The five members of the Tennessee supreme court deflect a demand that they stop imposing a F$550 privilege tax on an appellant not exercising the privilege of licensed attorney. (Photo administrator of the courts)

Jay Hirsch, left, files in the supreme court an emergency petition targeting the court’s pernicious justice for sale price set at F$550 per appeal with no blue light specials available. With him are Christopher Sapp, midstate bureau chief for NoogaRadio Network; and truck driver Michael James, a pro se litigant. (Photo David Tulis)

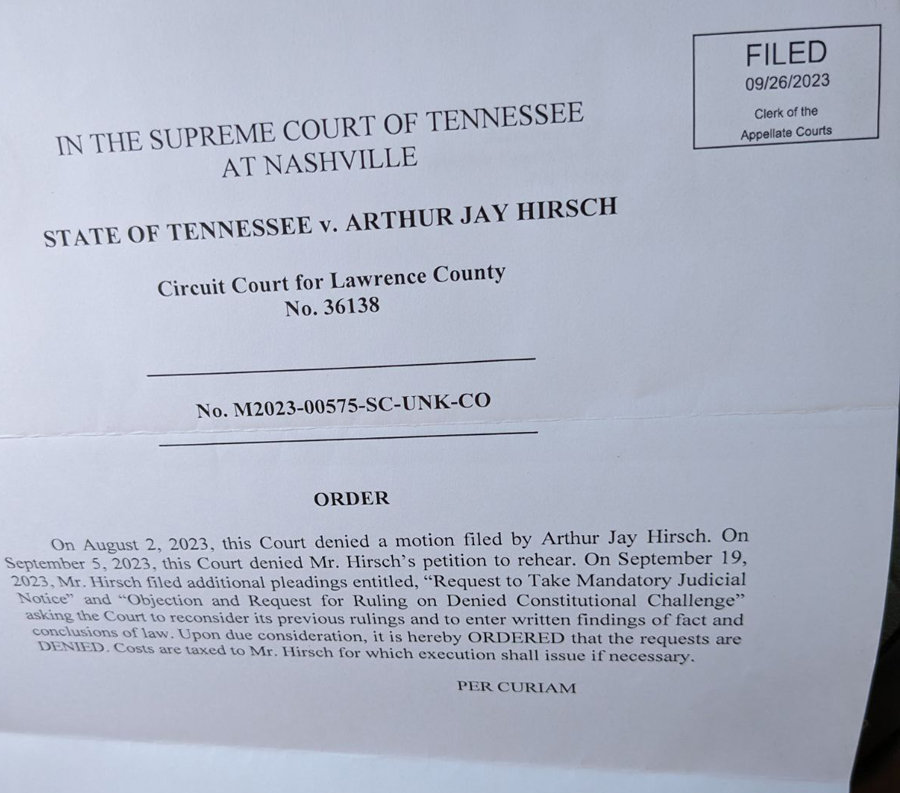

CHATTANOOGA, Tenn., Saturday, Sept. 30, 2023 — The Tennessee supreme court is refusing to consider a legal challenge to its off-the-books internal privilege tax that it applies upon nonlawyer appellants seeking review of their cases.

By David Tulis / NoogaRadio Network

The F$550 litigation privilege tax due in seven days to get a hearing by right in a criminal case applies to attorneys who exercise the privilege of being able to do business in courtrooms. The halls of justice are public property and unavailable for use in anyone’s private business. But the court gives permission to use the courtrooms by extending the privilege that is the armature of an attorney’s profession, his law license, and also demanding lawyer privilege taxes payable in every action.

But Arthur Jay Hirsch is not an attorney. He is a private tradesman, a 73-year-old bachelor and legal scholar known as “Fiddle Man of Lawrence County” for his gospel tunes in jails and nursing homes. He is petitioning to overturn a conviction in a suspended driver license case. He is unwilling to submit to the hefty, up-front litigation privilege tax demanded from the court of criminal appeals in Nashville, the invoice marked in bright red letters as due in seven days under threat of dismissal of the case.

“The supreme court denied my mandatory judicial notice,” Mr. Hirsch says. “They won’t take notice. *** I asked for a ruling on my constitutional challenge.That was in the title of the caption of my document. That was in there. They said they’ve already given a ruling. That’s a lie.They never gave me a ruling.

This dismissal order lets the supreme court keep running a tax scheme against the public without the court making a legal defense for it via a public-facing opinion. (Photo Arthur Jay Hirsch)

“They said they denied my request for a rehearing. I never had a hearing set with them. So it’s all lies. So they said, ‘Upon due consideration, both of his last filings are denied per curiam.’ Not one time have they addressed the challenge to the rule, nor the unconstitutional misapplication” of a tax on nonlawyers. “Not once. Not a word. Not in the trial court. Not in the appellate court, not in the supreme court. I made it real clear to the supreme court that the premier issue is the right that we have to the administration of justice without sale. And this tax. Oh, and they threatened me, and they said Mr.Hirsch has to pay the tax which will be executed or enforced; it’s a threat. Pay up or else.”

Key in Mr. Hirsch’s demand for relief as an impoverished appellant unwilling to petition for writ in forma pauperis, is a 1976 supreme court ruling. After stating that a chancery court cannot rule on the validity of a supreme court rule, the court says that there is always a remedy to challenge any rule “deemed to be arbitrary, illegal or improvident.”

This Court welcomes the continuing criticisms of its Rules. They never become final, and are always subject to change. We solicit advice and suggestions from the Bench and Bar for their improvement. When any individual deems any Rule of Court to be objectionable from any standpoint, it is his privilege to petition the Court for its elimination or modification. Indeed, it is the duty of the solicitors at the Bar of this Court to make suggestions and recommendations on the orderly administration of the appellate judicial process.

Barger v. Brock, 535 S.W.2d 337, 342 (Tenn. 1976)

Mr. Hirsch says the privilege tax is double taxation and violates the Tennessee constitution which guarantees that justice is administered without “sale, denial or delay” (Tenn. const. art. I § 17).

All legal authorities cited by Mr. Hirsch in his petition documents are rejected by the court, Mr. Hirsch says in a release. “That is, both the state and federal constitutions, the Tennessee rules of evidence, state statutes and controlling Tennessee and federal court decisions. Mr. Hirsch says he’ll appeal to the U.S. Supreme Court for justice. “The rule of law is no more.”

On Sept. 27, Mr. Hirsch says, the court of criminal appeals dismissed his case for nonpayment. “We’ve been so nice to you,” he says, paraphrasing the order, “‘We’ve given you all this time to pay the F$550, and we’ve extended it. We know you are pro se, and you gonna have to pay. We’re dismissing your case.’ So it’s over. Goodbye.” Mr. Hirsch says the lower court’s acting first pre-empted the supreme court.

The 6-year-old case Mr. Hirsch is appealing is in defense of his right to communicate and travel by car, with the local courts refusing to consider a detailed memo by attorney general lawyer Janet Kleinfelter that no records exist in Tennessee that Mr. Hirsch applied for a driver license, though the charge was that he was “driving on suspended.”

Says Mr. Hirsch’s fellow NoogaRadio Network correspondent, Christopher Sapp, midstate bureau chief:

Jay has them by the balls and they know it. Their most recent denial is more evidence that justice has fallen in the streets and that we are no longer under the rule of law but rather the whim and caprice of man. The drumbeats of civil war grow louder in my ears with each passing day.

What would you expect? It is a corporate court having no lawful authority with regard to the People, and no respect whatsoever for the Constitution they authored, to restrain such activity.