Gov. Bill Lee, who practices Christianity, participates in rituals in a foreign religion whose armies carpet bomb innocent civilians as efficiently as Lee stripmines the poor in Chattanooga and across the state via the “Eye of Sauron.” (Photo governor’s office)

CHATTANOOGA, Tenn., Wednesday, May 14, 2025 — Lawyers defending two Gov. Bill Lee commissioners say ending the mass fraud auto insurance fraud under color of the financial responsibility law would have an “adverse effect on the public” partly because it would “prevent effective regulation.”

On Friday Davidson County chancery court judge Anne Martin will hear motions in State ex rel Tulis v. Long et al in which cause a radio journalist is attempting to bring to a halt a 23-year-old fraud launched by the department of safety run by Jeff long. Department of revenue Commissioner David Gerregano got in on the $2 billion a year scam in 2017 with the launch of the EIVS surveillance tower targeting 1 million poor people who are insurance industry noncustomers.

“[T]he Court correctly determined that plaintiff is unlikely to succeed on the merits. Consequently, granting a preliminary injunction enjoining the commissioner from administering [EIVS, or electronic insurance surveillance system] and the financial responsibility laws would have an adverse effect on the public.”

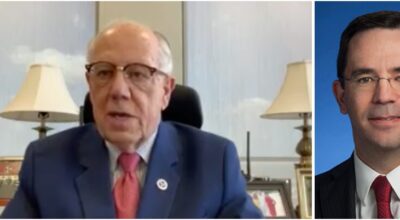

Left photo, Jason Mumpower is comptroller of the treasury. Right photo, Jonathan Skrmetti, center, is the attorney general, each charged with ferreting out crime and fraud in Tennessee government. Neither is willing to stop mass fraud serving insurance companies. (Photo comptroller’s office, AG’s office)

Lawyers from the Attorney General Jonathan Skrmeetti’s office sSay that the “balance of harm already favors the state,” forgetting that I am representing the state and they are representing the rogues in office.

Since the commissioner is likely to succeed on the merits, the balance of harms already favors the State. Furthermore, enjoining the enforcement of a statute is against the public interest because it subverts the democratic process. Cf. Maryland v. King, 567 U.S. 1301, 1303 (2012) (Roberts, C.J., in chambers.) (“[A]ny time a State is enjoined by a court from effectuating statutes enacted by representatives of its people, it suffers a form of irreparable injury.”).

‘Highly legitimate governmental interest’

Most amazing gazoozling of “The Guano” and Mr. Long is the claim that continuation of the program is maintaining the public safety. If it were true that using an automobile without auto Insurance were dangerous, how is it that the law lets people drop insurance once their suspensions are over? How is it DOR gives the uninsured four months to “get right with the law” before revoking them? How is it that the statute itself envisions that most people will not have insurance, as the court cases say.

The law’s central focus is an extraordinary type of insurance called the “motor vehicle liability policy” required of people as condition precedent of reinstatement. The shyster commissioners entirely ignore the particulars, and theorize about the law as if they were obeying it.

The state “has a highly legitimate governmental interest in maintaining, protecting, and regulating the public safety” through its financial responsibility laws. State v. Cosgrove, 439 N.W.2d 119 at 121 (S.D. 1989). The regulation of the operation of motor vehicles, including “legislation affecting the reciprocal rights and duties of all owners, operators or occupants when those rights and duties arise out of such operation,” Manzanares v. Bell, 214 Kan. 589, 601, 522 P.2d 1291, 1302 (1974) (internal citations omitted), constitutes an important state interest.

The state passed after World War II the Tennessee financial responsibility law, using its coercive power upon commerce to bully high risk drivers into having insurance if they want to keep their privilege.

The state has an interest in addressing “the enormous legal, social, and economic problems resulting from motor vehicle accidents” by legislating “compulsory liability and first party insurance coverage as to ensure prompt compensation to accident victims injured in the operation or use of a motor vehicle.” Id. at 601.

‘Harm the public’

DOR figures suggest the fraud generates $2 billion a year of premiums to members of the Tennessee automobile insurance plan. These 250 companies get the free ride thanks to the “Eye of Sauron” op. But they share the risk by having to issue the high risk motor vehicle liability policies that suspended drivers buy so they can regain their licenses.

[E]njoining the commissioner would harm the public because it would inhibit uniform compliance of the financial responsibility laws. “Effective regulation requires comprehensive, uniformly applicable laws. Uniform compliance is indispensable to successful administration and to attainment of an effective level of safety. Thus, the state has a strong interest in assuring mandatory, continuous and uniform compliance.” Bissett v. State, 111 Idaho 865, 868, 727 P.2d 1293, 1296 (Ct. App. 1986). The Atwood Law was enacted to ensure uniform compliance by providing an enforcement mechanism.

I am asking God’s providential care prior to this hearing. The frauds have filed motions to dismiss, and answers to me. I’ve filed motion to reconsider & decertify, motion for interlocutory appeal, motion for mandatory judicial notice.

Princely warfare against principalities & powers

David runs a personal nonprofit fighting and mercy ministry. He thanks you for checks sent directly to c/o 10520 Brickhill Lane, Soddy-Daisy, TN 37379. Also at GiveSendGo.

I am reporter with Eagle Radio Network — marvelously playing rock hits in Chattanooga, and online at https://www.eagleradionetwork.com/