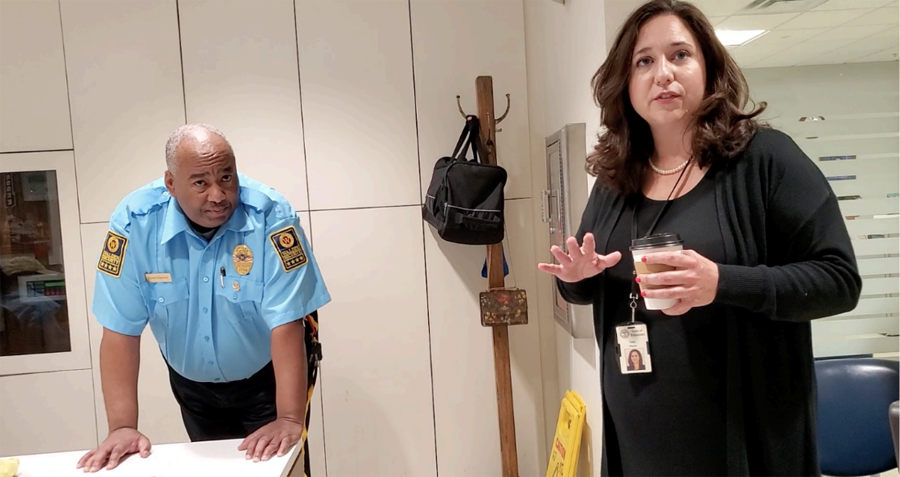

DOR attorney Anne Warner pulls a trick on three visitors entering the revenue department offices for a deposition Tuesday July 9 in Nashville, telling them “security” bans cameras and audio. Had the deposition been at a hotel, she would have no standing to make such claim. (Photo David Tulis)

Chattanooga radio reporter David Tulis, left, is suing Tennessee department of revenue for fraud, with assistance from “The Gnomes,” Christopher Sapp, midstate bureau chief of Sparta, Tenn., center, and unemployed handyman and mechanic Ed Soloe from Alcoa, Tenn. (Photo David Tulis)

NASHVILLE, Tuesday, July 9, 2024 — The revenue department program that scams hundreds of thousands of Tennesseans cannot hide even though a state lawyer yanks a shower curtain in front of a witness to prevent a soaking.

By David Tulis / Tulis Report

Jennifer Lanfair, a revenue official, admits commissioner David “The Guano” Gerregano, a Gov. Bill Lee appointee, reinstates revoked motor vehicle tags entirely on his own. By law, however, “[i]t is unlawful for the commissioner of revenue to reregister any vehicle, the registration of which has been revoked under the authority of this part, unless the written approval of the commissioner of safety is obtained prior to the reregistration” § 55-12-130. Reregistration; approval of commissioner (emphasis added)

She admits in a deposition today that in 2016 the department did not consult with the department of safety in creating EIVS, the “Eye of Sauron” insurance policy surveillance system. This admission shows violation of state law at T.C.A. § 55-12-201 et seq creating the data-search tower also known as the electronic insurance verification system. The two agencies were to have consulted.

Mrs. Lanfair confesses in preparing for deposition in David Jonathan Tulis v. Department of Revenue (DOR), docket no. 23-004, she read the Atwood law. But she didn’t did read Part 1 — the main financial responsibility law (TFRL) at T.C.A. § 55-12-101 et seq, telling the honorable intent of the general assembly that limits Sauron wattage. That is because the department of revenue is running a rogue mass surveillance gag stripmining the public, abrogating the main statute.

My suit claims I cannot be denied a registration tag because of a missing key fact: A wreck. In the law, no one is subject to performance until after the hubcap stops pirouetting on the pavement and the echo of the “qualifying accident” quits reverberating off nearby office buildings.

She says the department freely ignores exceptions in Part 1 because DOR doesn’t administer Part 1. Revenue creates meaningless exemptions (car on blocks).

One exception is for “[a]n owner or operator of any vehicle where there is no physical contact with another vehicle or object or person, unless a judgment has been obtained.” In other words, no wreck, no duty.

Other people not subject to duty are those involved in a case where “notarized releases executed by all parties” obviate any TFRL liability.

Numerous questions deal with oppression, denial of right to a hearing before revocation and other corrupt practices are slapped back to my table. Attorney Camille Cline orders the witness to be silent because the question implicates a legal question, not a fact matter.

Jennifer Lanfair, deponent in suit vs. TN department of revenue

STICKING TO FACTS, I ASK MRS. LANFAIR if she has a driver license and whether she remembers applying for it. Does she remember this certification? “I CERTIFY THAT I UNDERSTAND ABOUT TENNESSEE’S FINANCIAL RESPONSIBILITY LAW AND I AGREE TO ABIDE BY IT.” This promise shows a licensee is not subject to TFRL except after a qualifying accident. This promise to obey a law at a future date indicates the law doesn’t apply until after wreck dust settles.

I ask if she remembers signing the certification, and what this fact means to her. Mrs. Cline shoots me down.

I ask what her personal reaction was in first reading the Atwood ban, “Nothing in this part shall alter the existing financial responsibility requirements in this chapter,” § 55-12-214. Financial responsibility requirements unaffected, Mrs. Cline orders her not to answer. Mrs. Cline says later this prohibition is of no significance.

Mrs. Lanfair admits that revenue does not consult at all the driving records held by safety’s financial responsibility division, which oversees suspensions of license and tag. Law gives 100% of initiative to safety.

Revenue turns on its head the meaning of financial responsibility. It presumes all registered motor vehicles are owned by scofflaws and shirkers required to be under thumbscrew proof of wealth requirements at all times. DOR imposes, in departure from the law, and corruptly, a wealth test upon all members of the traveling and driving public.

DOR’s shakedown serves insurers with between $1 billion and $2 billion in “free” premiums a year, but the witness says no one in the insurance industry was consulted in developing EIVS, which went live against the public Jan. 1, 2017. Going it alone violates Atwood, which charged DOR to consult with insurance experts and safety.

The “Eye of Sauron” case in Tennessee claims that the state’s “financial responsibility” surveillance eyeball must operate not wide open (upon 100 percent of 6.34 million motorists), but through a pinhole (upon 3,000 high-risk drivers under suspension with “certified” owners’s or operator’s policies).

What insurance rackets get in easy loot they pay back continually with tens of millions in pac gifts to candidates. In 2016, as EIVS was built, 135 pacs gave $29 million, according to Opensecrets.org. Levels have dropped to $16 million since the Sauron coup.

The Guano is not the only crook in Nashville-based “commercial government” rackets. Jeff Long is the commissioner of safety. He, too, relies on a 2003 attorney general opinion that, by trickery, seems to let both departments rewrite the law to say “mandatory insurance” for all and prosecution for the innocent. Both fully back operation of police power without probable cause, outside of law.

AG gaslighting and agency practice violate a fundamental rule of statutory construction called ejusdem generis, that “where general words follow special words, which limit the scope of a statute, these general words will be construed ordinarily as applying to things of the same kind or class as those indicated by the preceding special words” State v. Wheeler, 127 Tenn. 58, 152 S. W. 1037.

Another roadblock to open inquiry is Mrs. Cline’s repeatedly citing as authority my notice of deposition. This document, settled after “lengthy, belabored” litigation, sets deposition boundaries. Alas, for this employee who worked the day before she had a baby under maternity leave, the notice of deposition controls, buster.

Camille Cline, revenue attorney

UNDER MRS. CLINE’S FIRE IN THAT CONFERENCE ROOM, many damning questions turn to gibberish. Rather than a seven-hour deposition max under the rules, my inquiry peters out before lunch.

Two Gnomes and I descend from the 11th floor of the Robertson office tower in downtown Nashville, crestfallen at the poverty of facts available, excited about valuable nuggets. On the sidewalk outside, I put down heavy bags. They light up a Teton and pipe.

Tamping his tobacco is Christopher Sapp, a Sparta computer repair genius and my midstate bureau chief, effectively a lawyer without license. He’s a “law guy” who absorbs cases on YouTube and on paper and can explain due process and the form of government with hayseed wit so radio listeners “see” why he’s become a bulldog for justice. Mr. Sapp is a freedom-oriented widower father of three who devotes countless hours haggling over TFRL’s verbose provisions. With jolly cheer he invites me to sit down after the deposition for a chat with Mrs. Cline and DOR attorney Anne Warner.

Next is feral Ed Soloe, in his best T-shirt with phone, smokes and billfold bulging in its pocket. Mr. Soloe is a litigious handyman who lives with his wife, Allison, in a U.S.-subsidized apartment complex in Alcoa. He accepts a subsistence economy without complaint. His federal lawsuit against a Monroe County cop is ignited by a TFRL revocation of tag and a later arrest for “driving on suspended.” When not mumbling TFRL bullet points in his sleep, he’s trying to sidestep “the Younger doctrine” in his case.

“Ask her what the difference between insurance and financial responsibility is,” he says in a break. “Ask her what the purpose of Atwood is. Is it for insurance or is it for verification of insurance as needed for financial responsibility?”

“Ask her if a bond is proof of financial responsibility. And ask her if a bond in the amount of damages sustained is proof of financial responsibility.”

Mrs. Lanfair indicates 1 million people are “unconfirmed,” a euphemism for “no insurance.” I ask why are not all 1 million of these people, who are the poor, the black and “white trash” like my Gnomes and me, don’t all get Sauron stinger notices immediately. Why are they “randomly selected” for Monday and Wednesday mailouts? To maintain quality customer service standards — that’s the answer. If all these criminals get notice at once, it would swamp the 20 EIVS staff people who help you “come into compliance,” she says.

I intend to make much of the 1 million noncustomers of the insurance cartel. The state registers 6.34 million passenger cars as motor vehicles. One in 6 people don’t have insurance and face revocation. Eighty-four percent of VINS “come back” from EIVS with no policy, Mrs. Lanfair says. Working people opt for food and drink, rent, meds and healthcare, keeping job going with overdue car repairs. MV insurance doesn’t make the cut for hundreds of thousands of Tennesseans. They are on the road with tag revoked — or not yet revoked but subject to criminal charge if stopped by, cop, deputy or trooper making demand “for proof of insurance.”

The poor are devastated by police encounters, their autos and vans towed out from under them, as occurred to Mr. Soloe and family. My case targets a plunder scheme against 7 million Tennesseans — the most badly hurt being poor who can’t afford trading with the cartel.

Only 43 VINS statewide among “passenger vehicles” have proof of financial responsibility other than insurance card. One person paid $130,000 to cover two VINS with a “deposit of cash,” obviously a person of means who forgoes use of that money and saves big time by ducking premiums.

WHAT WILL IT TAKE, I WONDER, FOR THE PEOPLE OF TENNESSEE to storm high-security photo ID-required buildings such as Robertson tower, herd out its well-dressed payrollees and chain them by their right ankles from light poles off 500 Deaderick St. and share life stories with them before arteries and eyeball vessels burst? My case intends to reduce pressure for revolt, prevent this outcome and bring the state under again under law.

Contested cases are lawsuits within an administrative agency such as revenue. I have standing to sue, having been duly injured by revenue’s revocation outside the law. As I am using the state’s court system for fraud busting, my duty is to exhaust my administrative remedies. Let the department fix its problems before going to court. I demand administrative court judge Brad Buchanan force down the Sauron eyelid to surveil fewer than 3,000 high-risk drivers. I demand the plunder scheme be “junked immediately as ultra vires to the statute,” with applause from 100 percent of court cases.

Mrs. Lanfair says EIVS operates with no human intervention. No department eyeball saw my name, VIN, driving record or anything else in revoking me July 21, 2023. Tennessee financial responsibility law of 1977 is paternalistic legislation launched just before the Korean war. It serves a moral purpose. The law seeks to secure accident victims from careless and irresponsible motorists, its social goals are mercy oriented.

DOR grants insurance companies a hearing prior to any one of them being booted from the Tennessee automobile insurance plan created in sect. 136. Under TFRL you have a right to a hearing pre-revocation in department of safety. DOR gives no hearings prior to the injury, a due process violation.

Atwood is a technical statute creating data mining miracles to make sure that high-risk drivers who wickedly ignore their after-accident or after-judgment duties make good and prove themselves financially responsible. They must carry costly SR-22 certificated insurance policies up to five years, during which time their revoked driver licenses and tags are restored on condition only.

Levi Thurston, leading Gnome, a Tennessee man in Mertens, Texas, trying to get a Texas driver license without a Social Security number. (Photo Michael James)

THE ABUSE OF THE TFRL “IS CORRUPT AND UNJUST from its inception,” says Levi Thurston, a Tennessee Gnome in Mertens, Texas. “The dishonesty is not ever pointed out to the degree ya’ll have spent time on it. It’s engineered and planned out by these corrupters and extortionists that are oppressing the public.

“This falls under cruel and unusual punishment and excessive fines and penalties description,” he says. “The bar association does the bidding of private industry and it purposely arranged so that there is nearly a 20 percent flow of cash into the bar association from these people who are in court.”

Mr. Thurston says corporations and government are indistinguishable. “What is prohibited directly is done indirectly, and we’re supposed to make this distinction that somehow this is private industry when it’s not. It is total government control over this. This is used against the poor. It’s directed at them. It’s not directed at safety issues.”

“If their agenda is threatened, they won’t be accountable,” he says, “’cause that requires a legal conclusion.”