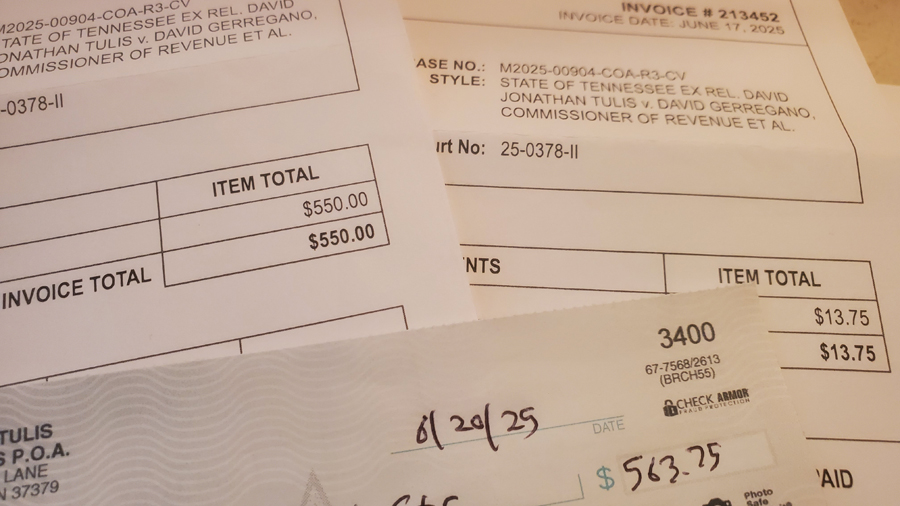

My three court cases to overthrow the “Eye of Sauron,” making the roads unsafe in Tennessee because the program turns cops, deputies and troopers into brigands making false arrests and filing false criminal charges for “no insurance.” (Photo David Tulis)

I’ve just put a check for F$563.75 into the mail to pay for the appeals court judges to hear my claims of mass fraud by two state commissioners. (Photo David Tulis)

CHATTANOOGA, Tenn., Saturday, June 21 — On Friday I submitted by email to Christine Lapps, the deputy commissioner of revenue, a motion for reconsideration of final order that will be denied and let me appeal the case into court.

Christine Lapps

It is certain that she will not read this 22-page motion and the appendices because these people have had enough of honest discussion about the law at T.C.A. 55-12-101 and -201 and are not interested in what it says to condemn what this Tennessee department is doing with the approval of Gov. Bill Lee, a Republican.

I appeal everything, and can endure in litigation despite denial of every motion and every filing, which is the story of this case, Tulis v. DOR, docket no. 23-004.

The level of legal conniving, artifice, flumdiddlery and fraud is staggering. I have built a terrific base of evidence of David Gerregano’s deceiving the public on behalf of hidden interests, most certainly that of the insurance industry.

As I note near the end of the petition, which summarizes the department’s position:

The commissioner annually reports to the general assembly convictions under TFRL, 40,832 per year over eight years, or 77,748 convictions since petitioner filed for contested case July 26, 2023, 695 days ago, this report evidence of the effect of respondent’s interpretation of TFRL and Atwood, described on its website: “The James Lee Atwood Jr. Law (also referred to as the electronic insurance verification program) imposes insurance requirements on motor vehicles operated on Tennessee roads” (emphasis added), which Atwood amendment states, “Nothing in this part shall alter the existing financial responsibility requirements in this chapter” T.C.A. § 55-12-214. Financial responsibility requirements unaffected (emphasis added); hence, the 77,748 convictions among the poor are valid and lawful use of police power and not evidence of harm or official misconduct, extortion or official oppression, as alleged.

Mrs. Lapps says the word certified is not defined in the Tennessee financial responsibility law of 1977, hence I can’t make an issue of it. Only certified motor vehicle liability policies are required under the law, and only people under suspension or people who are insured who have a qualifying accident are required to obtain and present the certificate.

Tulis v. DOR – Motion to reconsider final order by agency

The “certificate of insurance” is widely known as the SR-22. But the criminals running this oppression say the SR-22 is irrelevant and insignificant.

In other states, no doubt, the same fraud is run by state revenue departments deliberateliy misreading and imposing policy upon statutes that are designed to affect financial responsibility upon high-risk drivers — people adjudicated as high-risk and requiring a sort of supervision and probation.

The Gnomes of Tennessee had wonderfully joined me in this work of Christian reconciliation and mercey, even though at least one of them makes no profession of faith.

The terrible thing about all this is that the government employees will not abide by the written law, rules and regulations that apply A to government employees BUT not to the people…

Like Humpty Dumpty said: A word means whatever I want it to mean whenever I want it to mean anything; the question is: WHO IS TO BE MASTER?