Left photo, Jason Mumpower is comptroller of the treasury of Tennessee. Right photo, Jonathan Skrmetti, center, is the attorney general, each charged with ferreting out crime and fraud in Tennessee government. (Photos comptroller’s office, AG’s office)

CHATTANOOGA, Tenn., Wednesday, Sept. 25, 2024 — This morning I send a third letter of notice to the Tennessee attorney general, Jonathan Skrmetti, about the oppressive program in the department of revenue. I also send a similar letter to Jason Mumpower, comptroller of the treasury. Here’s the second — selling my findings of law and fact, trying to get a nibble, so that authorities will shut the program down tonight.

***

Dear Mr. Mumpower, the department of revenue is targeting poor people for seizure of their cars alongside the road and for criminal prosecution, in violation of their federal rights of travel and communication, in violation of their state rights to due process, in abusive use of the state’s surveillance apparatus for the Tennessee financial responsibility law of 1977.

In a recent five-year period, according to the Tennessee department of revenue (“DOR”), the state obtained 408,821 criminal convictions of people for “driving without insurance.” A vast majority of these prosecutions are under illegal policy that violates state and federal law.

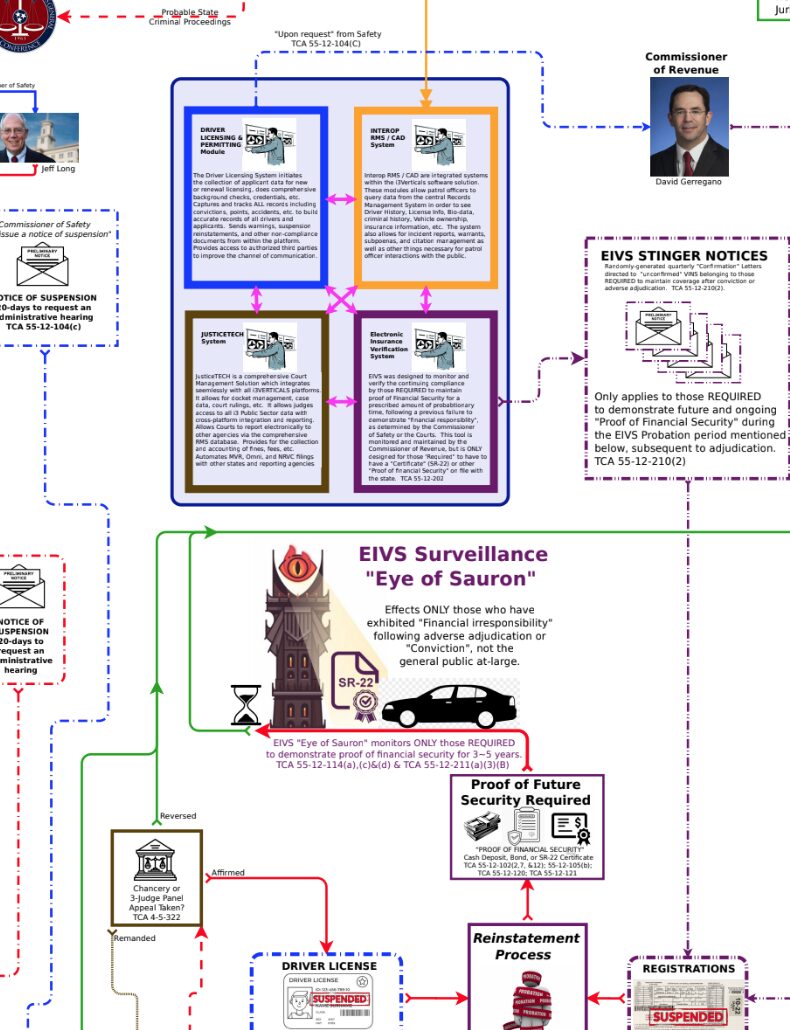

The law under which the department of revenue presumably operates is Tenn. code ann. 55-12-201 et seq, the so-called Atwood amendment. This law was passed in 2015 and went into effect Jan. 1, 2017. It created a data mining utility called EIVS, the electronic insurance verification system. The law lets EIVS surveil insurance customer data and revoke tags of only a small group of people. The breach of law occurs when EIVS targets every non-customer of the insurance industry for notice and revocation.

QUICK TAKE —————

➤ Law requires ‘watchdogs’ to hound crimes within the government first

➤ The TFRL shakedown is second only to the Covid-19 fraud of 2020, 878 days in court, with the AG defending policy deaths

The TFRL and Atwood require the department to surveil only people who are under suspension of their driver license or motor vehicle registration. The financial responsibility law requires this group of high-risk drivers to maintain proof of financial responsibility (“POFR”). They are under agreement to do so. They have had a driving violation such as DUI. They failed to show responsibility after a qualifying accident per T.C.A. §55-12-104. They are under court judgment or conviction. These people, seeking to keep the driving and operating privilege, agree with the Tennessee Department of Safety and Homeland Security and the department of revenue to maintain proof of financial responsibility for 3 years to 5 years, depending on the term of the suspension.

This group alone is under “mandatory insurance.” The law requires POFR only from suspendees using the privilege conditionally.

My investigation and contested case show that in violation of state law the entire populace is made subject to a mandatory insurance requirement.

I am an investigative reporter with Copperhead Radio Network and I run a law and economics blog focusing on traffic stop abuse, particularly as it injures the working poor. My two sites are DavidTulis.substack.com and TNtrafficticket.us. I’ve been a radio station owner, analyst, commentator and reporter 13 years. I worked 24 years as a copy editor at the Chattanooga Times Free Press with a bachelor’s degree in English from the University of Virginia and a master’s degree in English from the University of Tennessee.

To obtain standing to sue, I let a State Farm insurance policy on a 2000 Honda Odyssey minivan lapse March 2023. Department of revenue revoked the tag July 26, 2023. For the past 14 months I have been in a contested case in agency to overthrow the “Eye of Sauron” surveillance tower scouring the motoring landscape.

Twice already I’ve sent detailed letters to AG Mr. Skrmetti and to Mr. Mumpower. I am demanding the comptroller’s office look into the doings in department of revenue in the public interest.

The insurance industry has captured the department —and seemingly the whole of Tennessee government — and runs a shakedown of the traveling and motoring public. State government has a financial motive in allowing this fraud to persist.

The state gets 2½ percent tax skim from motor vehicle insurance premiums. T.C.A. § 56-4-205. If motor vehicle premiums in 2022 are $2.67 billion ($2,677,063,051), as DOR reports, that’s $66.92 million in tax revenues for state government at 2½ percent. If half of these premiums are fruit of extortion and not voluntary, fraud in 2022 generates $33.473 million for the state.

The Tulis v. DOR case is about an industry-backed rogue government program under color of law that is an oppression upon the people of Tennessee, including petitioner. EIVS’ Eye of Sauron applies only to high-risk drivers with certified SR-22 motor vehicle liability insurance policies per § 55-13-122(c)ff. The law applies to about 3,000 high-risk drivers, not upon the more than 1 million uninsured (poor) drivers among the owners of 6.34 million registered motor vehicles in Tennessee. DOR uses the U.S. mails to send out 12,000 dunning notices a week.

In the past five years insurance companies charged $12.511 billion in premiums, DOR says. The state collected $312.78 million in tax on those premiums. If half of the premiums are extorted, the “free money” collected from insurers is $156.39 million in payments to the state under color of taxation.

I have put more than 700 hours in researching this shakedown in court. Just this week I filed my findings with the administrative hearing officer, Brad Buchanan, head of department AHOs. My pleadings are conclusive as to the violation of state law. Tennessee DOR is running an extortion racket generating guaranteed receipts for insurance companies and bringing police and court abuse of the poor who can’t pay. The poor are criminally charged, lose their cars to roadside seizure by towing companies and police/sheriff’s departments, and suffer indignity and harm. Poor people have no choice but to drive and operate their cars to make their livings; they face further arrest threat in use of the roads with tags revoked.

Mr. Mumpower, the program is extraordinary. It violates 28 provisions of law under color of the Tennessee financial responsibility law of 1977 and its 2015 Atwood amendment. The documents attached evidencing my allegations as a matter of law are:

1. Motion for summary judgment. For starters I recommend your review start with the summary, p. 10, and the relief demanded section, p. 136, that states what department of revenue should be doing.

2. My brief on abrogated laws in support of motion for summary judgment — DOR’s shakedown abrogates 28 provisions of state law

3. A flowchart showing how the law is supposed to work. Sent in a separate email.

4. Proposed order applying the law to the EIVS system.

I urge the comptroller’s office to intervene administratively, by moral persuasion and by recitation of administrative law and criminal statutes.

By email, please confirm your ofice has received this notice, and that the four attachments came through.

Screengrab from financial responsibility flow chart