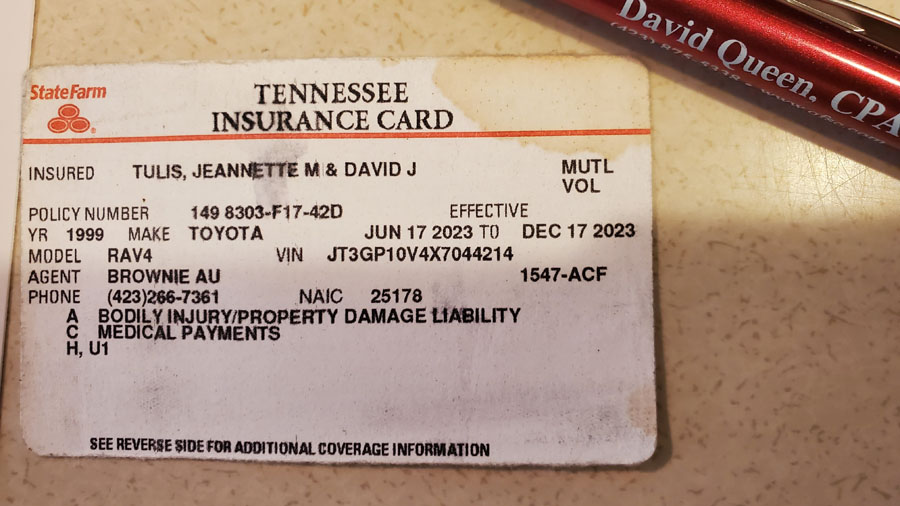

This is an insurance card for a Tulis family auto, currently a motor vehicle, that is destined Jan. 27 to have its registration as a motor vehicle be revoked, the car to be returned to its lowly status of automobile. More than 1 million motorists in TN are targeted for revocation even though they don’t meet the requirements of the law for this attack on their property rights. (Photo David Tulis)

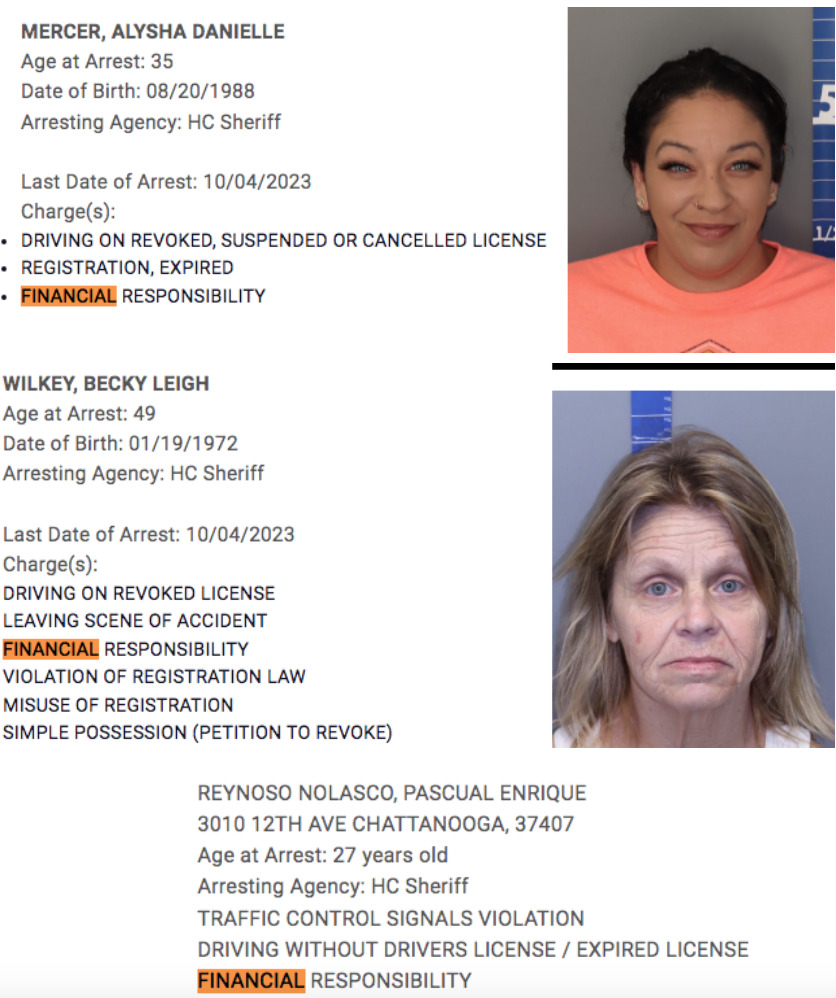

These are victims of DOR policy, prosecuted for “not having insurance” when there is no law requiring it, all the law, and all the court cases show. (Images from Chattanoogan.com)

CHATTANOOGA, Tenn. Thursday, Oct. 10, 2024 — My lawsuit against the commissioner of revenue and his crooked department in Nashville is in its 15th month, aggressively and fiercely argued. I am in midst of filing a second one, in U.S. district court.

I’m not just a critic who grumbles and complains, but a builder who explains exactly what has to be done to end a criminal enterprise that in a 5-year period ending in 2022 netted 408,800 criminal convictions of Tennesseans, and much heartbreak and seized vehicles. The demands I list I offered to the judge, Brad Buchanan, the department’s lead attorney, as a proposed order, 19pp long.

What follows may seem a little technical. But that’s how reform starts. It looks into the arcana of the evil afoot, and What follows is a set of demands to reform the department by cutting out the cancer of disobedience to the law.

The demands to end injustice and pillage by government reverse engineer, if you will, the Gnomes’ whole enterprise of establishing where and how crooked state employees turned the Tennessee financical responsibility law of 1977 into a shakedown club.

I am adding emphasis to this scintillating document.

EIVS use must be filtered

In light of the foregoing, given the law and the facts, petitioner demands the administrative officer deny respondent’s motion for summary judgment and approve this motion. He demands immediate rescission of the revocation of his registration with a declaratory order with a finding

➤ Of fact that the absence of a qualifying accident involving petitioner in his motor vehicle is dispositive of the contested case in favor of his claims. TC.A. § 55-12-104.

➤ Of law that respondent’s use of EIVS apply not to noncustomers of the insurance industry, but only to motor vehicle liability policy holders. The only policy required by T.C.A. § 139 that the deputy or police officer verifies is one certified pursuant to the IICMVA standard for mandatory insurance, namely the SR-22 liability policy, the certificate containing “the necessary information [filed] with the commissioner on a certificate or form approved by the commissioner [of safety],” § 55-12-137, which form is used by revenue, sect. 210(a)(1)(A) and sect. 211(a)(3))A), “The owner or operator’s proof of financial security in a form approved by the department of revenue,” which form is required of those people under privilege suspension that must be kept handy to show the officer as continuing proof of financial responsibility, and which form must be submitted, along with renewal fees, if applicable, “[w]henever a license or registration is suspended or revoked and the filing of proof of financial responsibility is made a prerequisite to reinstatement of the license or registration,” § 55-12-129, if time is due for renewal of the license or registration.

➤Of law-and-fact that in violation of T.C.A. §§ 55-12-139, 55-12-201 and 55-12-210 respondent is administering the statute beyond its scope, that administration violates the command to establish an “efficient insurance verification program,” T.C.A. § 55-12-202, one that “[verifies] whether the financial responsibility requirements of this chapter have been met with a motor vehicle liability insurance policy,” T.C.A. § 55-12-204 (emphasis added), wherein current practice generates false positives among registrants not subject to either TFRL nor amendment utility, therein adding to department payroll, mail and other overhead costs, while injuring petitioner in his rights, and others in like standing, and that respondent must cease all activity that prevents the program from working efficiently and regularly to prevent what is happening to petitioner from occurring upon others.

Further, petitioner demands the hearing officer make findings of law that:

➤ Respondent must forthwith, if not sooner, use EIVS under filter pursuant to T.C.A. § 55-12-202 to alert respondent of people whose policies are motor vehicle liability insurance policies, per § 55-12-122, that under TFRL are required to be certified, per § 55-12-102, “(7) ‘Motor vehicle liability policy’ means an ‘owner’s policy’ or ‘operator’s policy’ of liability insurance, certified as provided in § 55-12-120 or § 55-12-121 as proof of financial responsibility, and issued, except as otherwise provided in § 55-12-121 by an insurance carrier duly licensed or admitted to transact business in this state” (emphasis added), of such parties required under record from DOSHS’ financial responsibility division to carry such coverage for conditional use of the privilege.

➤Respondent is obligated, in verifying insurance as POFR, to use “the data elements that the department of revenue *** and automobile liability insurers have agreed upon and are necessary to receive accurate responses from automobile liability insurers” § 55-12-206.

➤Respondent’s administration of § 55-12-210 must comply with Part 1 of TFRL, delimiting the scope of Part 2, with the four notices served on the owner of a “motor vehicle *** not insured” whose duty and agreement to carry insurance or other POFR is known to the department under certificate and who has violated terms of his suspension by ceasing payment to his “liability insurer of record” and as such is “eligible for notice,” as follows: “(g) If the vehicle is no longer insured by the automobile liability insurer of record and no other insurance company using the IICMVA model indicates coverage after an unknown carrier request under § 55-12-205(3), the owner of the motor vehicle becomes eligible for notice as described in subsections (a) and (b)” § 55-12-210(f).

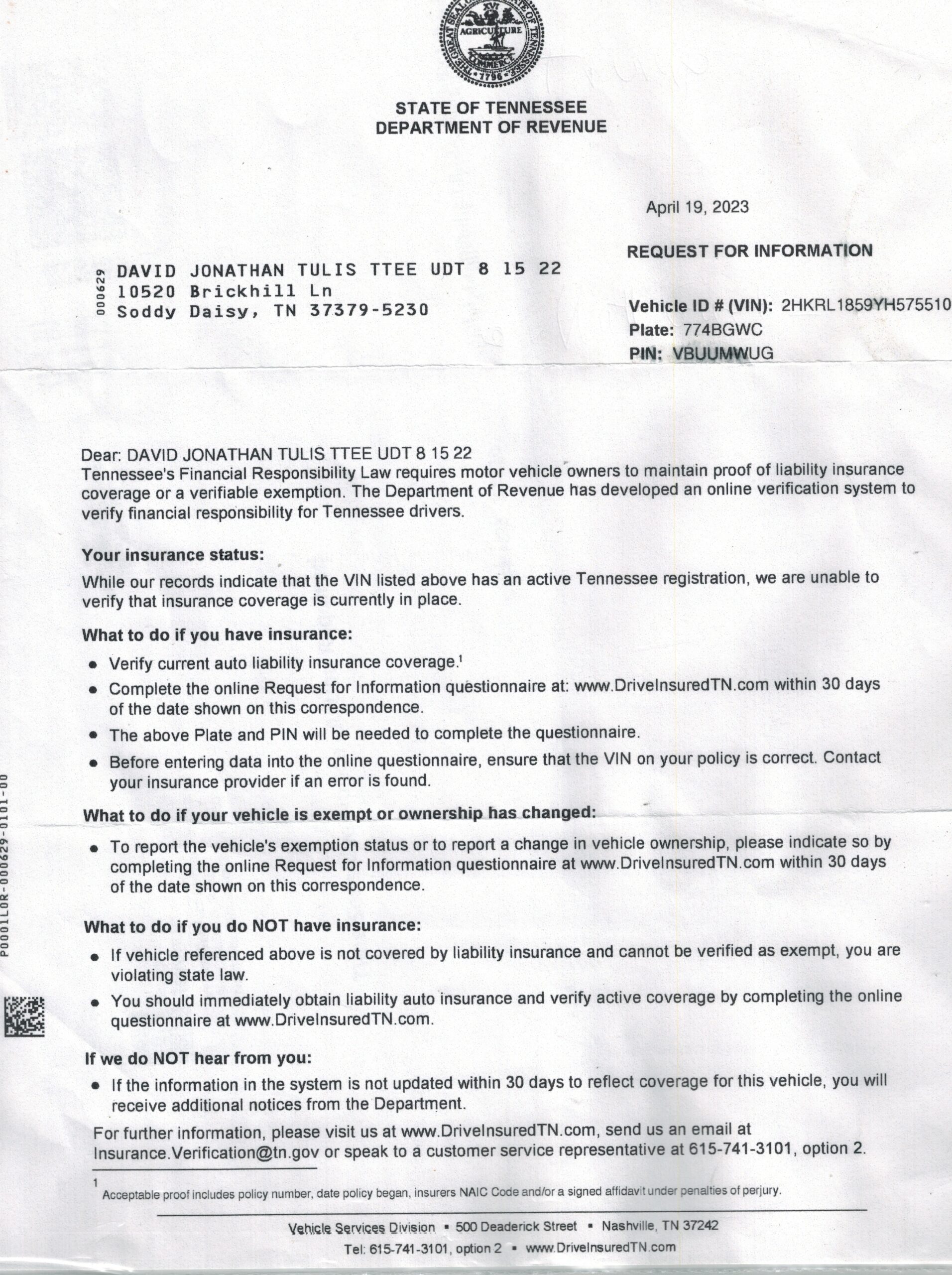

First of four notices is this one in department of revenue’s industry-capture fraud, worth up to F$2 billion in “free premiums” a year. My 300,000-mile 2000 Honda Odyssey minivan nor I am subject to TFRL, the Tenessee financial responsibility law of 1977, not having had a qualifying accident nor being one under privilege suspension.

Editing of notices to public

➤Department notices under § 55-12-210 are insufficient and misleading and that they be clarified to show that they apply only to suspendees who for reason that need to be stated in particular in personalized notice are required to have certified policies current with their insurance carrier but who do not have such policy, and are thus in jeopardy of losing the driving and operating privilege, said notice needing to confirm that the party has failed to show financial responsibility following a judgment, conviction, court order, or administrative determination as to the duty to have POFR, to which duty the notice recipient agreed. Respondent is directed in notice to explain how TFRL works from Part 1, explain that Atwood is the enforcement utility, that suspendee is in jeopardy of loss of privilege, and state the duration of the suspension, giving date of release. § 55-12-114, § 55-12-116 and § 55-12-126.

➤ Notice will make clear that POFR obligation is for no longer than five years, or the duration of the suspension. § 55-12-114. Notice will state that once the suspension ends, the person is released of any and all requirement to maintain that proof of financial security or financial responsibility, the release statement being made IN ALL CAPITAL LETTERS or in bolded letters that the registrant is free to have insurance coverage, or not, Tennessee being an after-accident voluntary insurance state, the law coercing no one to do business with any company or concern.

➤DOR consult and cooperate with DOSHS per Atwood law § 55-12-204 and regularly uses its financial responsibility division resources. § 55-12-204.

➤DOR use the records, kept by DOSHS financial responsibility division, to make only those persons with a motor vehicle liability policy on record subject to sect. 210 inquiry and revocation notice.

➤DOR inform DOSHS that in remediation it must release from the requirement of POFR any person who was required to have POFR because that person didn’t have POFR under the false reading of sect. 139.

Reinstatement of all registrations falsely revoked

➤Since DOR is to monitor each person with motor vehicle liability policy under T.C.A. §55-12-122(c), and since respondent sends out 6,000 notices each Monday and 6,000 each Wednesday, mostly in error, respondent staff and agency contractor i3 Verticals shall begin the process of restoration for past wrongful notice, based upon random selection of registrants present and former erroneously revoked, in the interest of maintaining quality of public service during the reformation.

➤DOR inform DOSHS of its compliance with law and request DOSHS reinstate any driver license suspended or revoked for above said reason, or non-payment of court cost thereof.

Refund of court fees, fines illegally imposed

➤Respondent reinstate any registration so suspended or revoked, free of fines or fees, and reimbursement of monies paid for said registration.

➤Department and contract personnel be trained by having familiarity with financial responsibility infrastructure of TFRL Part 1, that all personnel understand the POFR duty is on parties who have failed to show good behavior in the use of the privilege, whether following qualifying accident or other § Title 55 breach of rules of the road.

➤Notices, videos, memos, class lectures, social media posts, public service announcements and other remediation and correction updates be created and promulgated to Tennessee highway patrol and law enforcement agencies across the state so that they administer Atwood using EIVS according to law upon those parties required to have insurance or other POFR, those under suspension and conditional use, and no other.

➤Such communications with statewide law enforcement agencies must indicate that the motor vehicle of the POFR-liable person is subject to towing only if there is a local ordinance or provision allowing that to be done. §139(c)(4).

Office of master to oversee reform

➤ Respondent department create, or request to be created by another, an office of master to oversee reformation of the financial responsibility section, which party will give notice to the county clerk and courts in Hamilton County, where petitioner lives, that its past enforcement of TFRL is in error, and without authority, and that the office of master deal with a court record notification process serving citizens in all counties and oversee concessions state of Tennessee makes to people falsely criminally charged and convicted, either by jury, bench trial or by a plea bargain under law misapplied in breach of their rights in abuse of the peace and tranquility of the state and the people.

➤Department be commanded to use this master, and his/her office and staff, to heal the breach between petitioner in Hamilton County and the balance of people in the state’s other 94 counties where police, sheriff’s departments, the Tennessee highway patrol, other LEAs and respondent by agency abuse, harm and injure the people of Tennessee, so that respondent’s 22-yearlong abuse of sect. 139 since 2002 and its seven-year abuse of Atwood since Jan. 1, 2017, in cooperation with others, might be undone and the honor, dignity and civil records of falsely convicted people be restored, as equity and justice might require.

Equitable 1-time payment

➤ The master be authorized by this order to consult with the commissioner, the speakers of the state house and senate, the governor’s office, the state comptroller, the attorney general’s office and others as to a protocol for Tennesseans to follow in making application for redress, in the form of an equitable one-time payment or other just compensation for distress, harm, false report, inconvenience, humiliation respondent as caused, using authority lawlessly imposed, in use of police power exercise by law enforcement agencies in every county.

➤ Respondent issue a public statement regarding sect. 139, used as basis in every criminal prosecution, “that the 2003 Attorney general opinion on TFRL concerns only instances when insurance is used as proof of financial responsibility and T.C.A. § 55-12-139 does not require proof of financial responsibility of anyone not under duty by the department of safety and homeland security to provide proof of financial responsibility because of an earlier accident or judgment.” Such publicity will provide a contact for any person convicted under and aggrieved by former policy under § 55-12-139.

➤Respondent, in cooperation with DOSHS, revise the statement required of applicants of driver licenses pursuant to T..C.A. § 55-12-138, certificates and certification, that says the TFRL summary “shall contain the following or similar certification to be signed by the applicant” (emphasis added). The update shall state: “I certify that I understand that if I am involved in a qualifying accident under the Tennessee financial responsibility law of 1977, I agree I will abide by it.”

Publicity for reversal of program, restitution

Further, petitioner demands that —

➤Respondent be required to arrange for publicity, advertising and mass social media communications about respondent’s effort to heal the breach its program has caused among the people of Tennessee, so that the people of Tennessee might be put on awares about the wrong done them, and restitution offered by respondent and state of Tennessee in good faith and in sorrow.

➤The general assembly be consulted as to funding for this program of notice, reparation, restitution and healing, as to advertising, media outreach and compensation or reimbursement for damaged men and women among the “free people” of Tennessee, as they are called in Tenn. const. art 1, sect. 24.

Expungements ‘en masse and in toto’

➤Respondent petition the general assembly, as necessary, for accelerated means to allow for free, easy-to-obtain expungement of any record connected with a registration tag or plate revocation or suspension under the rescinded policy, and that court charges and fines that are fruit of criminal charges stemming from a tag revoked by respondent be sought, tallied, separated and expunged en masse and in toto.

Tulis tag restored

Disputed minivan — with registration revoked — waits outside radio studio as I fight maladministration and lawlessness by the TN department of revenue. (Photo David Tulis)

➤ In light of the hearing officer’s finding of law and fact in this contested case, that petitioner’s motor vehicle registration be restored upon payment of the annual fee, starting the day of the administrative judge’s final order, as the registration expired July 2023, with the commencement date of the one-year period of privilege being the date of the order; and that a roughly $3 unpaid balance be prorated out of the amount of privilege tax due.

➤Respondent on receipt of affidavit of petitioner’s billable hours and expenses in this case pay his reasonable attorney fee.