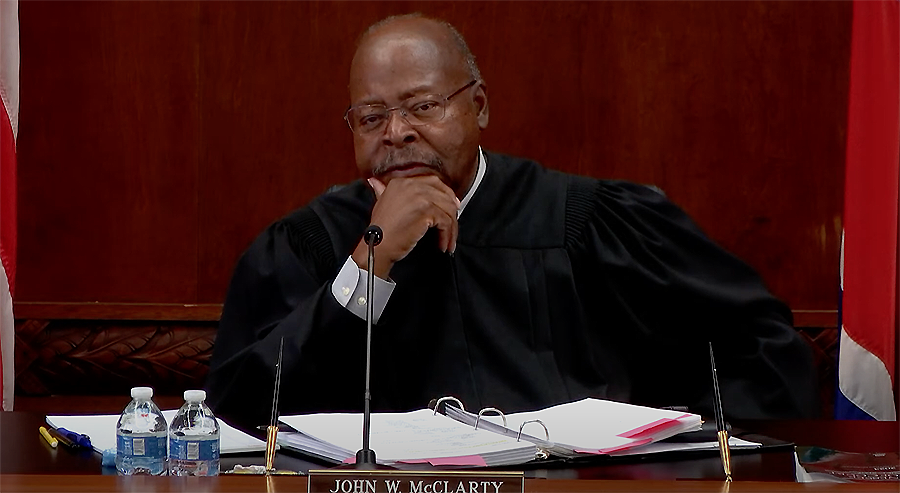

Tennessee appeals court judge John W. McClarty is from Chattanooga, and heads the panel Nov. 14, 2023, hearing my appeal against Flexibility Capital. He and two other judges let my presentation advance without question or quarrel. (Photo Administrator of the Courts)

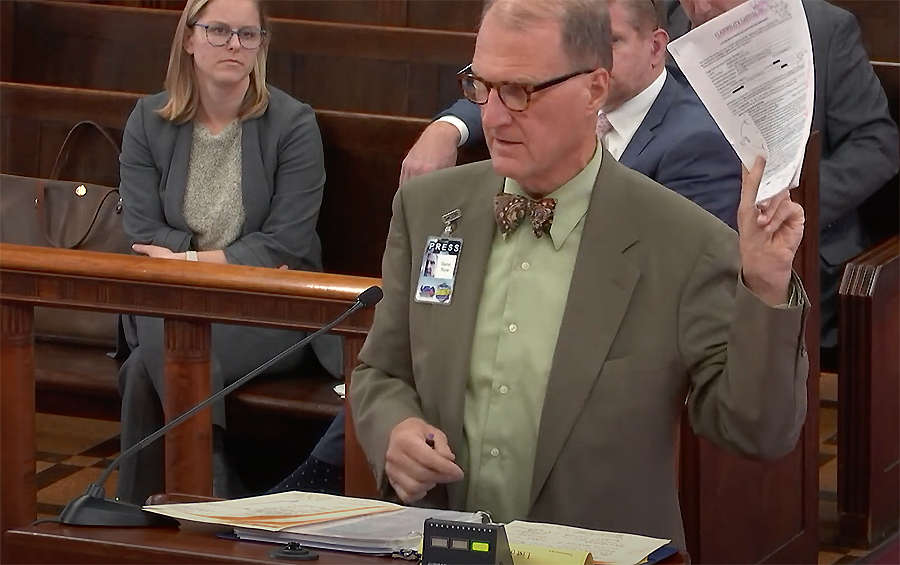

I take my 15 minutes alotted time to wreck the future fraudulent prosperity of loan shark Flexibility Capital of New York. (Photo Administrator of the Courts)

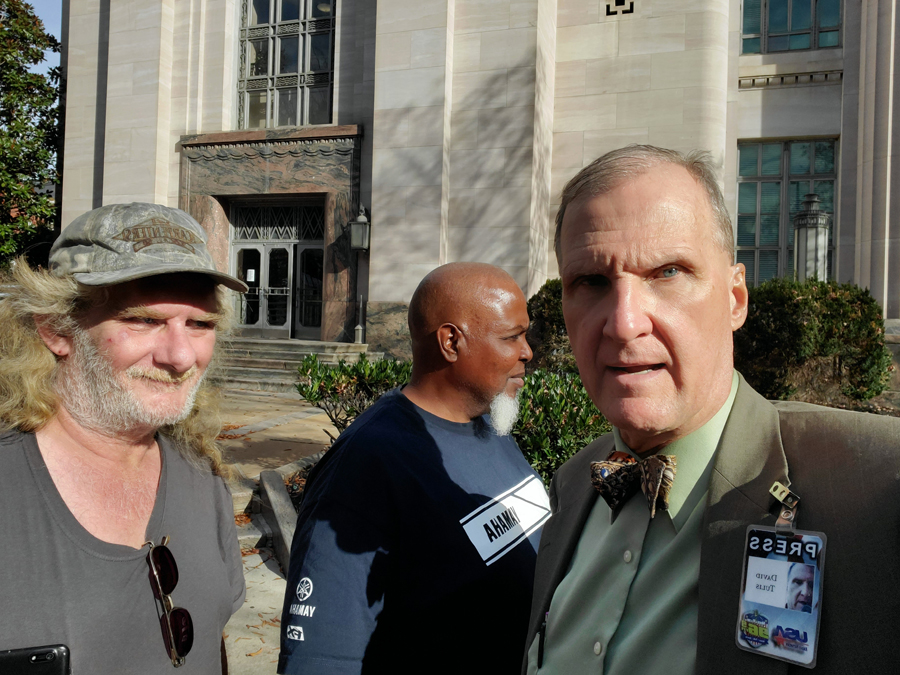

Ed Soloe, left, one of the gnomes, is an Alcoa, Tenn., man who fixes neighbor’s cars and studies law, especially my new lawsuit of the commissioner of revenue for fraud. At center is Michael James, a truck driver who fended off a lawless criminal assault prosecution after studying Tennessee criminal procedure and voiding his case in sessions court before the Hon. Gerald Webb. We enjoy the sunlight in front of the old post office and courts building in Knoxville, Tenn. (Photo David Tulis)

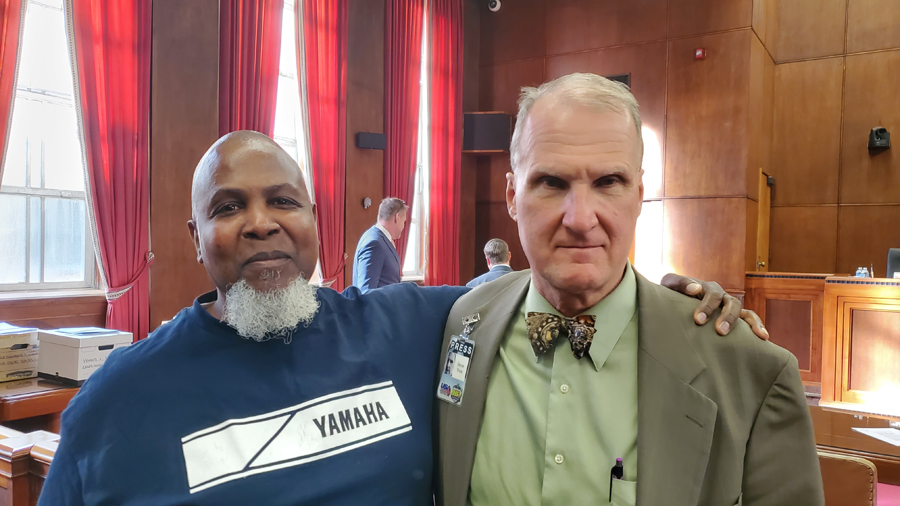

Michael James poses for a photo in the supreme court hearing room in Knoxville before the start of the afternoon 1:30 docket on Nov. 14, 2023. (Photo David Tulis

Attorney Mary Cheadle passes security in the Tennessee courts building in the historic post office in Knoxville, Tenn. (Photo David Tulis)

KNOXVILLE, Tenn., Tuesday, Nov. 14, 2023 — Today in the court of appeals I go on the attack after being sued by so-called business funder Flexibility Capital, which pretends to buy future receipts at a discount among many businesses in Tennessee and many other states. It is, in fact, a mere loan shark high-interest-rate lender. The tally for the amount it claims I owe is now past F$30,000 as it seeks to enforce an illegal contract unenforceable in any Tennessee court, or so I argue.

Oral arguments vs. Flexibility Capital

David Tulis A court without subject matter jurisdiction is like an orchestra without a pit or a plumber without a wrench. This case is about a predatory lender based in New York that strip mines the public in Tennessee with loans disguised as business cash advances, or as advance purchases of future receivables.

And it does so outside of the regulation of the state of Tennessee because it is not banking and these are not loans. So this is an industry which is – which is not subject to the rules for loans. It’s a very large industry. I’m in business and many people I’ve talked to have used these types of funders of business.

[These arguments are in Flexibility Capital Inc. v. Sabatino Cupelli et al, E2023-00335-COA-R3-CV, in the Tennessee court of appeals in Knoxville on Nov. 14, 2023. See “Journalist converts suit for nonpayment into attack on 208% APR loan sharking disguised as business-boosting cash advance.”]

So the American genius for capitalism and profit in this case collides with the moral speed trap of the usury law. The usury laws are intended to protect the ignorant, the weak and the poor from rapacious and advantageous-smart lenders such Flexibility Capital.

So the case has two main parts. One is the nature of the contract. And also the second part is about the court.

The courts lose their virtue, they lose their moral purpose and they lose their role in justice when joining and aiding with the wolf in this case, despite proper pleas by the appellant that the court cannot hear a void case.

I would say it’s voidable, but I would go further to say it’s a void case.

This case empowers this court and the courts in Tennessee to deal for the first time with this issue of business loans of this kind.

These are loans and this case empowers you to give a clear ruling on this type of contract operating across the business spectrum, medium and small-sized business across our state with a huge book of business, as Flexibility’s debt collector can attest.

So I’m asking for a clear ruling on this. There are many cases out of New York where these people work. There’s a good federal case on this, the Shoot the Moon case which I cite in our petition.

Is this a lawful contract is the question. If it is a lawful contract, then the court has subject matter of jurisdiction in Hamilton County. I contend, having analyzed the contract, that it’s not, that it is a fraudulent contract.

If you look at the name on the front page of the contract which is 14 pages – it’s in the record – it’s called a “future receivable sale and purchase agreement.” Well that’s fine for 10 pages of type suggesting, as it did to the defendants in the trial court, suggesting that this is an advance purchase of future receivables.

In fact we did argue that that’s — we defended the contract in those terms. But if you look further – Pages 11 through 13 – it is not that. It is a personal guaranty of the owners of the radio station.

I am in the radio business. I do a report every morning for 3 hours with politics, law, religion, and so on. That’s my calling as member of the press.

Judge John W. McClarty Tell us: Who is actually the client that you have that you’re representing on this case?

David Tulis I’m David Tulis. I’m the appellant.

McClarty OK. you’re representing yourself?

Tulis Yes, sir.

McClarty. Yes, sir. OK, then, go ahead.

Tulis The guarantee overwrites the contract in the first part. So the guarantee makes this a loan. It is not an advance purchase of future receivables. And in fact, we were so confused in this litigation we, as I said, we defended that, that the lender accepts that our business has gone down in the CV-19 state of emergency. We were effectively put out of business. The contract indicates that these people will wait for us to get back on our feet.

So, in fact, in the hearing in the court, we argued for a Rule 8 sanctions against Mary Cheadle for calling it a loan because it’s not a loan. We said this is – this is not a loan and we said she needs to be sanctioned. And the judge denied that.

The case Jenkins vs Dugger gives the four essential elements of usury. There’s a loan or forbearance. There’s an absolute requirement to repay – that’s an essential element. And third, if it violates a statutory limit. And there’s also mens rea — intent.

Now the statutory limit is at 47-14-103 and the limit on loan requirements of a debtor is 10 percent.

This case, you could say is void, and the litigation is void because there’s no meeting of the minds on the agreement. Here we are, two sides missing, each arguing opposite of each other. And in the course of the case in circuit we effectively change positions – still on the opposite sides. So where is the meeting of the minds? How can there be an enforceable contract if the parties simply don’t understand what it’s all about? Is it a sale of future receivables that you’re looking at in the papers? Or is it a loan?

The loan hallmarks are in my filings. But these are not points made by Flexibility. Flexibility doesn’t really attempt to defend its contract. But let me just say quickly – just FYI – because I know you want to give a clear writing about about this type of business. Loan recourse powers against — the lender against the debtor — is all the instruments, the equipment of the radio station. There’s a UCC-1 [lein] for all of its assets. On page 8 in paragraph 26, the contract says effectively that Flexibility can run the radio station. So the asset claim range is very broad.

Again, that implies — if you read the CapCall vs. Shoot the Moon case out of Montana, which is a very detailed discussion about this whole type of business, it’s very — that implies, again, a loan in operation, not a true and genuine purchase of advance receivables.

But, also now, the contract has reconciliation provisions which are important to that federal judge. Also, adjustment features where the rate of payment can go up or down. Well, those look good.

But we paid $164 a day every weekday, taken out of our account and then when the economy crashed at the hand of the governor the last payments were for more money than we had. So, again that’s not — if you’re buying receivables you’re buying, you know, a $100 check from a small business, a $500 check from a bigger business — and you get that portion.

Well, here, we have payments that are drawn out from the account regularly as loan payments. The treatment is of a loan. Flexibility has been silent about these details and I would say has waived them.

But I would ask you to look at them because I’m hoping for a clear – a clear analysis in Tennessee on on this type of transaction, and so points a way there.

There are on the very first page of the complaint, your honor, an admission against interest— meaning it’s a highly credible admission. And it’s two quotes.

➤ “The plaintiff loaned defendants money; defendants failed to pay the money back.” OK, here we have the people who are extending the blessings of this credit calling it loan.

➤ The second quote on also Page 1: “This is a straightforward collection case to recover the balance due on a loan.”

Well, I mean maybe all these words are needless. But that is an admission by Flexibility of what its business is all about. And the rate of interest? Just guess: 208.05 percent.

If it’s a loan, that’s how much the interest rate is. If it’s not a loan, of course, you don’t calculate the payment — the repayment — in terms of percentage because if the business ebbs and flows, the repayment varies and it might take an unclear – there’s an unclear terminus as to when the obligation is finally met. But if it is a loan, that’s the rate of interest.

Does the court in circuit, Hamilton County, have subject matter of jurisdiction? The answer is no. That’s because this is unenforceable.

It’s an unenforceable claim that violates our law and also it violates New York law with a 25 percent limit on loans and it’s a felony to do it in New York. I haven’t seen any felony cases filed, but here it’s a misdemeanor to knowingly do this. It’s a felony there and in the litigation we put Flexibility on notice. We put the law firm on notice — “Hey this is a criminal activity.” These are, you know, these are, “You’re reaching to Rule 8 again — watch out.”

Mary Cheadle after using only a third of her alloted time to trying to defeat my claims against her client, Flexibility Capital. (Photo David Tulis)

The circuit court says yes it has subject matter jurisdiction despite pleas that are not untimely. When you challenge subject matter jurisdiction, it’s never, it’s not untimely.

Is it timely? Well the judge said, “This is an untimely challenge. I’ve ruled as I’ve ruled. Y’know, what I’ve written, I have written. Just appeal it.”

He failed in the job of deciding when it’s properly raised. And there we were at that hearing — a document in the record was submitted in detail and that same day and I turned to the Flexibility representative, “please defend subject matter jurisdiction.”

Flexibility did not. And the judge did not say, “Well, ma’am, you have the floor; now how is it I have jurisdiction, given these claims orally made about the nature of the contract?”

Circuit has authority to enforce contracts in TCA 16-11-115. Of course these have to be lawful. They have to be — they have to be honorable.

And the Circuit Court says it can enforce — and it has enforced against me — a 208.05 percent interest rate. It says also that “I’m not bound by TCA 47-14-103 and the 10 percent limit. I’m not bound by that. Flexibility does not have to defend subject matter of jurisdiction when challenged.”

There is no subject matter jurisdiction that’s untimely. That’s Redwing vs. Catholic Bishop case — is the leading case on that point.

Standing. Flexibility has no standing. You can’t you can’t come in with dirty hands. You can’t come in with red ink on the equity side. It’s coming into this case with negative equity and has no harm for which relief can be granted. It has no harm — and it can’t show any harm.

Other stories on Flexibility Capital fight

So that’s why — that’s why I suggest that this is a void case. You may say, “Well it’s void. It’s not, we won’t go that far. It’s not not void, it’s just voidable. But circuit had a duty to decide it when it was raised. It had a duty for yet another hearing; that was my right to have that done there and not to have to come here.

Though in God’s Providence I would say I’m glad I’m here. I’m very glad to be here despite being abused and injured by this loan shark. Fraud of the court is done by the lawyer and by Flexibility to bring this on and to persist in it. A fraud of the court.

This is a Rule 10 violation by the court. He had to rule on subject matter jurisdiction. Rule 2.7. The denial of my petition was illicit. He’s OK’d a criminal contract. He accepts the fraud in the court by the plaintiff. And he’s denying the statute.

So these are not just harms to me. This is a harm to our judicial process in Tennessee. This case should never have come here — ever. I reserve my time — two minutes.

Thank you.

Investigative journalist v. debt collector lawyer