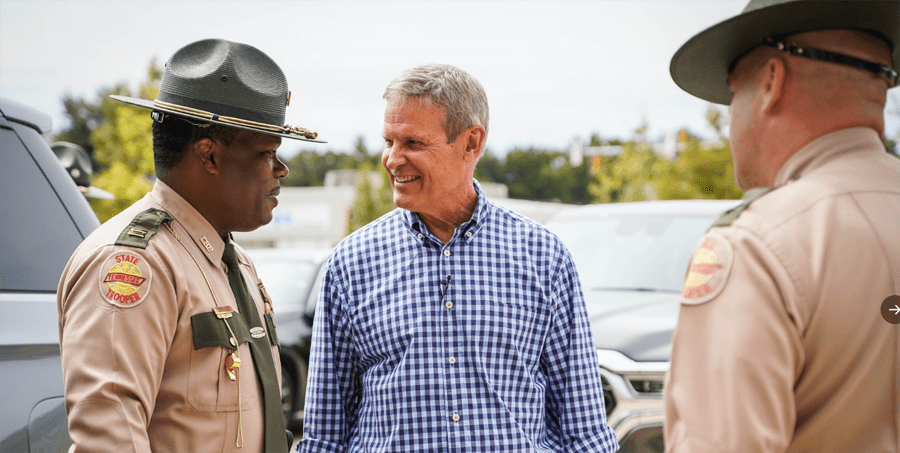

Hamilton County sheriff’s deputies and state troopers block a road in Hamilton County. Each enforces “mandatory insurance” contrary to clear law at T.C.A. 55-12-101 et seq. (Photo HCSO)

CHATTANOOGA, Tenn., Monday, Aug. 4, 2025 — My complaint filed July 21, 2025, in Hamilton County chancery court explains in short order why “universal mandatory auto insurance” in Tennessee is part of a state official-approved and ordained shakedown and extortion racket serving insurance companies. What follows is the first half of my complaint for judicial review of a two-year case fought in department of revenue over its “Eye of Sauron” program, or EIVS, electronic insurance verification system.

Under color of that system, DOR serves up F$2 billion in free premiums annually to inurance companies licensed in Tennessee. It doesn’t mind that people have a right to contract, or to not contract, nor that poor people are not able to afford what to them is a luxury, insurance coverage for their autos or vehicles. Annually, 40,832 poor people are convicted for “no insurance.”

My lawsuit zooms in on the operating mechanism, the certified motor vehicle liability policy. The short of the oppression is this: The department forces people to buy insurance they can’t afford to obtain policies that are legally insuficient to be evidence or proof of financial responsibility.

****

The Tennessee department of revenue is party to a fraud upon the public and a system of oppression petitioner targets in a bid to restore a revoked motor vehicle registration tag. His goal in this suit is an order commanding return of the privilege, and a halt to misuse of the Tennessee Financial Responsibility Law of 1977 (§ 55–12–101 to § 55–12–142), or Part 1, and Insurance Verification Program (“James Lee Atwood JR. Law”) (§ 55–12–201 to § 55–12–215), or Part 2.

The department (“DOR” or “revenue”) operates a universal mandatory insurance program upon all motor vehicle registrants on grounds that T.C.A. § 55-12-139 creates such a scheme, and that T.C.A. § 55-12-210 commands the commissioner of revenue to mail revocation inquiries and notices to any registrant who doesn’t purchase auto insurance.

Its theory is that every registrant must continually be able to show proof of financial responsibility (“POFR”), or evidence of POFR, and that it is proper to use the electronic insurance verification system (“EIVS”) created by the Atwood amendment to match insurance company data and to apply state police power to revoke the registration tag of the noncompliant.

The question for the court is whom is liable to have evidence or proof of financial responsibility at all times while using the roads thrown open for public use? Respondent says 100 percent of registrants are liable under the law. Respondent’s administration disregards the statute’s limiting language and utilizes EIVS to indiscriminately surveil and penalize citizens not subject to the statute. This is not a filtering error; it is a foundational legal defect.

The record of proceedings in agency shows shows the extent of the departure from law, and degenerate zeal over two years in rationalizing that departure.

In a nutshell ——————

➤ The scam runs under color of the financial responsibility law of 1977

➤ Only people in qualifying accidents or with suspended licenses must show proof

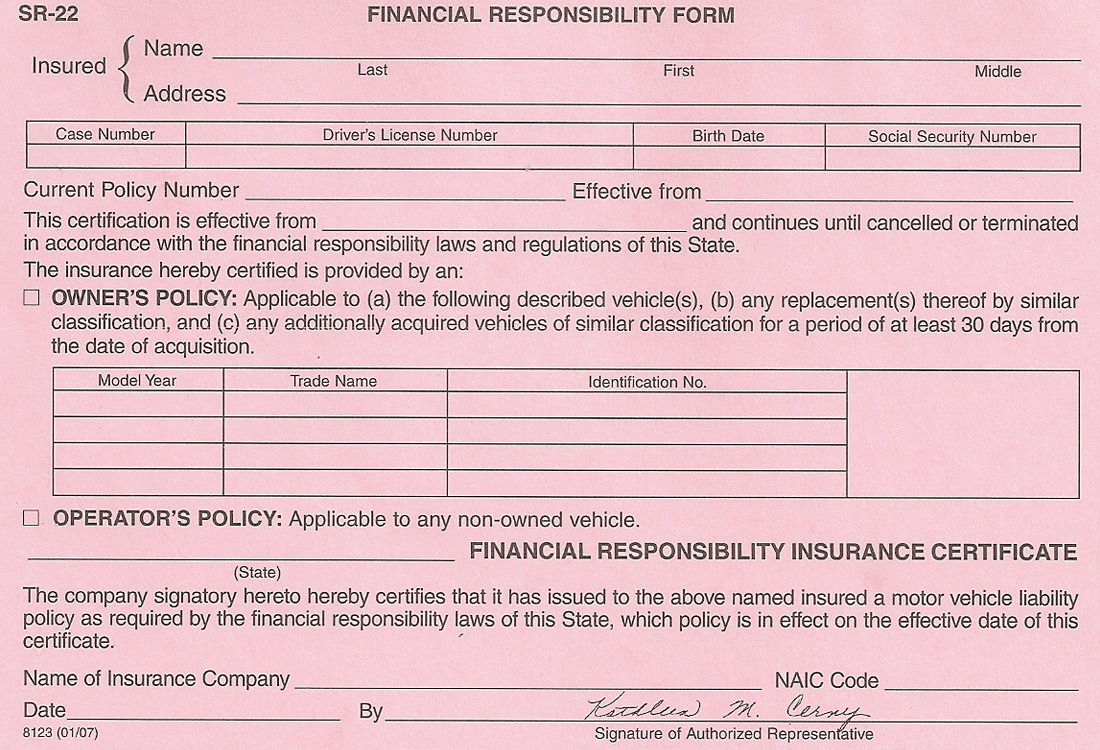

➤ The certiiciate required to be obtained to secure validity of the insurance is the SR-22

An individual in either of two groups has to show POFR and bear the duty of producing the certificate as “evidence” or “proof” of financial responsibility. (1) An individual in a qualifying accident, T.C.A. § 55-12-104, or, (2) a person under suspension for violation of rules of the road, conviction or adjudication or a finding by department of safety that he (or she) is financially irresponsible and requires supervision under administrative probation “for as long as the suspension shall last,” T.C.A. §§ 55-12-114 and -116, up to five years.

Two issues are dispositive in this controversy: The hearing officer’s subject matter jurisdiction and the certification requirement for the type of auto insurance subject to law:

Respondent’s lack of authority to hold hearings under TFRL. This case arises from litigation in DOR under color of TFRL. Respondent claims authority to conduct hearings under the state tax code. The financial responsibility law says hearings are held in department of safety. T.C.A. § 55-12-103.

The role of certification of insurance policies. Certification makes an auto insurance policy proof or evidence of financial responsibility. Without certification, no paperwork passes legal muster as proof or evidence. Certification is part of the definition of “motor vehicle liability policy,” the name of the policy a subject person must obtain to comply with the law in exercise of the privilege. T.C.A. § 55-12-102(7).

2 ROUTES INTO TFRL – WRECK, SUSPENSION

TFRL creates the duty of obtaining evidence or proof of financial responsibility. Law gives four ways to show POFR. “The following, and only the following, shall be acceptable proof of financial security. (1) Filing of written proof of insurance coverage with the commissioner [of safety] on forms approved by the commissioner;” (2) a cash deposit with DOSHS commissioner “in the total amount of all damages suffered”; (3) execution and filing of a bond with the commissioner of safety vouching for “the total amount of all damages suffered” and (4) “submission to the commissioner [of safety] of notarized releases executed by all parties” in a qualifying accident. T.C.A. § 55-12-105.

DOSHS approves for “written proof” the industry standard SR-22 form. The SR-22 proves or gives evidence that an insured in a qualifying accident had insurance coverage at the time of the accident. For a person under suspension, the SR-22 shows the licensee enjoys the driving and operating privilege on condition of having a current and active motor vehicle liability policy as defined in T.C.A § 55-12-103(7), with the certificate constituting the acceptable proof.

Is every licensee, or every registrant with a motor vehicle tag, required at all time to have an operator’s or owner’s insurance policy connected to a vehicle identification number (“VIN”)? Did the general assembly, in adding T.C.A. § 55-12-139 in 2002, actually make a full rewrite of the law to convert an after-accident, voluntary-insurance first-bite-at-the-apple financial responsibility statute into one that makes proof of financial security (or responsibility) a condition precedent to registration?

To both questions respondent says, “Yes.”

The record shows respondent’s program premised on T.C.A. § 55-12-139 is rogue. It creates duties with which it is impossible for petitioner to comply. It abrogates 28 provisions of law. It violates petitioner’s numerous protected rights.

DOR admits an illegal and unconstitutional purpose not part of the general assembly’s intent: That the law is intended to ban the poor from the road (Initial order p. 31). The effect of the program is just that: Criminally prosecute the poor who cannot afford a cash payment to Mr. Gerregano’s department or who cannot afford to become customers of State Farm or other for-profit corporations.

In the 706 days DOR had this case, state courts convicted 78,979 souls of “driving without insurance,” making them customers and clients of the court system.

The shakedown requires people to buy insurance they cannot afford to obtain policies that are legally insufficient.

Gov. Bill Lee speaks with state troopers. Gov. Lee refuses to order troopers or LEAs to comply with the financial responsibility law that requires proof of financial responsibility after a qualifying accident or among people with suspended licenses. (Photo governor’s office)

Overview of case

The program creates two evil consequences for which petitioner seeks redress.

DENIAL OF DUE PROCESS

DOR puts petitioner in a position where he is denied the right of appeal. His case in agency is a nullity and void because the hearing officer has no subject matter jurisdiction under T.C.A. § 55-12-103.

The purported requirement that he obtain “adequate” insurance does not make him qualified to be able to show an officer or EIVS proof of a financial responsibility. Any paper, billfold card, policy page or other insurer document not certified as a motor vehicle liability policy cannot meet the POFR requirement.

It is a denial of due process to be subject to extortion — a threat of harm imposed (revocation, with criminal prosecution certain) if petitioner refuses to perform a certain act (buy insurance product).

STATUTORY CONSTRUCTION RULES VIOLATION

The court is being asked to read the law, say what it means and describe what the department of revenue is required to do, and what it is forbidden to do under Parts 1 and 2. There are no disputed material facts in this contest. The 2000 Honda Odyssey minivan is owned by petitioner and he has no insurance policy connected with the machine.

The department will be asking the court to uphold its revocation and the challenged program. It will cite public safety, legislative history, and claim its operation is independent and parallel to the program described in the law as operating under DOSHS. Respondent upholds an interpretation of T.C.A. § 55-12-139 as imposing a requirement on all registrants of proof of financial responsibility.

Respondent claims the first sentence in T.C.A. § 55-12-139, “(a) This part shall apply to every vehicle subject to the registration and certificate of title provisions,” creates broad new powers and converts a financial responsibility law into a mandatory-insurance- upon-all law, in violation of rule ejusdem generis and duty to construe all provisions of law in pari materia.

The litigation has targeted respondent’s use of EIVS without a filter to discern whom is to receive revocation notices. The department’s insurance monitoring system functions in practice like an all-seeing surveillance tool, targeting citizens in ways inconsistent with the enabling statutes and constitutional restraints.

Most of insurance noncustomers are too poor to secure their investment in their automobiles. They use their limited means for medicines, food, gasoline, rent, car repairs and utilities. They are the most vulnerable Tennesseans who fall victim to respondent.

Respondent claims its program of criminalizing parties who don’t have insurance company contracts, or who can’t pay $65,000 to respondent in lieu of insurance makes the streets safer.

Ordinary hazards of travel claimed 1,314 lives in 2022 and 1,323 in 2023 in Tennessee. Misuse of police power makes life far worse for the public. Men, women and families are targeted by armed officer criminal enforcement authority apart from law. Officers order cars towed out from under their owners. Deputies strand families on the side of the road with their bags of groceries. Crippled by loss of an auto, some police victims face “failure to appear” criminal charges for not showing up for proceedings.

The program adds harm to stressed or preoccupied working class people with fines, penalties, court costs, a blight on their legal records that hinders many from gaining employment. The “Eye of Sauron,” as petitioner calls it, referring to the “Lord of the Rings” literary and Hollywood franchise, makes the streets unsafe. It transforms well-intentioned and honorable law officers into brigands.

For reason of poverty and free choice, petitioner is a former customer of State Farm Insurance. He is an insurance industry noncustomer,.

The record shows that petitioner has thorough knowledge and familiarity with the law in its 54 provisions in Parts 1 and 2. He finds no duty therein upon himself, nor any other member of the innocent traveling public, to produce evidence or POFR.

Registration of a motor vehicle is proof of tax paid for the privilege of using the conveyance as a motor vehicle. T.C.A. § 55-4-101. The injury of being denied the use of his automobile as a motor vehicle is arrest and criminal prosecution for activity that is not privilege taxable activity requiring driver license or registration.

Record shows the commissioner denies a distinction between privilege taxable activity and non-privilege taxable activity. This position is alarming. It’s no different than if the enforcer of tax law says no difference exists between taxpayer and nontaxpayer.

Respondent misconstrues the law, ignores provisions that contradict its policy, decoheres the law and fails to account for 28 abrogations he imposes upon the public, as cited by petitioner in an exacting investigation of the department’s activities.

Brief history of case

Department has steadfastly resisted petitioner’s demands to comply with clear and unambiguous law and immediately cease its oppressive, arbitrary, capricious and constitution-abrogating industry-capture program.

Petitioner received notices April 19, 2023, request for information; May 19, 2023, first notice; June 21, 2023, final notice; and July 21, 2023, vehicle registration suspension notice.

Petitioner filed timely his petition for a contested case with the department circ. July 26, 2023, following correspondence.

***

The last filing in the case is commissioner’s Order denying petitioner’s motion to reconsider final order by agency, July 1, 2025.

Dispositive issues

The record shows respondent’s EIVS operation founders as against clear and unambiguous statute. In the interest of brevity, petitioner focuses on two determinative issues determinative of his claims: (1) denial of due process with no lawful venue for appeal, violating T.C.A. 55-12-103, and (2) rejection of the certification requirement for any insurance policy tendered as proof of financial responsibility, contradicting T.C.A. § 55-12-103(7) and, consequently, other provisions of law.

Respondent lack of authority for hearing; T.C.A. 55-12-103

In a fundamental error and threshold defect, department of revenue’s EIVS revocation program affords no due process for an aggrieved party. The AHO’s bar has no subject matter jurisdiction because the hearing has no statutory authorization.

All hearings under TFRL are heard by commissioner of safety.

(a) Except as otherwise specifically provided, the commissioner [of safety] shall administer and enforce this chapter, may make rules and regulations necessary for its administration, and shall provide for hearings upon request of persons aggrieved by orders or acts of the commissioner under this chapter; provided, that the requests are made within twenty (20) days following the order or act and that failure to make the request within the time specified shall without exception constitute a waiver of the right.

(b) Any person aggrieved by an order or act of the commissioner under this chapter may seek judicial review of the order or act as provided by § 4-5-322.

T.C.A. § 55-12-103

Safety “shall administer and enforce this chapter,” meaning revenue commissioner is order-taker, not order giver. Because safety is the head and revenue the tail in TFRL, hearings are in safety, which operates a financial responsibility division that has all driver records as basis for a licensee being subject to the POFR requirement.

It is not “otherwise specifically provided” that instant case be held under tax law.

Denial of a lawful venue is a violation of due process, indicating a program ultra vires as alleged.

Statutory construction: Policy certification requirement

A person subject to TFRL and Atwood monitoring establishes financial responsibility “on a form approved by the [DOSHS] commissioner” T.C.A. §§ 55-12-137, -210.

A “motor vehicle liability policy” is defined as “certified *** as proof of financial responsibility” T.C.A. § 55-12-102 (emphasis added).

POFR is not universally required. But “when required under this chapter,” it is established by a “certificate of insurance,” sects. 119, 125 and 133.

Suspended parties regain the privilege after wrongdoing. “Proof of financial responsibility may be furnished by filing with the commissioner” the “written certificate” from a carrier “certifying that there is in effect a motor vehicle liability policy,” sect. 120 (emphasis added).

TFRL applies to people, not to any one motor vehicle, as the certificate requirement shows: “This certificate shall give the effective date of the motor vehicle liability policy, which date shall be the same as the effective date of the certificate, and shall designate by explicit description or by appropriate reference all motor vehicles covered thereby,” sect. 120 (emphasis added). A DOR workaround forces each non-certified policy to be connected to a vehicle identification number.

A person from another state under sanction may “give [POFR]” by filing with Tennessee’s safety department “a written certificate or certificates of an insurance carrier” and the commissioner “shall accept the certificate” with condition. Sect. 121 (emphasis added).

A form of the word “certified” appears seven (7) times in sect. 123 to the effect that when an insurer “has certified a motor vehicle liability policy,” the “insurance so certified” cannot be canceled without notice filed with department of safety (emphasis added).

A truck driver, when or as required by the chapter to have evidence of POFR, can get his commercial policy “certified” as proof of financial responsibility, sect. 124.

Key wording “financial responsibility insurance certificate” appears in the provision limiting the time requirement for a suspendee’s duty to have POFR during his probation, saying “a person who is required to provide proof of financial responsibility shall maintain that proof for the period of the revocation or suspension,” sect. 126 (emphasis added).

Safety must hear about a party’s shift from insurance to either of two purported alternatives to POFR and handle return of funds paid to safety or “shall consent to the cancellation of any bond or certificate of insurance,” sect. 133 (emphasis added).

A certificate of insurance is equivalent to a bond. A carrier that “fails or refuses to file *** the certificate or form” with safety may be fined, with proceeds payable to the insured person, sect. 137 (emphasis added).

An applicant for a driver license files with safety a certificate that he “[agree]s to abide by” TFRL when required, sect. 138.

State law divides ordinary insurance from the “certificate of compliance with the Tennessee Financial Responsibility Law of 1977.” At an accident scene, parties “exchange insurance information.” The police report “shall include information pertaining to the insurance policy.” A person subject to POFR is treated differently. There exist regular insureds, then people who are required to show POFR. “If a person has a certificate of compliance with the Tennessee Financial Responsibility Law of 1977, compiled in chapter 12 of this title, issued by the commissioner of safety, a copy of the certificate shall be included in the report” T.C.A. § 55-10-108 (emphasis added).

A party subject to POFR has a policy the lapsing of which (for nonpayment) makes that person “eligible for notice” by “automobile liability insurer of record,” sect. 210 (emphasis added).

Insurance companies take part in Part 1 and Part 2 under a “certificate of authority,” sect. 136. The state forces insurance companies to insure suspended tag and license holders “who are in good faith [are] entitled to, but are unable to, procure automobile liability policies through ordinary methods” and who have a right to a “motor vehicle liability policy” that the carrier certifies (emphasis added).

EIVS began operation “upon certification by the commissioner of revenue[.] *** Until such certification occurs,” no police officer is authorized to use EIVS. Sect. 212 (emphasis added).

Atwood creates the EIVS utility to administer TFRL. Its search parameters under Insurance Industry Committee on Motor Vehicle Administration (“IICMVA”) standards are bound by TFRL’s definitions, categories and duties in pari materia.

No authority exists for DOR to run EIVS in a parallel, independent process torn free from the concept of the certified motor vehicle liability policy controlling in Part 1. Court cases as to the merits of relator’s claims describe Tennessee as an after-accident, voluntary insurance, “first bite at the apple”-type financial responsibility state, not a “mandatory insurance” state.

Abrogations of law — sucking chest wound in the law

Respondent lacks authority to use EIVS to generate a list of noncustomers of the insurance industry (called “unconfirmeds”), and to begin enforcement action against their privilege of motor vehicle registration for which they paid annual renewal fees. A database crossmatch with private insurance industry records cannot form the basis of a revocation without a statutory adjudication framework with due process safeguards.

Respondent is counting on the court to pretermit the sucking chest wound it imposes upon the law. Respondent department claims authority from Part 2 to run EIVS without filters in a way making it “independent from” and “parallel to” Part 1, having no need to acknowledge or defend instances of abrogation, incoherence and confusion:

➤ The law grants exceptions, but respondent denies them

➤ The law halts suspension terms, DOR says they are forever

➤ Law says SR-22s are for suspendees or for an insured motorist in a qualifying accident, DOR says effectively SR-22s are for all

➤ Uninsured person in an accident signs release affidavit to comply with law, DOR revokes him

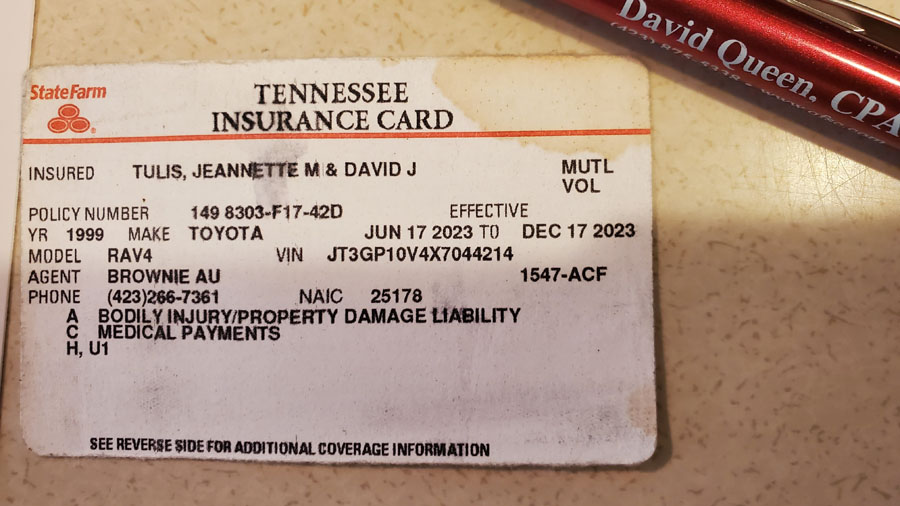

➤ The law says “certified” policy = POFR, DOR says uncertified wallet card = POFR

➤ Law says SR-22s are “eligible for notice” if they don’t keep up premium payments; DOR says insurance noncustomers “eligible”

➤ Law says 100 percent of SR-22s who drop coverage are revoked; DOR says 100% of registrants who lack non-certified policy coverage are revoked

➤ Law says unlawful for DOR to restore tag without DOSHS written approval, DOR says it’s not

Altogether the record traces 28 abrogations of law created by misuse of EIVS that DOR admits.

Harms resulting from respondent acts

CONSTITUTIONAL VIOLATIONS

Respondent program violates nine (9) provisions of the Tennessee constitution.

Tenn. Const. art 11 § 16 BAN ON PRETENDED AUTHORITY

Section 16. The declaration of rights hereto prefixed is declared to be a part of the Constitution of this State, and shall never be violated on any pretense whatever. And to guard against transgression of the high powers we have delegated, we declare that every thing in the bill of rights contained, is excepted out of the General powers of government, and shall forever remain inviolate. [emphasis added]

Respondent commissioner and department deny fundamental rights against rights and privileges with a “pretense” of mandatory auto insurance upon all Tennesseeans in the privilege, using powers “excepted out of” the general powers the people gave to government, which rights “shall forever remain inviolate,” except under respondent arbitrary program.

Tenn. Const. art 1 § 22 NO MONOPOLIES

That perpetuities and monopolies are contrary to the genius of a free State, and shall not be allowed.

Respondent’s EIVS program creates a monopoly serving members of the Tennessee automobile insurance plan. T.C.A. § 55-12-136. Respondent gives racket protection to these companies, and will punish petitioner if he does not do business with the cartel.

Tenn. Const. art 1 § 3 FREE EXERCISE OF RELIGION

No authority can arrest a man or woman who has committed no crime and is imposing no actionable harm upon another for traveling by his personal property on the public road. Respondent use of EIVS violates this provision by acts making travel to church in his 2000 Honda Odyssey minivan illegal.

Tenn. Const. art. 1 § 5 SUFFRAGE

Suffrage implies rights in movement, assembly, and those qualified exercising the privilege of going to the place of balloting. Respondent EIVS program violates this supreme law by prohibiting any use of the public road by petitioner in his automobile to exercise right and privilege political.

Tenn. Const. art. 1 § 7 DUE PROCESS

That the people shall be secure in their persons, houses, papers and possessions, from unreasonable searches and seizures; and that general warrants, whereby an officer may be commanded to search suspected places, without evidence of the fact committed, or to seize any person or persons not named, whose offences are not particularly described and supported by evidence, are dangerous to liberty, and ought not to be granted. [emphasis added]

Right to travel the public road, enjoyment of ingress-egress rights, rights of communication in moving one’s personal or private chattel property as matter of right on the highways, roadways, thoroughfares, lanes and streets anywhere in the state; right to earn a living.

The right to have and use property apart from privilege is constitutionally guaranteed. Phillips v. Lewis, 3 Shannon’s cases 230, 1877. Privilege law is upon acts of commercial nature for private profit and gain affecting the public interest.

The right to contract – or to not contract.. No authority exists for a department or commissioner to criminalize use of the ordinary means of communication of the day, petitioner’s Honda Odyssey minivan, on the public right of way in exercise of individual rights of ingress and egress, and force petitioner into a contract with an insurance company or bonding agency.

Right to a hearing is abrogated in violation of this provision. DOR denies relator a hearing before revocation in violation of his due process rights to a hearing before the axe falls. Beazley v. Armour, 420 F. Supp. 503, 506, 507, 509 (M.D. Tenn. 1976). Except in emergency situations, due process requires that when state seeks to terminate interest such as driver’s license it must afford notice and opportunity for hearing appropriate to the nature of case before termination becomes effective. Bell v. Burson, 402 U.S. 535, 91 S. Ct. 1586, 29 L. Ed. 2d 90 (1971).

Respondent program violates this constitutional provision denying petitioner a hearing, and forcing him into an administrative venue without subject matter jurisdiction, which is conferred by statute alone.

Tenn. Const. art. 1 § 8 PROTECTION OF PRIVILEGES, RIGHTS

That no man shall be taken or imprisoned, or disseized of his freehold, liberties or privileges, or outlawed, or exiled, or in any manner destroyed or deprived of his life, liberty or property, but by the judgment of his peers, or the law of the land. [emphasis added]

Respondent’s program denies a hearing in an authorized venue, and operates an attainder upon petitioner, outlawing him in his personal and private movement in his Honda Odyssey minivan on the public road, violating this section.

Respondent says the SR-22 financial responsibility certificate (photo top) is legally

= equal to =

a billfold card from an insurance company (bottom photo)

Tenn. Const. art 1 § 17 COURTS ARE OPEN

That all courts shall be open; and every man, for an injury done him in his lands, goods, person or reputation, shall have remedy by due course of law, and right and justice administered without sale, denial, or delay. Suits may be brought against the State in such manner and in such courts as the Legislature may by law direct. [emphasis added]

Barring member of the public from using his personally owned 2000 Honda Odyssey minivan prevents compliance with court orders, openness promised of the courts, reachable practically only by motor vehicle or car. Respondent’s void case violates this provision of the constitution.

Tenn. Const. art 1 § 19 PRESS

That the printing press shall be free to every person to examine the proceedings of the Legislature; or of any branch or officer of the government, and no law shall ever be made to restrain the right thereof. The free communication of thoughts and opinions, is one of the invaluable rights of man and every citizen may freely speak, write, and print on any subject, being responsible for the abuse of that liberty. *** [emphasis added]

Respondent denies any private use of the 2000 Honda Odyssey minivan, insisting under rebuttable presumption that all travel by road is commercial, for hire, as employment, in commerce, business or industry, a confusion in which law enforcement agencies (“LEAs”) participate to harass, abuse and injure petitioner and members of the public under attainder, which is outlaw, U.S. Const. art.1 § 9, ¶3 (no bill of attainder shall be passed). Petitioner is a press member whose rights to use the automobile or the motor vehicle are violated by respondent’s EIVS program, breaching constitutional protections of the press.

Tenn. Const. art 1 § 23 FREE ASSEMBLY

That the citizens have a right, in a peaceable manner, to assemble together for their common good, to instruct their representatives, and to apply to those invested with the powers of government for redress of grievances, or other proper purposes, by address or remonstrance. [emphasis added]

Respondent abrogation of private communication by use of motor vehicles or automobiles violates this provision of the constitution securing right of the people to assemble. Petitioner has a fundamental right to use his Honda Odyssey minivan under these protections of communication.

COMMON LAW, STATUTORY VIOLATIONS

Respondent department, its commissioner and its employees join in violation of criminal laws, namely:

T.C.A. § 39-14-112 EXTORTION

T.C.A. § 39-16-402 — OFFICIAL MISCONDUCT

T.C.A. 39-16-403 — OFFICIAL OPPRESSION

[David note: Criminal laws do not create a civil cause of action.]

The program in excess of statutory authority is a degenerate overthrow of lawful government that respects the people and their rights.

The roads belong to the people. “A regulated monopoly in the motor carrier field is not authorized by Chapter 119, Public Acts 1933. The highways of the State belong to the people of the State. Many of these highways have been improved at large cost to the taxpayers. It is the convenience and necessity of the people of the State that must be given predominant consideration by the Commission, and not that of contending motor carriers operating free over these highways. It is within the power of the Commission, in proper cases, to permit several motor carriers to operate over the same route. No one carrier, by virtue of a certificate, obtains a monopoly over the route granted” Dunlap v. Dixie Greyhound Lines, 178 Tenn. 532, 160 S.W.2d 413, 418 (1942) (emphasis added).

“All roads, streets, alleys, and promenades where legally dedicated and thrown open for public travel or use free of charge shall be exempt from taxation” T.C.A. § 67-5-204. Use of the roads, in other words, is “free of charge” not contingent on any insurance contract upon either traveler or motor vehicle operator.

Respondent commissioner denies the roads “thrown open for public travel” are open and useable “free of charge,” being exempt from taxation as physical property owned by the people, and the people’s using them not liable to a tax or fee. Respondents threaten petitioner to pick his poison: He may (1) buy insurance from a state-approved insurance company, (2) pay Mr. Gerregano $65,000 for use of his Honda Odyssey minivan, or (3) be revoked without a hearing or recourse.

These statutory violations are sufficiently alleged in the case record, under administrative notice from the first day of proceedings, circ. July 27, 2023.

Part 2: Demands for halting of program, restitution to abused public

David runs a personal nonprofit fighting and mercy ministry. He thanks you for checks sent directly to c/o 10520 Brickhill Lane, Soddy-Daisy, TN 37379. Also at GiveSendGo.