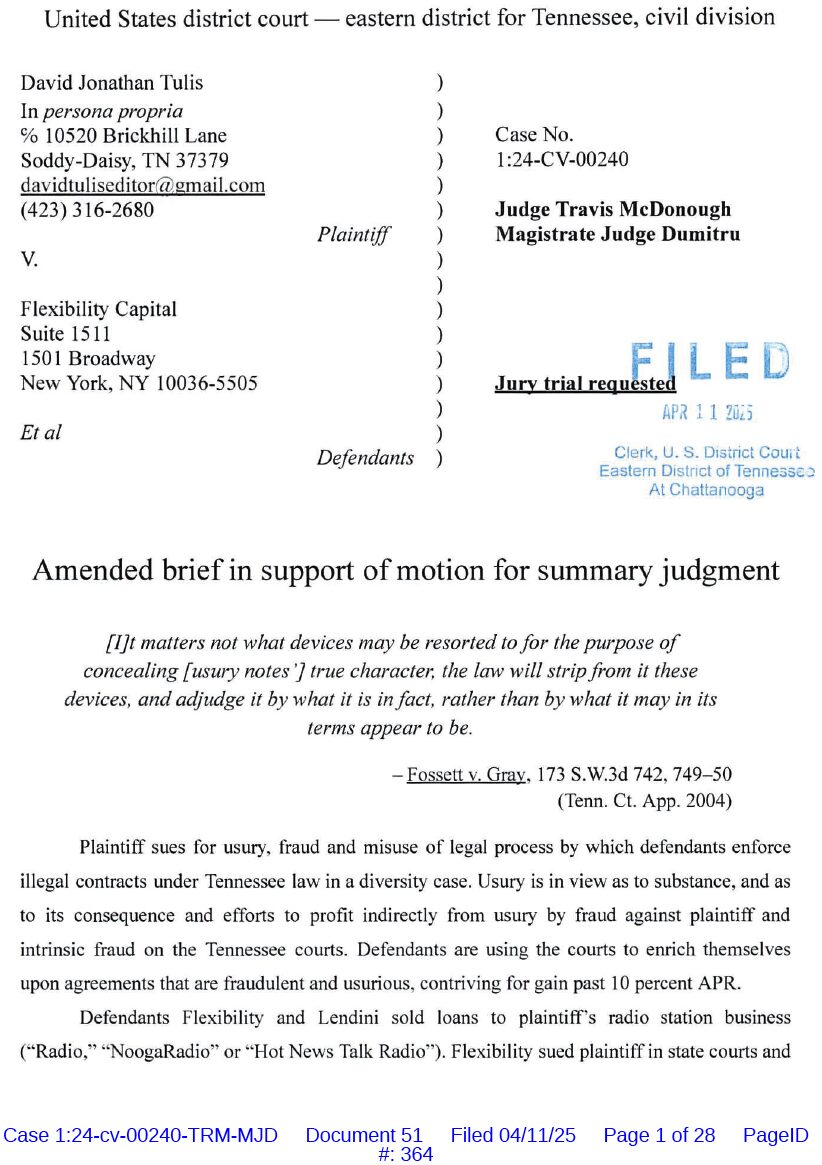

Mary Cheadle of Cheadle Law in Nashville pursues debtors for loan sharks such as Flexibility Capital, as here in Hamilton County circuit court. Representing predatory lenders, she sued me to enforce a fraudulent contract by Flexibility Capital in New York. (Photo David Tulis)

This brief from my federal case against Flexibility capital explains how MCA contracts are fraudulent and usurious personal loans. Link is below.

CHATTANOOGA, Tenn., Monday, July 28, 2025 — What useful basic ideas should you have as you are being sued by an MCA — or merchant cash advance funder — and you’re not sure how to start analyzing your situation.

As someone who has been in state and federal court with high-flying business funders with interest rates up to 593.44 percent APR, I propose that your main defense is that the contract is fraudulent and possibly a violation of your state’s prohibition against usury.

Summary of what to look for

- The contracts are deceptively crafted to appear to be advanced purchases of future receivables

- They are personal loans in disguise. Because you and your business partner inked the “personal guaranty,” the loan is in fact a personal loan to each of you, due from either or both of you. The money passes through to your business, and you pay a set amount daily by automatic withdrawal.

- The transaction is not a purchase of your future receivables at discount, but a loan because it is absolutely repayable by you.

- If it were a true purchase, the repayments would adjust according to cash flow, but you “agree” to a set amount in the application form (aka contract).

- The loans usually have 2 parts, the first being evidences of a purchase of a product called a namely or receipt, but the second part of the loan is the personal guarantee section which makes the loan a loan, the final sum absolutely due to the lender, no matter what distress has afflicted your business.

- The difference between a purchase agreement and a loan agreement is that the lender is receipt of the final amount of money.

- The controlling interest for the court is whether the agreement makes the lender bear market risk or only financial risk. An investor takes market risk in which he might lose all. A lender’s risk is different, doesn’t account for your market.

- Your loan agreement probably had terminology over several paragraphs about how the lender may not get paid back if the market goes down or if your company runs into trouble.

- These statements imply you are off the hook if disaster strikes and you can’t pay. Window dressing, because the personal guaranty controls.

- Contract reconciliation provisions exist to make it appear the lender is buying a product — your receipts — cash flow that has varying availability for “purchase.” These provisions allow you to reduce payments in time of stress, or claw back earlier payments that were too high. Such provisions are complex, unworkable, time-consuming to use and part of the fraud making the loan appear to be an advance purchase of future receivables.

- Fraud is not enforceable in court, and a lawsuit to enforce such a contract is void, not giving the court subject matter jurisdiction. If you challenge subject matter jurisdiction, the rules require the moving party to establish the court’s authority.

In sum: The factoring arrangement is not a real purchase, but a loan absolutely repayable, putting it possibly under your state’s ban on usury or limits on maximum personal loans. Since these loans are sold to businesses, they are not covered by state limits on retail personal loans.

My experience with predatory lenders

A partner and I ran a talk radio station, wrecked by the CV-19 state of emergency in March 2020. Flexibility Capital of New York sued us, and I fought through the court of appeals and was denied a hearing by the Tennessee supreme court. I argued it was a void case ab initio, but state courts upheld the execution of judgment because of late filing of notice of appeal amid flurry of post-judgment motions to reconsider. I was sued by TBF Financial, a bad-debt buyer that had bought a loan issued my radio station by Funding Metrics, aka Lendini, from Bensalem, Pa. I sued these players and others in U.S. district court for usury and fraud. The case was dismissed because of the doctrine of res judicata (already fought) and enforcement of the venue provisions in the Lendini contract that I alleged was fraudulent and unenforceable. Dismissal prevented the suit from airing its merits.

From a brief describing these contracts, Lendini’s in particular.

They indicate they share market risk and that no absolute repayment requirement exists. They explicitly deny they are loans or credit and deny the merchant is paying interest; they indicate the merchant may not have to pay in business failure and create provisions whereby the merchant can cut daily debit payment as receipts fall. By reconciliation provisions they attempt to show themselves risk-sharing co-adventurers in the business, investors, allies and patient co-operators who are buying slices of incoming daily receipts, the agreement to conclude on some unforeseeable date contingent on market circumstances, and not a guaranteed fixed daily loan repayment with a certain terminus.

Brief explaing MCA contract fraud

Amended fraud complaint filed Aug 12, 2024

David runs a personal nonprofit fighting and mercy ministry. He thanks you for checks sent directly to c/o 10520 Brickhill Lane, Soddy-Daisy, TN 37379. Also at GiveSendGo.