A state trooper is trained to administer tax and safety rules upon the shipping public. (Photo department of safety)

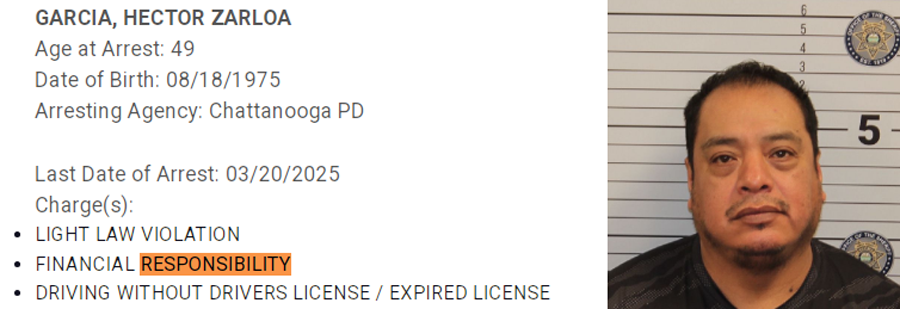

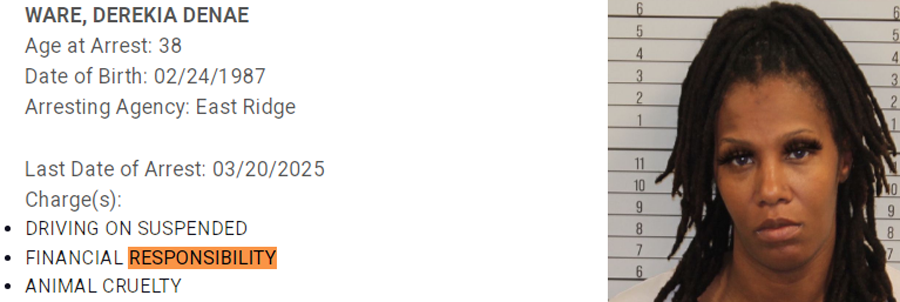

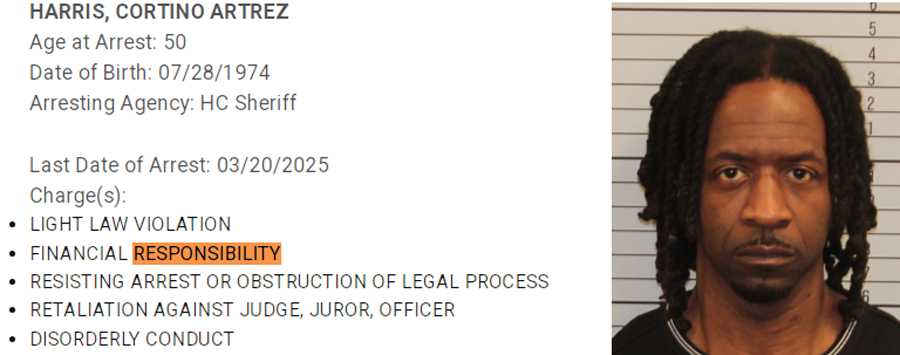

These people are criminally accused of “driving without insurance,” which the financial responsibility law requires only suspendees with conditional licenses with the duty to carry evidence or proof of financial responsibility, which special policy is called a “motor vehicle liability policy” at T.C.A. § 55-12-102. (Photos from Chattanoogan.com)

CHATTANOOGA, Tenn., Friday, March 28, 2025 – A radio journalist suing the commissioner of revenue alleging mandatory auto insurance is a fraud says the state’s “Eye of Sauron” program skims $156.39 million in taxes from illicit premiums.

CHATTANOOGA, Tenn., Friday, March 28, 2025 – A radio journalist suing the commissioner of revenue alleging mandatory auto insurance is a fraud says the state’s “Eye of Sauron” program skims $156.39 million in taxes from illicit premiums.

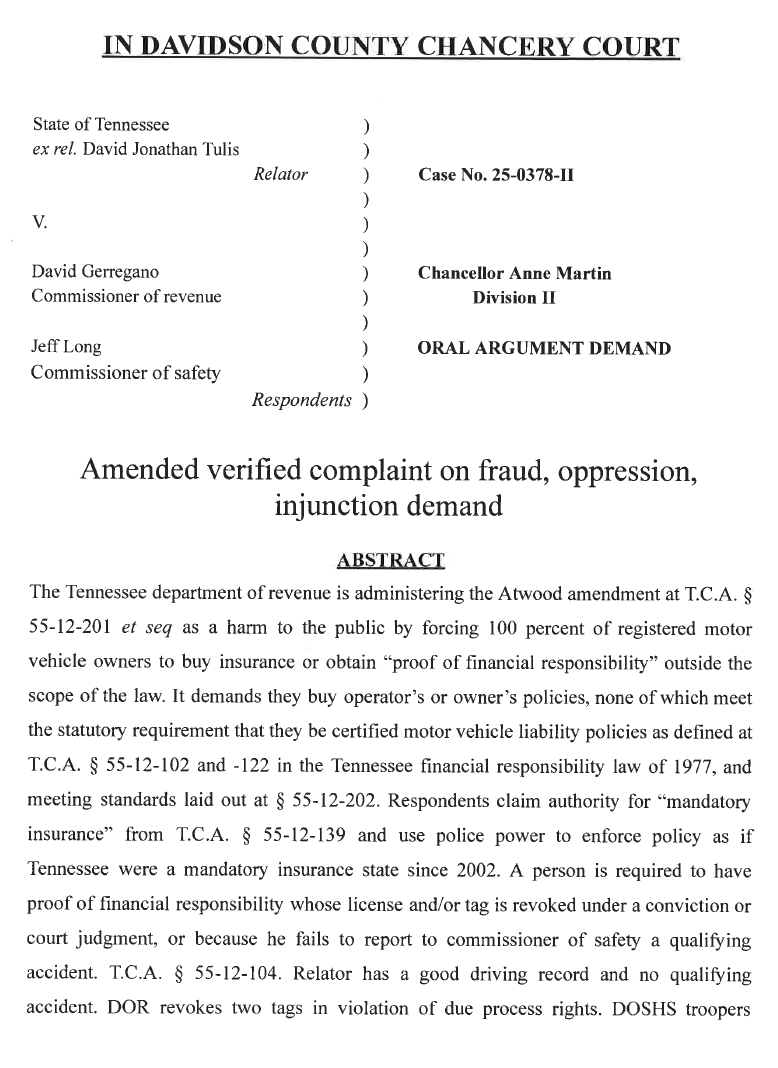

In a filing this week in Davidson County Chancery Court, David Tulis says government “gets 2½ percent tax skim from motor vehicle insurance premiums” as a matter of law.

“If motor vehicle premiums in 2022 are $2.67 billion ($2,677,063,051), as (Department of Revenue) reports,” the Eagle Radio Network reporter tells chancellor Anne Martin, “that’s $66.92 million in tax revenues for state government at 2½ percent. If half of these premiums are fruit of extortion and not voluntary, fraud in 2022 generates $33.473 million for the state.”

His 94-page amended complaint says over five years insurers charged $12.5 billion in premiums, with the state collecting $312.78 million in tax. “If half of the premiums are extorted, the ‘free money’ collected from insurers is $156.39 million in payments to the state under color of taxation.”

The complaint says “well more than half” of the premiums generated by carriers under the Tennessee financial responsibility law of 1977 policy are not free market choices of consumers but “fruit of the poisonous tree,” Tulis says.

In litigation against the commissioner and department since July 2023, Tulis says Tennessee is a “voluntary insurance, after-accident, ‘first bite at the apple’ financial responsibility state, not a mandatory insurance state.”

“That means that the only people who are required to show proof of financial responsibility are those involved in a qualifying accident or people who have suspended licenses on account of a motor vehicle related court judgment in which they are determined to have acted in a financially irresponsible way. This last group is required to have the special SR-22 insurance. It’s called a motor vehicle liability policy.”

He likens the department’s EIVS surveillance system to the “Eye of Sauron” because it revokes tags of poor people who are not insurance industry customers. “The department says its job is to keep the poor off the roads, not the irresponsible,” Tulis said.

Amended complaint State ex rel Tulis

David runs a personal nonprofit fighting and mercy ministry. He thanks you for checks sent directly to c/o 10520 Brickhill Lane, Soddy-Daisy, TN 37379. Also at GiveSendGo.