number of years. The purpose of “Part 2 Insurance Verification Program (‘James Lee Atwood Jr. Law’)” (“Atwood”) as stated by T.C.A. § 55-12-202 is the verification of motor vehicle liability insurance policies used as proof of financial responsibility.

Judge Jerri Bryant

The Court makes a finding of law that the certified motor vehicle liability insurance policy is central to administration of EIVS and parts 1 and 2 of TFRL.

“Part 1, Tennessee financial responsibility law of 1977” (“TFRL”) defines motor vehicle liability policy. Part 2 is to be read and understood in para materia with Part 1, which defines motor vehicle liability insurance policy as follows: “‘Motor vehicle liability policy’ means an ‘owner’s policy’ or ‘operator’s policy’ of liability insurance, certified as provided in § 55-12-120 or § 55-12-121 as proof of financial responsibility, and issued, except as otherwise provided in § 55-12-121 by an insurance carrier duly licensed or admitted to transact business in this state, to or for the benefit of the person named therein as insured” T.C.A. § 55-12-102(7).

Motor vehicles cannot be “financially irresponsible,” per se. Policies are issued to indemnify owners or operators, not their equipment. The requirement of a certified policy places the owner or operator in EIVS, not the vehicle identification number (“VIN”) or tag.

Tennessee law presumes its fully emancipated adult citizens are morally upright and financially responsible. There is also a standing presumption of liberty which the state may not curtail absent a justiciable harm or injury for which notice is required. Unless and until an owner or operator demonstrates “financial irresponsibility” as adjudicated by the courts, they are free to use the road without encumbrance or restraint.

How ‘financial responsibility’ works

The state suspends licenses for unpaid court judgments involving a motor vehicle or conviction in a traffic case. Safety “may issue notice of suspension” for one who “willfully fails, refuses or neglects to make or have filed an accident report” under TFRL’s 20-day reporting requirement after a qualifying accident, T.C.A. § 55-12-104.

If the State of Tennessee suspends a driver license or registration plate for cause, the obligation of the licensee or registrant is to regain the state’s good graces and restore the privilege by meeting the condition of having POFR “for the duration of the license’s suspension or revocation” T.C.A. § 55-12-114. This person thus becomes “eligible” for the four-notice sequence described in T.C.A. § 55-12-210. At the end of a suspension, the person is “[released] from the requirement” to have POFR. T.C.A. § 55-12-126. The court finds that DOR does not use DOSHS’s financial responsibility division records of certified policies sent by insurers of record to calibrate EIVS monitoring.

The primary revocation authority under Parts 1 and 2 of TFRL resides with DOSHS, in which department hearings are held to preserve due process rights. Revenue gains supplementary revocation authority in Part 2 after individuals have been included in EIVS by DOSHS. Revenue’s initiatory revocation authority is limited to T.C.A. § 55-5-117(a)(1)-(5), for fraud.

Insurance carriers participating in the Tennessee Automobile Insurance Plan, T.C.A § 55-12-136, certify insurance policies using the industry standard form, the SR-22, a document which the insurer provides to the Department of Safety and Homeland Security (“Safety” or “DOSHS”). The insurance company then has the duty of providing notice to DOSHS when such policies are sold, T.C.A. § 55-12-102(7) and § 55-12-120, or cancelled, T.C.A. § 55-12-123, information which DOSHS then passes on to DOR. The EIVS system is simply a software platform that assists the defendants in monitoring those “subject to” parties that Safety suspends for cause.

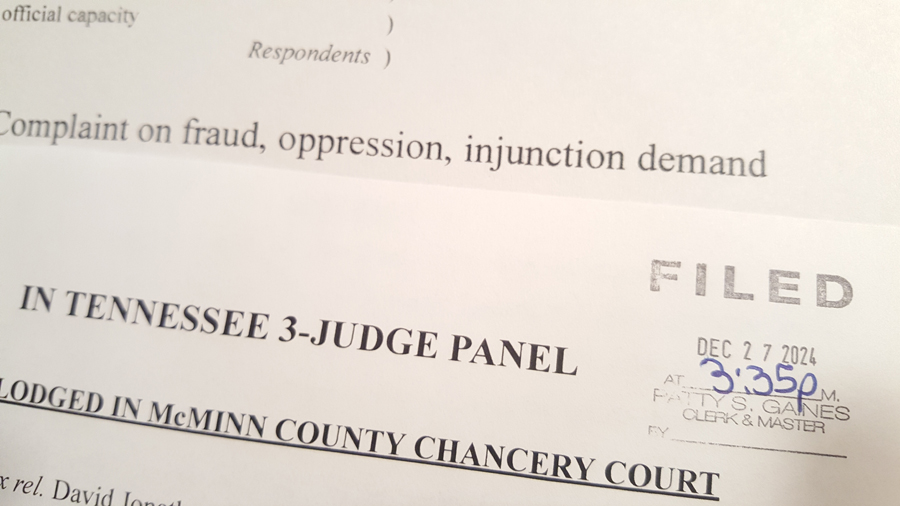

This draft order accompanies a motion of default and a supoorting affidavit. (Photo David Tulis)

The state has an interest in protecting its citizenry from those who have demonstrated a lack of financial responsibility, not to impose burdens upon those who are financially responsible. Thus, the state’s concern is to monitor those who violate the privilege trust and are subsequently compelled by law to post proof of financial responsibility as security against potential future harms.

Extortion is not state policy

Relator has no less right to use the public right of way than others who purchase insurance to protect their investment in an automobile. The instrumentalities of government, while coercive in nature, cannot be used for extortion via use of the police power. Because Tennessee is a financial responsibility state, its powers are focused on select high-risk parties, not on the general motoring public whose members have caused no offense to law or to another member of the traveling or shipping public.

Respondents concede that the relator has not had a qualifying accident nor that he is under suspension due to a conviction. Hence, this Court discerns, he is not subject to performance under any part of TFRL. Relator indicates a notice of revocation was to be issued by DOR on Dec. 27, 2024, purportedly due to a lapse in coverage by a non-certified non-SR-22 policy from State Farm insurance. Lapses of non-certified policies should not trigger automated suspension notices because these policies do not meet the criteria for EIVS inclusion.

From left, gnomes Christopher Sapp and Ed Soloe discuss deposition workarounds with David Tulis, an Eagle Radio Network radio investigative reporter, inside a revenue department conference room during a break in a deposition of DOR official Jennifer Lanfair, establsihing a record of fraud. (Photo David Tulis)

T.C.A. § 55-12-205 commands DOSHS and respondents to use “multiple data elements to make insurance verification inquiries *** accurately.” Absent the employment of a proper database filter to distinguish between individuals mandated by law to have certified SR-22 policies and those not so required, a vast number of otherwise “financially responsible” citizens are included in EIVS absent statutory authority. DOR uses EIVS to target motorists who lack non-certified insurance coverage when such individuals would not otherwise fall under DOR supervision and who should otherwise enjoy a presumption of financial responsibility.

T.C.A. § 55-12-139 is typically used as the basis of every “driving without insurance” prosecution in Tennessee. Under color of law, respondents have erected a system that inflicts grave harm upon the public, resulting in unwarranted prosecutions and up to 40,800 wrongful convictions per year. This provision of law operates exclusively upon those “high-risk” drivers and operators adjudicated to be financially irresponsible, not the at-large public who register automobiles.

The sect. 139 nightmare

Enforcement of respondents’ mandatory-insurance-for-all policy is premised on misinterpretation of a single sentence: “This part shall apply to every vehicle subject to the registration and certificate of title provisions” T.C.A. § 55-12-139. The rules of construction require this provision to be read in para materia with § Title 55, chapter 12, which respondents do not. This sentence applies to persons required to have proof of financial responsibility (“POFR”).

Before the Court is a motion for preliminary injunction to suspend respondents’ corralling and revoking of the uninsured. The Court considers the affidavit of complaint, relator’s motion for preliminary injunction, a supportive memorandum of law and other filings. State on relation files motion for entry of default, as neither commissioner has responded to the complaint. Given this review, and its rehearsal of law and fact above, the Court hereby ORDERS that respondents must:

- Immediately halt notice for revocation of any person, relator included, who is not in the DOSHS record as having agreed, on payment of fines and fees, to purchase a certified SR-22 motor vehicle liability policy to retain the operating privilege after suspension;

- Halt or rescind tag revocation of relator and his use of 1999 RAV4 under vehicle identification number (“VIN”) JT3GP10V4X7044214;

- Halt or rescind any act of revocation of registration of any person not subject to TFRL, any such act commencing on or after 12:01 a.m. Sept. 27, 2024, the date of respondents’ first “request for information” notice sent to state of Tennessee on relation;

- Immediately halt any surveillance or monitoring of any person or vehicle that is not on the list of certified SR-22 motor vehicle liability policy holders (1) on record with an insurer of record, and (2) on record in DOSHS’ financial responsibility division, said insurance policy subject to certification; and

- Order their agent in Hamilton County, the county clerk, to send by U.S. mail a one-year sticker for relator’s 2000 Honda Odyssey minivan, VIN 2HKRL1859YH575510, pending conclusion of these proceedings on condition of payment of the annual fee, the one year tolling from the date of this order.

- Direct Tennessee highway patrol under duties at T.C.A. § 4-7-104 to cease forthwith enforcement of T.C.A. § 55-12-139 until such time as respondents recalibrate EIVS, so that the system alerts officers of SR-22 policyholders, who alone are subject to monitoring.

- Notify all municipal police departments across the state and all sheriffs in Tennessee’s 95 counties that they must cease administration of T.CA. § 55-12-139 until the commissioners of revenue and safety reorganize administration of TFRL and EIVS to come into compliance with the law.

Departments must come ‘into conformity’ with law

State of Tennessee on relation has met its burden of proof in petitioning for preliminary injunction.

The Court makes a preliminary finding that the EIVS program is out of order and cannot remain certified by the commissioner of revenue, pursuant to T.C.A. § 55-12-212. Given the great public interest in an immediate disposition of this litigation, the Court directs the respective clerks to move this matter to the head of the docket for a hearing so that respondents show cause how they can bring EIVS into conformity with the law.

The Court urges the parties to consider entering into an agreed order in light of the court’s preliminary findings so as to prevent further harm to the relator and to the general public until such time the defendants employ a filter for the accurate EIVS monitoring of SR-22 policyholders.

IT IS SO ORDERED.

David runs a personal nonprofit fighting and mercy ministry. He thanks you for checks sent directly to c/o 10520 Brickhill Lane, Soddy-Daisy, TN 37379. Also, in GiveSendGo

Princely warfare against principalities & powers

These two notebooks contain the filings in the administrative case Tulis v. DOR seeking to decertify a program causing 40,800 illegal criminal convictions a year, nearing its final filing before a hearing officer gets it for a ruling. In Christian ministry, I sue public officials to halt oppression and wickedness among public servants. I appreciate your generous support of my ministry. (Photo David Tulis)

“This part shall apply to every vehicle subject to the registration and certificate of title provisions” T.C.A. § 55-12-139. The rules of construction require this provision to be read in para materia with § Title 55, chapter 12, which respondents do not. This sentence applies to persons required to have proof of financial responsibility (“POFR”).”

What law commands that the People of Tennessee, having Lawfully inherited “all power” within the state, are “persons required”?